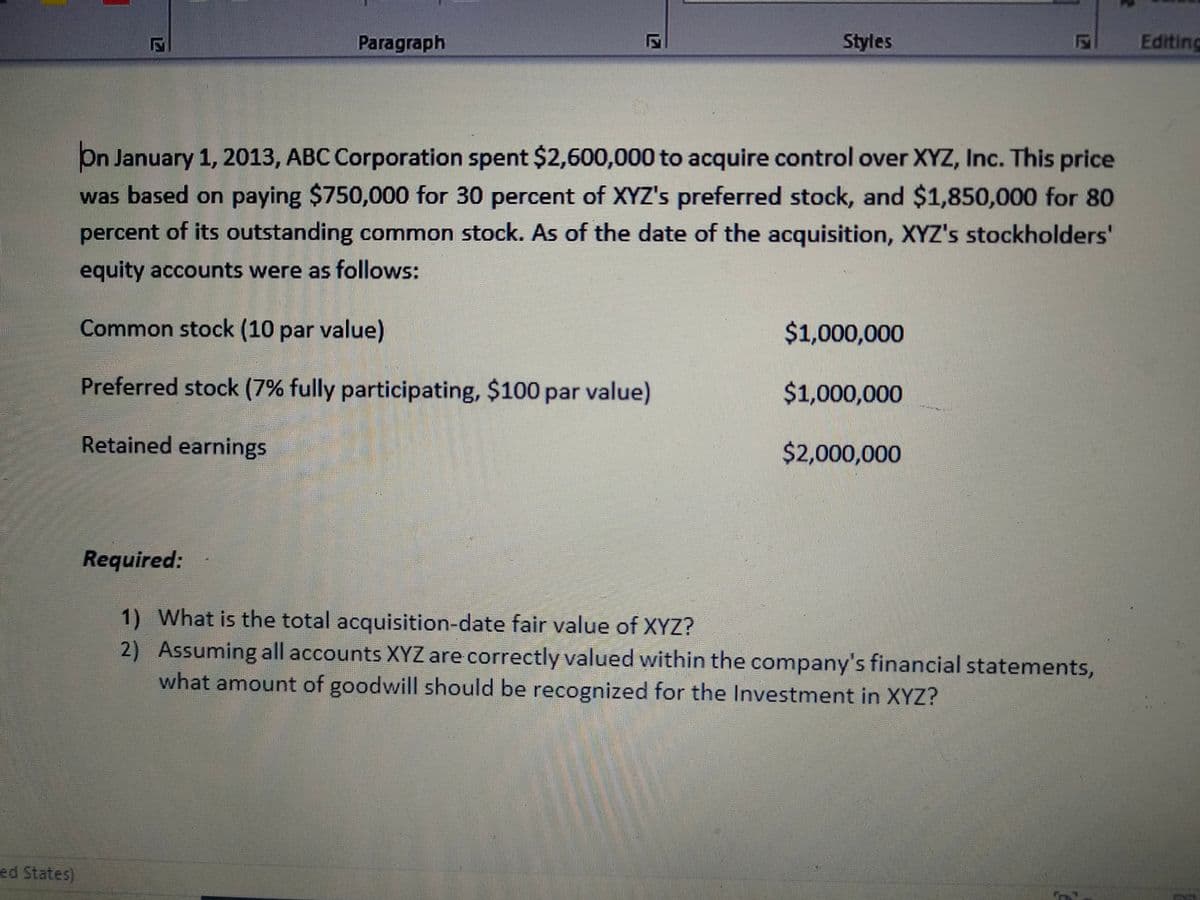

On January 1, 2013, ABC Corporation spent $2,600,000 to acquire control over XYZ, Inc. This price was based on paying $750,000 for 30 percent of XYZ's preferred stock, and $1,850,000 for 80 percent of its outstanding common stock. As of the date of the acquisition, XYZ's stockholders' equity accounts were as follows: Common stock (10 par value) $1,000,000 Preferred stock (7% fully participating, $100 par value) $1,000,000 Retained earnings $2,000,000 Required: 1) What is the total acquisition-date fair value of XYZ? 2) Assuming all accounts XYZ are correctly valued within the company's financial statements, what amount of goodwill should be recognized for the Investment in XYZ?

On January 1, 2013, ABC Corporation spent $2,600,000 to acquire control over XYZ, Inc. This price was based on paying $750,000 for 30 percent of XYZ's preferred stock, and $1,850,000 for 80 percent of its outstanding common stock. As of the date of the acquisition, XYZ's stockholders' equity accounts were as follows: Common stock (10 par value) $1,000,000 Preferred stock (7% fully participating, $100 par value) $1,000,000 Retained earnings $2,000,000 Required: 1) What is the total acquisition-date fair value of XYZ? 2) Assuming all accounts XYZ are correctly valued within the company's financial statements, what amount of goodwill should be recognized for the Investment in XYZ?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter15: Contributed Capital

Section: Chapter Questions

Problem 2MC: Cary Corporation has 50,000 shares of 10 par common stock authorized. The following transactions...

Related questions

Question

Transcribed Image Text:Paragraph

Styles

Editing

On January 1, 2013, ABC Corporation spent $2,600,000 to acquire control over XYZ, Inc. This price

was based on paying $750,000 for 30 percent of XYZ's preferred stock, and $1,850,000 for 80

percent of its outstanding common stock. As of the date of the acquisition, XYZ's stockholders'

equity accounts were as follows:

Common stock (10 par value)

$1,000,000

Preferred stock (7% fully participating, $100 par value)

$1,000,000

Retained earnings

$2,000,000

Required:

1) What is the total acquisition-date fair value of XYZ?

2) Assuming all accounts XYZ are correctly valued within the company's financial statements,

what amount of goodwill should be recognized for the Investment in XYZ?

ed States)

124

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning