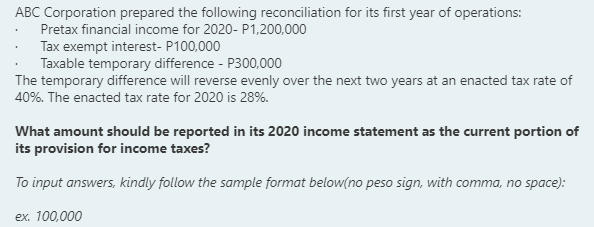

ABC Corporation prepared the following reconciliation for its first year of operations: Pretax financial income for 2020- P1,200,000 Tax exempt interest- P100,000 Taxable temporary difference - P300,000 The temporary difference will reverse evenly over the next two years at an enacted tax rate of 40%. The enacted tax rate for 2020 is 28%. What amount should be reported in its 2020 income statement as the current portion of ts provision for income taxes? To input answers, kindly follow the sample format belowíno peso sign, with comma, no space):

ABC Corporation prepared the following reconciliation for its first year of operations: Pretax financial income for 2020- P1,200,000 Tax exempt interest- P100,000 Taxable temporary difference - P300,000 The temporary difference will reverse evenly over the next two years at an enacted tax rate of 40%. The enacted tax rate for 2020 is 28%. What amount should be reported in its 2020 income statement as the current portion of ts provision for income taxes? To input answers, kindly follow the sample format belowíno peso sign, with comma, no space):

Chapter14: Taxes On The Financial Statements

Section: Chapter Questions

Problem 4BCRQ

Related questions

Question

15

Transcribed Image Text:ABC Corporation prepared the following reconciliation for its first year of operations:

Pretax financial income for 2020- P1,200,000

Tax exempt interest- P100,000

Taxable temporary difference - P300,000

The temporary difference will reverse evenly over the next two years at an enacted tax rate of

40%. The enacted tax rate for 2020 is 28%.

What amount should be reported in its 2020 income statement as the current portion of

its provision for income taxes?

To input answers, kindly follow the sample format below(no peso sign, with comma, no space):

ex. 100,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning