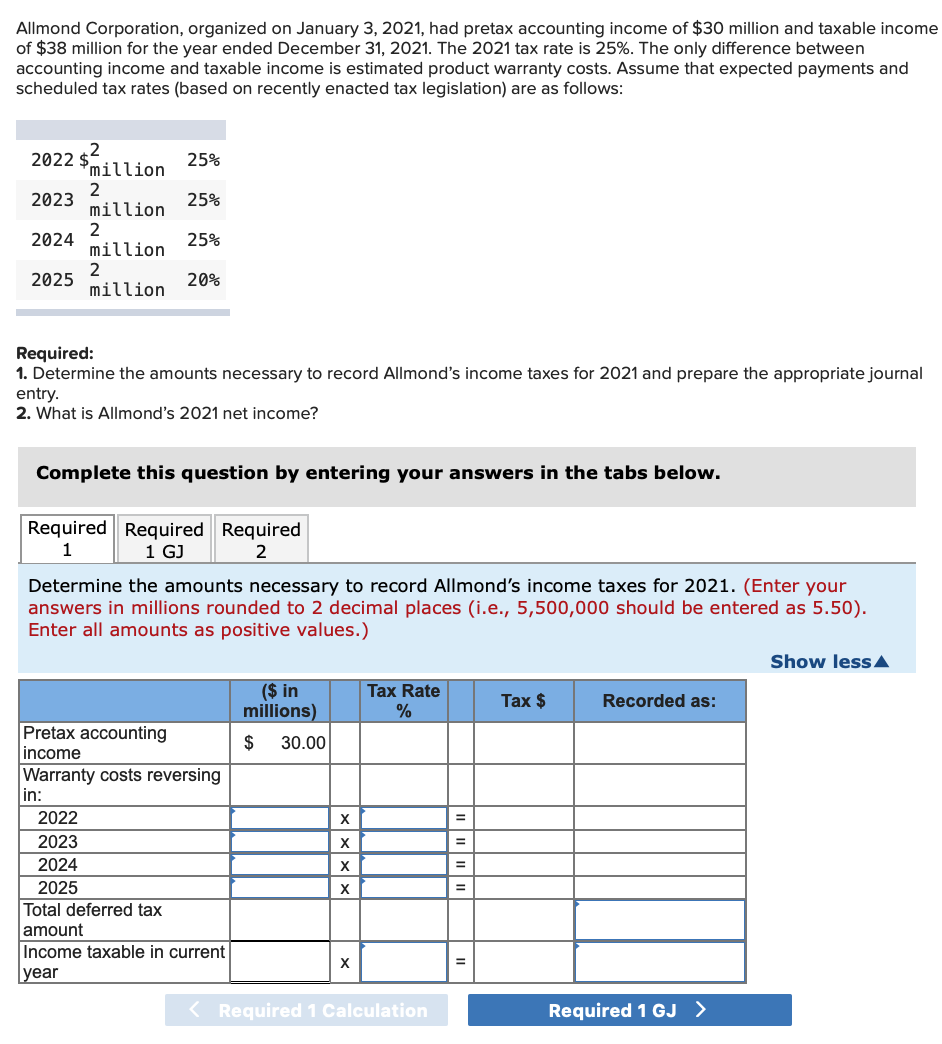

Allmond Corporation, organized on January 3, 2021, had pretax accounting income of $30 million and taxable income of $38 million for the year ended December 31, 2021. The 2021 tax rate is 25%. The only difference between accounting income and taxable income is estimated product warranty costs. Assume that expected payments and scheduled tax rates (based on recently enacted tax legislation) are as follows: 2022 $ "million 25% 2 million 2023 25% 2 2024 million 25% 2 2025 million 20% Required: 1. Determine the amounts necessary to record Allmond's income taxes for 2021 and prepare the appropriate journal entry. 2. What is Allmond's 2021 net income?

Allmond Corporation, organized on January 3, 2021, had pretax accounting income of $30 million and taxable income of $38 million for the year ended December 31, 2021. The 2021 tax rate is 25%. The only difference between accounting income and taxable income is estimated product warranty costs. Assume that expected payments and scheduled tax rates (based on recently enacted tax legislation) are as follows: 2022 $ "million 25% 2 million 2023 25% 2 2024 million 25% 2 2025 million 20% Required: 1. Determine the amounts necessary to record Allmond's income taxes for 2021 and prepare the appropriate journal entry. 2. What is Allmond's 2021 net income?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter18: Accounting For Income Taxes

Section: Chapter Questions

Problem 9MC: Brooks Company reported a prior period adjustment of 512,000 in pretax financial "income" and...

Related questions

Question

Transcribed Image Text:Allmond Corporation, organized on January 3, 2021, had pretax accounting income of $30 million and taxable income

of $38 million for the year ended December 31, 2021. The 2021 tax rate is 25%. The only difference between

accounting income and taxable income is estimated product warranty costs. Assume that expected payments and

scheduled tax rates (based on recently enacted tax legislation) are as follows:

2022 $million

25%

2023

25%

million

2

2024

25%

million

2025

20%

million

Required:

1. Determine the amounts necessary to record Allmond's income taxes for 2021 and prepare the appropriate journal

entry.

2. What is Allmond's 2021 net income?

Complete this question by entering your answers in the tabs below.

Required Required Required

1 GJ

1

2

Determine the amounts necessary to record Allmond's income taxes for 2021. (Enter your

answers in millions rounded to 2 decimal places (i.e., 5,500,000 should be entered as 5.50).

Enter all amounts as positive values.)

Show lessA

($ in

millions)

Tax Rate

Tax $

Recorded as:

Pretax accounting

income

$

30.00

Warranty costs reversing

in:

2022

2023

%3D

2024

X

2025

Total deferred tax

amount

Income taxable in current

year

%3D

< Required 1 Calculation

Required 1 GJ >

Transcribed Image Text:Required:

1. Determine the amounts necessary to record Allmond's income taxes for 2021 and prepare the appropriate journal

entry.

2. What is Allmond's 2021 net income?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning