ABC Ltd. issued a prospectus for inviting application from the public for 10,000 equity shares of" $ 10 each. The amounts were payable as follows: $3 on Application, $2 on Allotment & the balance as and when called. Applications were received for 12,000 shares & the allotment was made as follows: Full applications for 8,000 shares 2,000 shares shares to remaining applicants and the excess application money is to be adjusted towards allotment. totally reject applications for 2,000 shares Pass Journal entries in the books of the company assuming that all allotment money was received and the call was not made.

ABC Ltd. issued a prospectus for inviting application from the public for 10,000 equity shares of" $ 10 each. The amounts were payable as follows: $3 on Application, $2 on Allotment & the balance as and when called. Applications were received for 12,000 shares & the allotment was made as follows: Full applications for 8,000 shares 2,000 shares shares to remaining applicants and the excess application money is to be adjusted towards allotment. totally reject applications for 2,000 shares Pass Journal entries in the books of the company assuming that all allotment money was received and the call was not made.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter15: Contributed Capital

Section: Chapter Questions

Problem 9P: Comprehensive Young Corporation has been operating successfully for several years. It is authorized...

Related questions

Question

ABC Ltd. issued a prospectus for inviting application from the public for 10,000 equity

shares of" $ 10 each. The amounts were payable as follows: $3 on Application, $2 on

Allotment & the balance as and when called.

Applications were received for 12,000 shares & the allotment was made as follows:

Full applications for 8,000 shares

2,000 shares shares to remaining applicants and the excess application money is

to be adjusted towards allotment.

totally reject applications for 2,000 shares

Pass Journal entries in the books of the company assuming that all allotment money was

received and the call was not made.

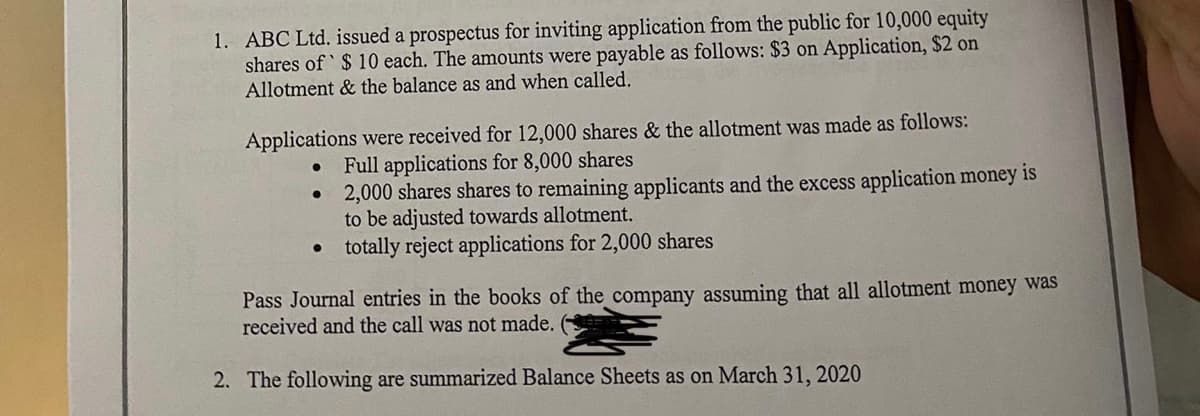

Transcribed Image Text:1. ABC Ltd. issued a prospectus for inviting application from the public for 10,000 equity

shares of $ 10 each. The amounts were payable as follows: $3 on Application, $2 on

Allotment & the balance as and when called.

Applications were received for 12,000 shares & the allotment was made as follows:

Full applications for 8,000 shares

2,000 shares shares to remaining applicants and the excess application money is

to be adjusted towards allotment.

totally reject applications for 2,000 shares

Pass Journal entries in the books of the company assuming that all allotment money was

received and the call was not made.

2. The following are summarized Balance Sheets as on March 31, 2020

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning