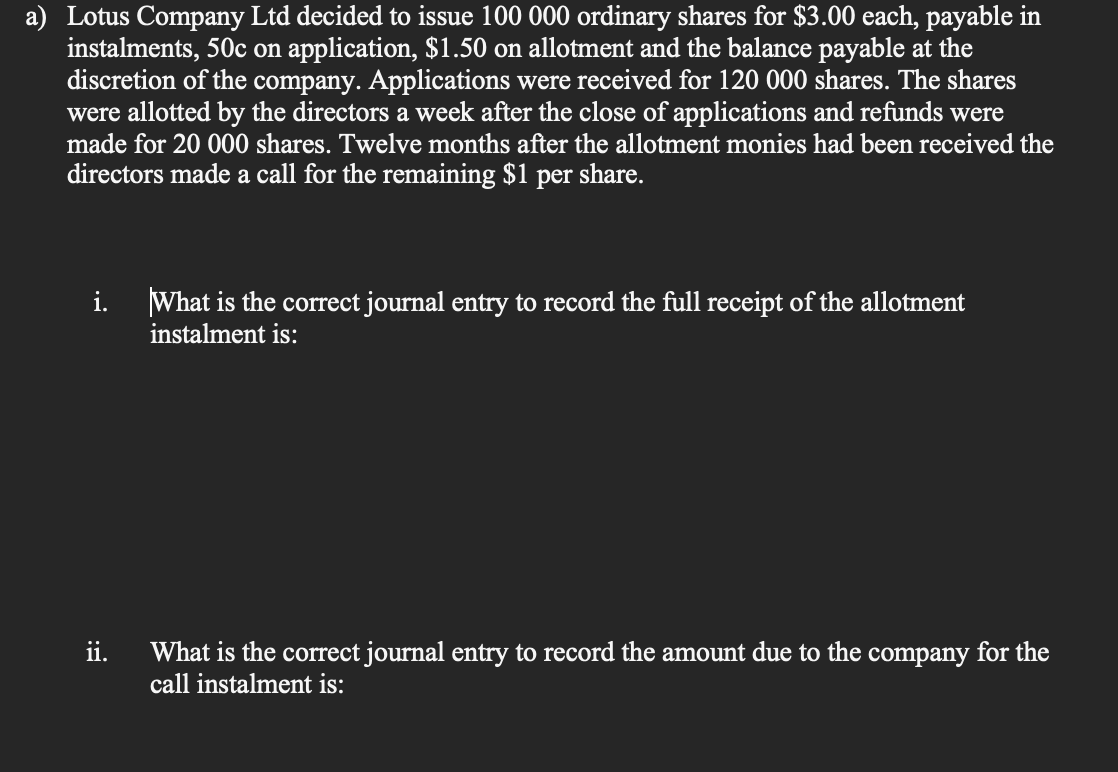

a) Lotus Company Ltd decided to issue 100 000 ordinary shares for $3.00 each, payable in instalments, 50c on application, $1.50 on allotment and the balance payable at the discretion of the company. Applications were received for 120 000 shares. The shares were allotted by the directors a week after the close of applications and refunds were made for 20 000 shares. Twelve months after the allotment monies had been received the directors made a call for the remaining $1 per share. i. What is the correct journal entry to record the full receipt of the allotment instalment is: ii. What is the correct journal entry to record the amount due to the company for the call instalment is:

a) Lotus Company Ltd decided to issue 100 000 ordinary shares for $3.00 each, payable in instalments, 50c on application, $1.50 on allotment and the balance payable at the discretion of the company. Applications were received for 120 000 shares. The shares were allotted by the directors a week after the close of applications and refunds were made for 20 000 shares. Twelve months after the allotment monies had been received the directors made a call for the remaining $1 per share. i. What is the correct journal entry to record the full receipt of the allotment instalment is: ii. What is the correct journal entry to record the amount due to the company for the call instalment is:

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter15: Contributed Capital

Section: Chapter Questions

Problem 9P: Comprehensive Young Corporation has been operating successfully for several years. It is authorized...

Related questions

Question

Please answer option 1 and 2

Transcribed Image Text:a) Lotus Company Ltd decided to issue 100 000 ordinary shares for $3.00 each, payable in

instalments, 50c on application, $1.50 on allotment and the balance payable at the

discretion of the company. Applications were received for 120 000 shares. The shares

were allotted by the directors a week after the close of applications and refunds were

made for 20 000 shares. Twelve months after the allotment monies had been received the

directors made a call for the remaining $1

per

share.

i.

What is the correct journal entry to record the full receipt of the allotment

instalment is:

ii.

What is the correct journal entry to record the amount due to the company for the

call instalment is:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,