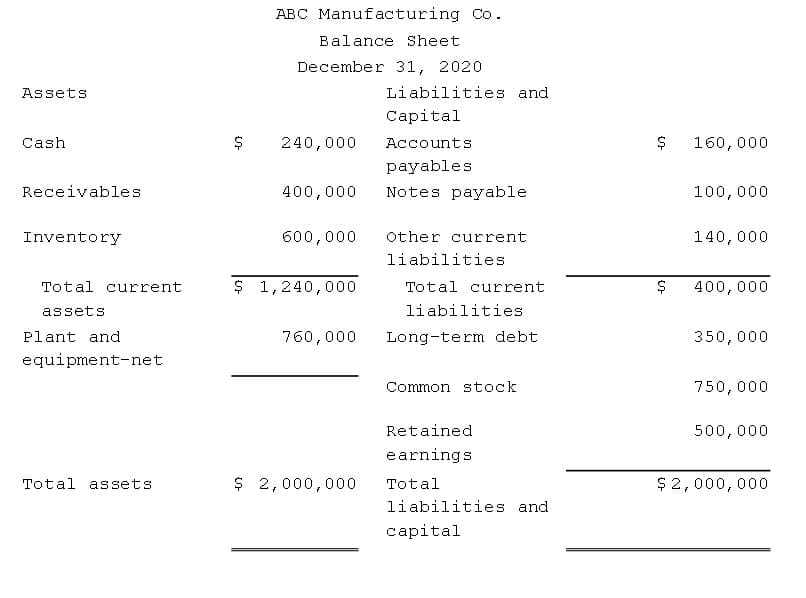

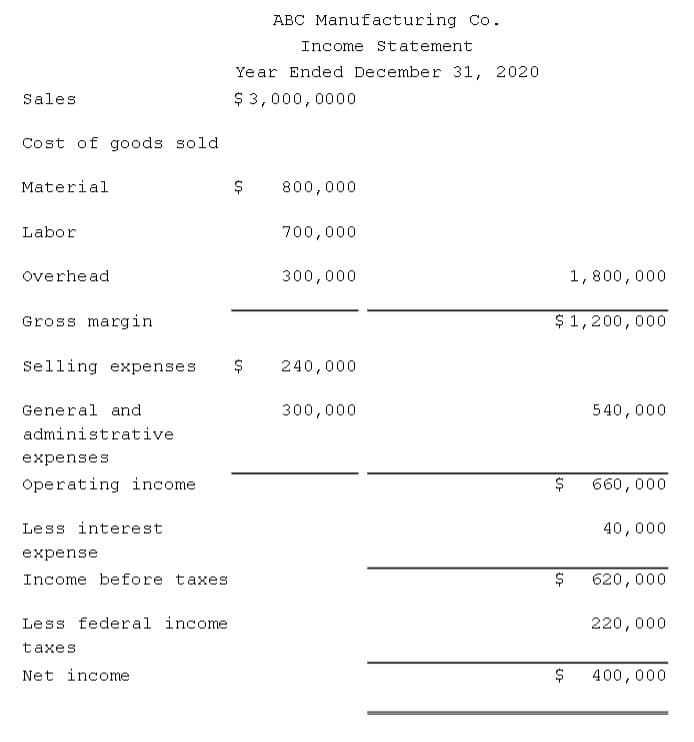

Analytical procedures are evaluations of financial information made by a study of plausible relationships among financial and nonfinancial data. Understanding and evaluating such relationships are essential to the audit process. The following financial statements were prepared by ABC Manufacturing Co. for the year ended December 31, 2020. Also presented are various financial statement ratios for Holiday as calculated from the prior year's financial statements. Sales represent net credit sales. The total assets and the receivables and inventory balances at December 31, 2020, were the same as at December 31, 2019.

Analytical procedures are evaluations of financial information made by a study of plausible

relationships among financial and nonfinancial data. Understanding and evaluating such

relationships are essential to the

by ABC Manufacturing Co. for the year ended December 31, 2020. Also presented are various

financial statement ratios for Holiday as calculated from the prior year's financial statements.

Sales represent net credit sales. The total assets and the receivables and inventory balances at

December 31, 2020, were the same as at December 31, 2019.

See image: audit

See image: audit 2

Required:

Items 1 through 9 below represent financial ratios that the auditor calculated during the prior

year's audit. For each ratio, calculate the current year's ratio from the financial statements

presented above.

Calculations 12/31/2020 12/31/2019

1.

2. Quick ratio 1.3

3.

4. Inventory turnover 2.5

5. Total asset turnover 1.2

6. Gross margin percentage 35%

7. Net operating margin % 25%

8. Times interest earned 10.3

9. Total debt to equity 50%

Trending now

This is a popular solution!

Learn your way

Includes step-by-step video

Step by step

Solved in 2 steps