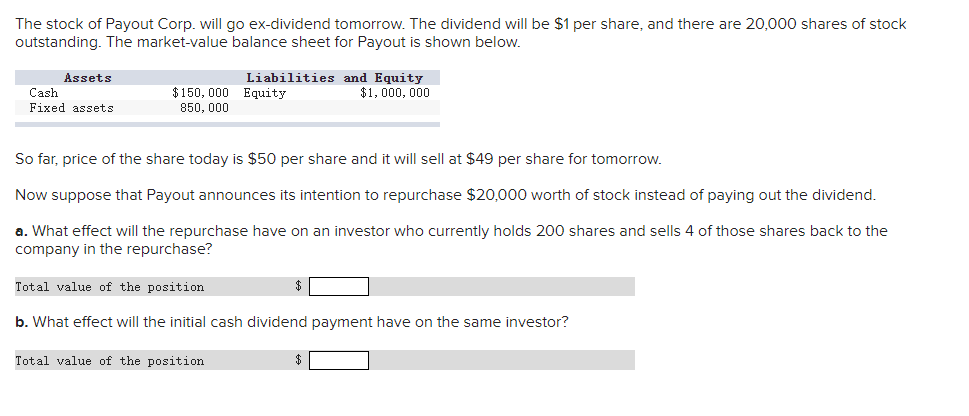

The stock of Payout Corp. will go ex-dividend tomorrow. The dividend will be $1 per share, and there are 20,000 shares of stock outstanding. The market-value balance sheet for Payout is shown below. Assets Liabilities and Equity $1, 000, 000 Cash Fixed assets $150, 000 Equity 850, 000 So far, price of the share today is $50 per share and it will sell at $49 per share for tomorrow. Now suppose that Payout announces its intention to repurchase $20,000 worth of stock instead of paying out the dividend. a. What effect will the repurchase have on an investor who currently holds 200 shares and sells 4 of those shares back to the company in the repurchase? Total value of the position b. What effect will the initial cash dividend payment have on the same investor? Total yalue of the nosition

The stock of Payout Corp. will go ex-dividend tomorrow. The dividend will be $1 per share, and there are 20,000 shares of stock outstanding. The market-value balance sheet for Payout is shown below. Assets Liabilities and Equity $1, 000, 000 Cash Fixed assets $150, 000 Equity 850, 000 So far, price of the share today is $50 per share and it will sell at $49 per share for tomorrow. Now suppose that Payout announces its intention to repurchase $20,000 worth of stock instead of paying out the dividend. a. What effect will the repurchase have on an investor who currently holds 200 shares and sells 4 of those shares back to the company in the repurchase? Total value of the position b. What effect will the initial cash dividend payment have on the same investor? Total yalue of the nosition

Chapter7: Stocks (equity) - Characterstics And Valuation

Section: Chapter Questions

Problem 14PROB

Related questions

Question

Transcribed Image Text:The stock of Payout Corp. will go ex-dividend tomorrow. The dividend will be $1 per share, and there are 20,000 shares of stock

outstanding. The market-value balance sheet for Payout is shown below.

Liabilities and Equity

$1, 000, 000

Assets

Cash

Fixed assets

$150, 000 Equity

850, 000

So far, price of the share today is $50 per share and it will sell at $49 per share for tomorrow.

Now suppose that Payout announces its intention to repurchase $20,000 worth of stock instead of paying out the dividend.

a. What effect will the repurchase have on an investor who currently holds 200 shares and sells 4 of those shares back to the

company in the repurchase?

Total value of the position

b. What effect will the initial cash dividend payment have on the same investor?

Total value of the position

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning