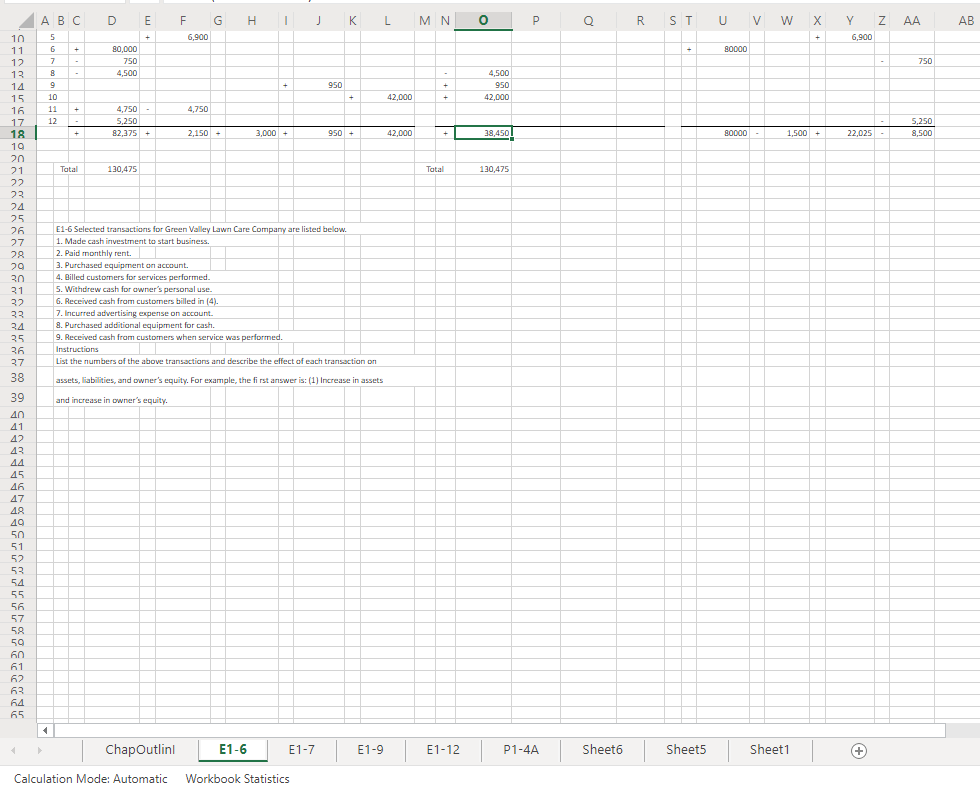

ABC Н L M N ST AA AB 10 6,900 6,900 11 80,000 80000 12 750 750 13 4,500 4,500 14 950 950 15 10 42,000 42,000 16 11 4,750 4,750 17 12 5,250 5.250 18 82,375 2,150 + 3,000 + 950 + 42,000 38,450 B0000- 1,500 + 22,025 8,500 + 19 20 21 Tatal 130,475 Tatal 130,475 22 23 24 25 E1-6 Selected transactions for Green Valley Lawn Care Company are listed below. 1. Made cash investment to start business. 26 27 2. Paid monthly rent. 3. Purchased equipment on account. 28 20 30 4. Billed customers for services performed. 5. Withdrew cash for awner's personal use. 6. Received cash from customers billed in (4). 7. Incurred advertising expense on account. 8. Purchased additional equipment for cash. 9. Received cash from customers when service was performed. 31 32 33 34 35 36 Instructions 37 List the numbers of the above transactions and describe the effect of each transaction on 38 assets, liabilities, and owner's equity. For example, the fi rst answer is: (1) Increase in assets 39 and increase in owner's equity. 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 ChapOutlinl E1-6 E1-7 E1-9 E1-12 P1-4A Sheet6 Sheet5 Sheet1 Calculation Mode: Automatic Workbook Statistics

ABC Н L M N ST AA AB 10 6,900 6,900 11 80,000 80000 12 750 750 13 4,500 4,500 14 950 950 15 10 42,000 42,000 16 11 4,750 4,750 17 12 5,250 5.250 18 82,375 2,150 + 3,000 + 950 + 42,000 38,450 B0000- 1,500 + 22,025 8,500 + 19 20 21 Tatal 130,475 Tatal 130,475 22 23 24 25 E1-6 Selected transactions for Green Valley Lawn Care Company are listed below. 1. Made cash investment to start business. 26 27 2. Paid monthly rent. 3. Purchased equipment on account. 28 20 30 4. Billed customers for services performed. 5. Withdrew cash for awner's personal use. 6. Received cash from customers billed in (4). 7. Incurred advertising expense on account. 8. Purchased additional equipment for cash. 9. Received cash from customers when service was performed. 31 32 33 34 35 36 Instructions 37 List the numbers of the above transactions and describe the effect of each transaction on 38 assets, liabilities, and owner's equity. For example, the fi rst answer is: (1) Increase in assets 39 and increase in owner's equity. 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 ChapOutlinl E1-6 E1-7 E1-9 E1-12 P1-4A Sheet6 Sheet5 Sheet1 Calculation Mode: Automatic Workbook Statistics

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Transcribed Image Text:ABC

Н

L

M N

ST

AA

AB

10

6,900

6,900

11

80,000

80000

12

750

750

13

4,500

4,500

14

950

950

15

10

42,000

42,000

16

11

4,750

4,750

17

12

5,250

5.250

18

82,375

2,150 +

3,000 +

950 +

42,000

38,450

B0000-

1,500 +

22,025

8,500

+

19

20

21

Tatal

130,475

Tatal

130,475

22

23

24

25

E1-6 Selected transactions for Green Valley Lawn Care Company are listed below.

1. Made cash investment to start business.

26

27

2. Paid monthly rent.

3. Purchased equipment on account.

28

20

30

4. Billed customers for services performed.

5. Withdrew cash for awner's personal use.

6. Received cash from customers billed in (4).

7. Incurred advertising expense on account.

8. Purchased additional equipment for cash.

9. Received cash from customers when service was performed.

31

32

33

34

35

36

Instructions

37

List the numbers of the above transactions and describe the effect of each transaction on

38

assets, liabilities, and owner's equity. For example, the fi rst answer is: (1) Increase in assets

39

and increase in owner's equity.

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

ChapOutlinl

E1-6

E1-7

E1-9

E1-12

P1-4A

Sheet6

Sheet5

Sheet1

Calculation Mode: Automatic

Workbook Statistics

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education