P. assets nt and equipment 34,600 12,000 46,600 abilities of $0,5 each ings 10,000 25,400 35.400

P. assets nt and equipment 34,600 12,000 46,600 abilities of $0,5 each ings 10,000 25,400 35.400

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 8MC

Related questions

Question

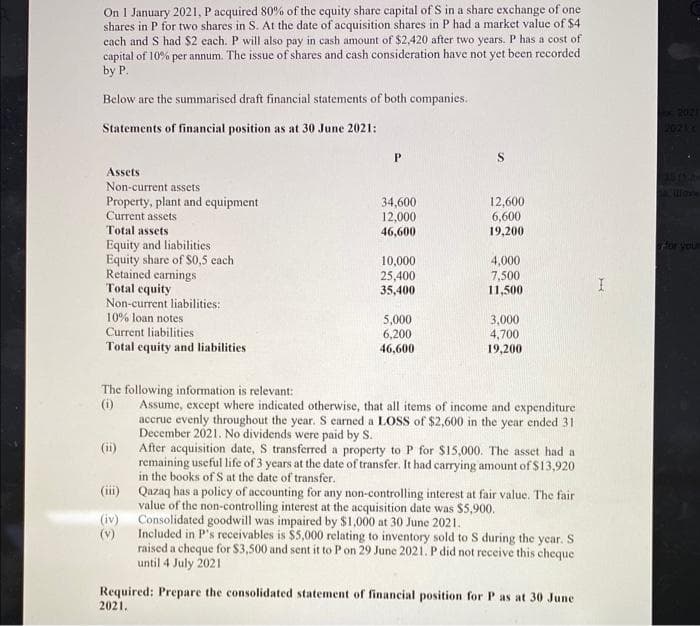

Transcribed Image Text:On I January 2021, P acquired 80% of the cquity share capital of S in a share exchange of one

shares in P for two shares in S. At the date of acquisition shares in P had a market value of $4

cach and S had $2 cach. P will also pay in cash amount of $2,420 after two years. P has a cost of

capital of 10% per annum. The issue of shares and cash consideration have not yet been recorded

by P.

Below are the summarised draft financial statements of both companies.

Statements of financial position as at 30 June 2021:

P.

S

Assets

Non-current assets

Property, plant and equipment

Current assets

34,600

12,000

46,600

12,600

6,600

Total assets

19,200

Equity and liabilities

Equity share of $0,5 cach

Retained earnings

Total equity

For your

10,000

25,400

35,400

4,000

7,500

11,500

Non-current liabilities:

10% loan notes

Current liabilities

Total equity and liabilities

5,000

6,200

46,600

3,000

4,700

19,200

The following information is relevant:

(i)

Assume, except where indicated otherwise, that all items of income and expenditure

accrue evenly throughout the year. S carned a LOSS of $2,600 in the year ended 31

December 2021. No dividends were paid by S.

(ii)

After acquisition date, S transferred a property to P for $15,000. The asset had a

remaining useful life of 3 years at the date of transfer. It had carrying amount of $13,920

in the books of S at the date of transfer.

(iii) Qazaq has a policy of accounting for any non-controlling interest at fair value. The fair

value of the non-controlling interest at the acquisition date was $5,900.

(iv) Consolidated goodwill was impaired by $1,000 at 30 June 2021.

(v)

Included in P's receivables is $5,000 relating to inventory sold to S during the year. S

raised a cheque for $3,500 and sent it to P on 29 June 2021. P did not receive this cheque

until 4 July 2021

Required: Prepare the consolidated statement of financial position for P as at 30 June

2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning