Abenson Trading Co. sells household furniture both in cash and in installment basis. For each installment sale, a sale contract is made whereby the following terms are stated: a. A down payment of 25% of the installment price is required and the balance payable in 15 equal monthly installment. b. Interest of 1% per month is charged on the unpaid cash sale price-equivalent at each installment. c. The price on installment sales is 110% of the cash sales price. For accounting purposes, installment sales are recorded at contract price. Any unpaid balances on defaulted contracts are being charged to uncollectible accounts expense. Sales of defaulted merchandise were credited to uncollectible accounts expense. Interest are recognized in the period earned. For its first year of operations ending December 31, 2009, the books of the company show the following: A contract amounting to P3,300 was defaulted after paying three(3) monthly installments. The total interest earned for the first four month in the defaulted contracts is: a. 72.07 b. 69.30 c. 80.85 d. 60.94 e. answer not given

Abenson Trading Co. sells household furniture both in cash and in installment basis. For each installment sale, a sale contract is made whereby the following terms are stated: a. A down payment of 25% of the installment price is required and the balance payable in 15 equal monthly installment. b. Interest of 1% per month is charged on the unpaid cash sale price-equivalent at each installment. c. The price on installment sales is 110% of the cash sales price. For accounting purposes, installment sales are recorded at contract price. Any unpaid balances on defaulted contracts are being charged to uncollectible accounts expense. Sales of defaulted merchandise were credited to uncollectible accounts expense. Interest are recognized in the period earned. For its first year of operations ending December 31, 2009, the books of the company show the following: A contract amounting to P3,300 was defaulted after paying three(3) monthly installments. The total interest earned for the first four month in the defaulted contracts is: a. 72.07 b. 69.30 c. 80.85 d. 60.94 e. answer not given

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter21: Supply Chains And Working Capital Management

Section: Chapter Questions

Problem 6P

Related questions

Question

Abenson Trading Co. sells household furniture both in cash and in installment basis. For each installment sale, a sale contract is made whereby the following terms are stated:

a. A down payment of 25% of the installment price is required and the balance payable in 15 equal monthly installment.

b. Interest of 1% per month is charged on the unpaid cash sale price-equivalent at each installment.

c. The price on installment sales is 110% of the cash sales price.

For accounting purposes, installment sales are recorded at contract price. Any unpaid balances on defaulted contracts are being charged to uncollectible accounts expense. Sales of defaulted merchandise were credited to uncollectible accounts expense. Interest are recognized in the period earned. For its first year of operations ending December 31, 2009, the books of the company show the following:

A contract amounting to P3,300 was defaulted after paying three(3) monthly installments. The total interest earned for the first four month in the defaulted contracts is:

a. 72.07

b. 69.30

c. 80.85

d. 60.94

e. answer not given

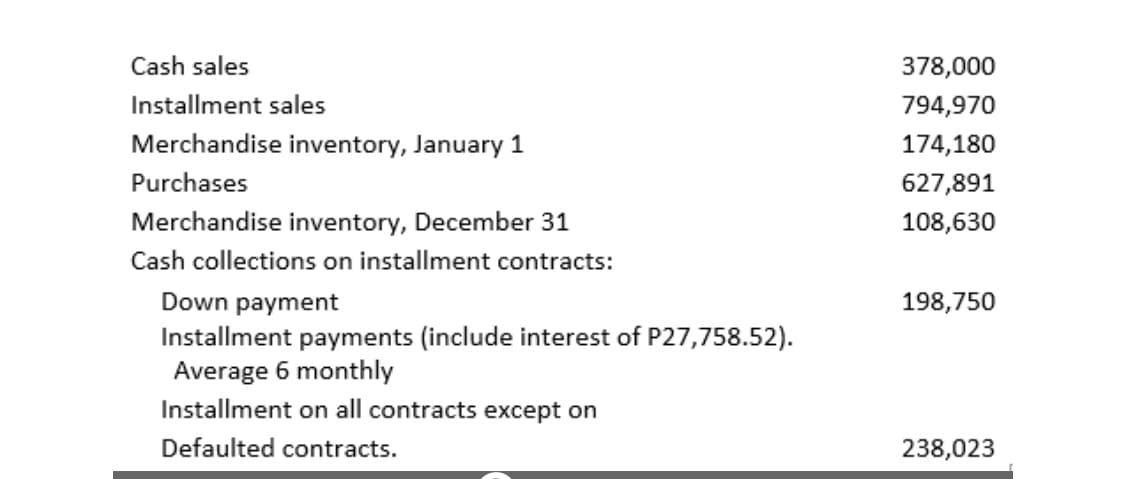

Transcribed Image Text:Cash sales

378,000

Installment sales

794,970

Merchandise inventory, January 1

174,180

Purchases

627,891

Merchandise inventory, December 31

108,630

Cash collections on installment contracts:

Down payment

Installment payments (include interest of P27,758.52).

Average 6 monthly

Installment on all contracts except on

198,750

Defaulted contracts.

238,023

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning