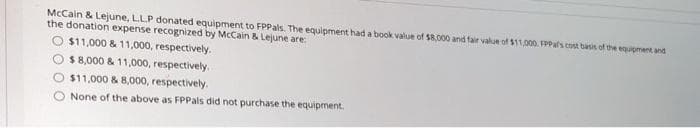

AcCain & Lejune, LLP donated equipment to FPPals. The equipment had a book value of $8.000 and fair value of $11000. Fmes cot bais of the eimentand the donation expense recognized by McCain & Lejune are $11,000 & 11,000, respectively. $8,000 & 11,000, respectively. $11,000 & 8,000, respectively. None of the above as FPPals did not purchase the equipment.

Q: Tri-City Ironworks Co. reported $65,500,000 for equipment and $33,415,000 for accumulated…

A: Note: “Since you have asked multiple question, we will solve the first question for you. If you want…

Q: At the beginning of current year, Apple Company purchased a plating machine for P5,400,000. The…

A: Journal entries are the entries to be recorded in the accounting books of the business for all the…

Q: Choose the letter of the correct answer At the beginning of the current year, an entity purchased…

A: Grant is the amount of money or donation received from government for purchasing or acquiring any…

Q: At the beginning of current year, Exodus Company purchased a machine for 8,000,000 and received a…

A: Grants means the amount received without any sale of product or providing any services. When grants…

Q: Racquel Company purchased a machine for P3,000,000 on January 1, 2020. The entity received a…

A:

Q: Tri-City Ironworks Co. reported $44,500,000 for equipment and $29,800,000 for accumulated…

A: a)

Q: What should be the carrying amount of the machine as of December 31, 2021? QUESTION 2: What is the…

A: The determination of the carrying amount of machine as of December 31,2021,the deferred income…

Q: Johnson acquired for a lumpsum price of P6,000,000 a piece of land and the building on it. The land…

A: Johnson acquired a piece of land and building = P6000000 Fair value of land = $4200000 Building =…

Q: Magic accepted several office equipment from a stockholder which originally costed the donor…

A: The assets will be recored at fair value less cost of sellling. The asset includes all Direct…

Q: The Yeet Corporation purchased an office building several years for $200,000. The company took…

A: Section 1231 property is one that is retained by the company for more than one year for use in…

Q: On January 1, 2022, ABC Organization, a non-profit private organization, received the gift of a…

A: On January 1, 2022, ABC Organization booked the building at the fair value at date of donation i.e.…

Q: In 20X6, Hat Corporation exchanged an apartment complex in Dallas (purchased in 20X2; cost $540,000;…

A: GIVEN In 20X6, Hat Corporation exchanged an apartment complex in Dallas (purchased in 10 * 2 cost…

Q: Rigg Owusu Enterprises Ltd bought a machine for GH₵ 150,000 on 1st January 2019. It depreciates the…

A: Depreciation means the loss in value of assets because of usage of assets , passage of time or…

Q: Atchison Corporation purchased equipment, a building, and land for $1,000,000 ($200,000 in cash and…

A: Allocation of Purchase Price Appraised Value Percentage of Total Appraised Value Total Cost of…

Q: At the beginning of the current year, Diamond Company purchased a tract of land for P 12,000,000.…

A: Cost allocation is a method of allocating or assigning the total cost to the individual object as…

Q: Parmida sold a Class 1 depreciable asset to a corporation that she controls in exchange for a…

A: Section 85 election is used to reduce or minimize the liability of tax by transferring the eligible…

Q: Assume that Sohar Aluminium Company purchased a machinery for OMR 2000 and spent OMR200 for its…

A: Formula: Total cost of machinery = Machinery purchase price + Tax + Transportation cost +insurance…

Q: Atchison Corporation purchased equipment, a building, and land for $1,000,000 ($200,000 in cash and…

A: This is a basket purchase so in this the fair value is used to allocate the purchase of group…

Q: The Bronco Corporation exchanged land for equipment. The land had a book value of $129,000 and a…

A: GIVEN The Bronco Corporation exchanged land for equipment. The land had a book value of $129,000…

Q: Ôn January 1, 2020, Pharoah Company purchased a varnishing machine for P6,000,000. The entity…

A: Grants means the amount received without any sale of product or providing any services. Government…

Q: ABC Co purchases a Bus at a price of OMR 25,000 and incurred other expenditures such as…

A: Cost of bus to be capitalised = Purchase price + Non refundable taxes + paitning of truck

Q: On January 1, 20x1, Entity A received land with fair of ₱200,000 from the government conditioned on…

A: Government Grant is the financial assistance provided by the government to an entity to buy an asset…

Q: Johnson acquired for a lumpsum price of P6,000,000 a piece of land and the building on it. The land…

A: “Since you have asked multiple sub-parts, we will solve the first three sub-parts for you. If you…

Q: The following nominal accounts apply to a primary beneficiary company and a VIE:…

A:

Q: Carlos Company purchased a building and land for $400,000 in total. Individually, the landappraised…

A: Plant assets: Plant assets refer to the fixed assets, having a useful life of more than a year that…

Q: On January 1, 20Y3, The Simmons Group, Inc., purchased the assets of NWS Insurance Co. for…

A: Book value of the goodwill on December 31, 20Y9 = Goodwill premium on January 1, 20Y3

Q: Maple Corporation owns several pieces of highly valued paintings that are on dis This year, it…

A: Capital gain property When a business contributes capital gain property, i.e. property that will…

Q: Simpson and Homer Corporation acquired an office building on three acres of land for a lump-sum…

A: Lets understand the basics. When land, building and furniture purchased cumulatively in single price…

Q: On April 1, Proton Corporation purchased for P855,000 a tract of land on which was located a…

A: Fixed assets are assets that are purchased for a lengthy period of time and are unlikely to be…

Q: Y corporation acquired an P8,000,000 yacht and transferred in the name of its executive. Compute the…

A: Monetary Value of Property in Fringe Benefit Tax While calculating the monetary value in the case of…

Q: ABC Co. acquired land, buildings, and equipment from XYZ Co. at a lump-sum price of P1,800,000. ABC…

A: Answer Lum- sum price = P1,800,000 appraisal = P120,000

Q: ABC Company acquired a rice milling machine to be used by farmers for P 900,000 on January 1, 2020.…

A: Grants means the amount received without any sale of product or providing any services. When…

Q: Tri-City Ironworks Co. reported $44,500,000 for equipment and $29,800,000 for accumu-lated…

A: Depreciation is the expense that is incurred due to the usage of machinery and other assets during…

Q: On January 1, 20x1, Entity A receives a financial aid from t govermment amounting to PIM as…

A: Government grants are recognized in the financial statement over the period of fulfilling the…

Q: Concord Pet Care Clinic paid $210,000 for a group purchase of land, building, and equipment. At the…

A:

Q: BC Corporation accepted several office equipment from a stockholder which originally cost the donor…

A: Solution Concept When the asset is donated to the company ,in such case it shall be recorded as…

Q: Karen Company purchased a varnishing machine for P3,000,000 on January 1, 2019. The entity received…

A: As per the IAS 20, government grant related to assets requires setting up grant as deferred income…

Q: Rhino Company, a real estate entity, had a building with a The building was used as offices of the…

A: Given information, Carrying amount of building =P20,000,000 Fair value of building =P35,000,000…

Q: ABC purchased a piece of equipment by paying $5,000 cash. They also incurred a shipping cost of S400…

A: Financial management refers to planning organization direction and control of financial activities…

Q: The president of ACCO 202 Corporation donated a building to Ana G. Méndez Corporation. The building…

A: The donation of anything includes two parties donor and the acceptor.

Q: 'he Bronco Corporation exchanged land for equipment. The land had a book value of $122,000 and a…

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in…

Q: The president of Christmas Corporation donated a building to Tuesday Corporation. The building had…

A: Introduction: Journal: Recording of a business transactions in a chronological order. First step in…

Q: Salmyia bought land, buildings and equipment for a combined cash payment of $800,000. The estimated…

A: Formula: Amount capitalized for Equipment = Combined cash payment x % of Total fair value for…

Q: Peach Company purchased a machine for P7, 000, 000 on Jan. 1, 2019 and received a government grant…

A: The process of recording business transactions in the books of accounts for the first time is known…

Q: On January 2, 20x1, Ross Co. purchased a machine for P70,000. This machine has a 5-year useful life,…

A: Here in this question, we are required to calculate how much amount should be reported as current…

Q: Mohave Inc. purchased land, building, and equipment from Laguna Corporation for a cash payment of…

A:

Q: Sebastian purchases two pieces of equipment for $113,000. Appraisals of the equipment indicate that…

A: Combined Cost Price = $113,000 This cost price will be allocated to individual equipment in the…

Q: XYZ Company received a P2,800,000 govemment grant for a factory building it purchased in January…

A: Government Grant: Government grants are financial aid provided by the government in the form of…

Step by step

Solved in 2 steps

- The president of ACCO 202 Corporation donated a building to Ana G. Méndez Corporation. The building had an original cost of $200,000, a book value of $75,000, and a fair market value of $180,000. To record this donation, Ana G. Méndez would a. Make a memorandum entry b. Debit Building for $75,000 and credit Gain for $75,000 c. Debit Building for $200,000 and credit Gain for $200,000 d. Debit Building for $180,000 and credit Gain for $180,000CuddlePH accepted several office equipment from a stockholder which originally costed the donor P1,200,000. On the same date, the items had aggregated fair value totaling P985,000. The company incurred P30,000 for professional fees and transfer taxes related to the transaction. The amount was charged to other expenses. How much should be the credited as donated capital?Magic accepted several office equipment from a stockholder which originally costed the donor P1,200,000. On the same date, the items had aggregated fair value totaling P985,000. The company incurred P30,000 for professional fees and transfer taxes related to the transaction. The amount was charged to other expenses. How much should be the credited as donated capital?

- The president of Christmas Corporation donated a building to Tuesday Corporation. The building had an original cost of $675,000, a book value of $255,000, and a fair market value of $475,000. The journal entry by Tuesday Corporation to record this donation will include a debit Building for $255,000 and credit Gain for $255,000. debit Building for $675,000 and credit Gain for $200,000. debit Building for $475,000 and credit Gain for $200,000. debit Building for $475,000 and credit Gain for $475,000.ABC Corporation accepted several office equipment from a stockholder which originally cost the donor 1,200,000. On the same date, the items had aggregated fair value totaling 985,000. The company incurred 30,000 for professional fees and transfer taxes related to the transaction. The amount was charged to other expenses. How much should be the credited as donated capital?Simpson and Homer Corporation acquired an office building on three acres of land for a lump-sum price of $2,850,000. The building was completely furnished. According to independent appraisals, the fair values were $880,000, $1,320,000, and $2,200,000 for the building, land, and furniture and fixtures, respectively. The initial values of the building, land, and furniture and fixtures would be: Building Land Fixtures a. $ 880,000 $ 1,320,000 $ 2,200,000 b. $ 570,000 $ 855,000 $ 1,425,000 c. $ 855,000 $ 570,000 $ 1,425,000 d. None of these answer choices are correct. Option B Option C Option D Option A

- On January 1, 20X1, the city government of Faraway donated property to Amazing, Inc., in return for the commitment from the company that it would build a manufacturing plant on the site and employ residents of the city in the plant. Information on the donated land appears below. Cost of the land paid by Faraway = $1,000,000 Fair valiue of the land at time of donation = $1,865,000 What is the donation revenue recognized by Amazing, Inc.?Monty Corporation donates equipment and a truck to the community Home Assistance Centre. The equipment had a cost of $93,000, accumulated depreciation to the contribution date of $46,000, and a fair value of $46,000. The truck had a cost of $42,000, accumulated depreciation to the contribution date of $37,000, and a fair value of $24,000. Prepare the journal entry Monty Corporation would make for the donation.7. Karen Company purchased a varnishing machine for P3,000,000 on January 1, 2019. The entity received a government grant of P500,000 in respect of this asset. The accounting policy is to depreciate the asset over 4 years on a straight line basis and to treat the grant as deferred income. How much deferred income from the government grant will be presented in the statement of financial position for 2019?

- John’s uncle donated a truck to his company, John’s Corporation. The truck had an original cost of $95,000, a book value of $40,000, and a fair value of $55,000. The journal entry by John’s Corporation to record this donated asset will include a a. debit Truck for $60,000 and credit Gain for $20,000. b. debit Truck for $55,000 and credit Gain for $55,000. c. debit Truck for $95,000 and credit Gain for $95,000. d. debit Truck for $60,000 and credit Gain for $60,000.Sanders Corporation acquired a furnished office building on two acres of land for a lump-sum payment of $4,800,000. An independent appraiser estimated fair values of $2,600,000, $1,560,000, and $1,040,000 for the building, land, and furniture, respectively. Compute the costs recorded by Sanders for the building, land, and furniture, respectively.Garrett Corporation paid $200,000 to acquire land, buildings, and equipment. At the time of acquisition, Garrett paid $20,000 for an appraisal, which revealed the following values: land, $100,000; buildings, $125,000; and equipment, $25,000. Required: 2. Assume that Garrett uses IFRS and chooses to use the revaluation model to value its property, plant, and equipment. At the end of the year, the book value of the land, buildings, and equipment are $88,000, $105,000, and $19,000, respectively. The company determines that the fair value of the land, buildings, and equipment at the end of year is $113,000, $107,000, and $16,000, respectively. Prepare the journal entries that Garrett should make to value its property, plant, and equipment.