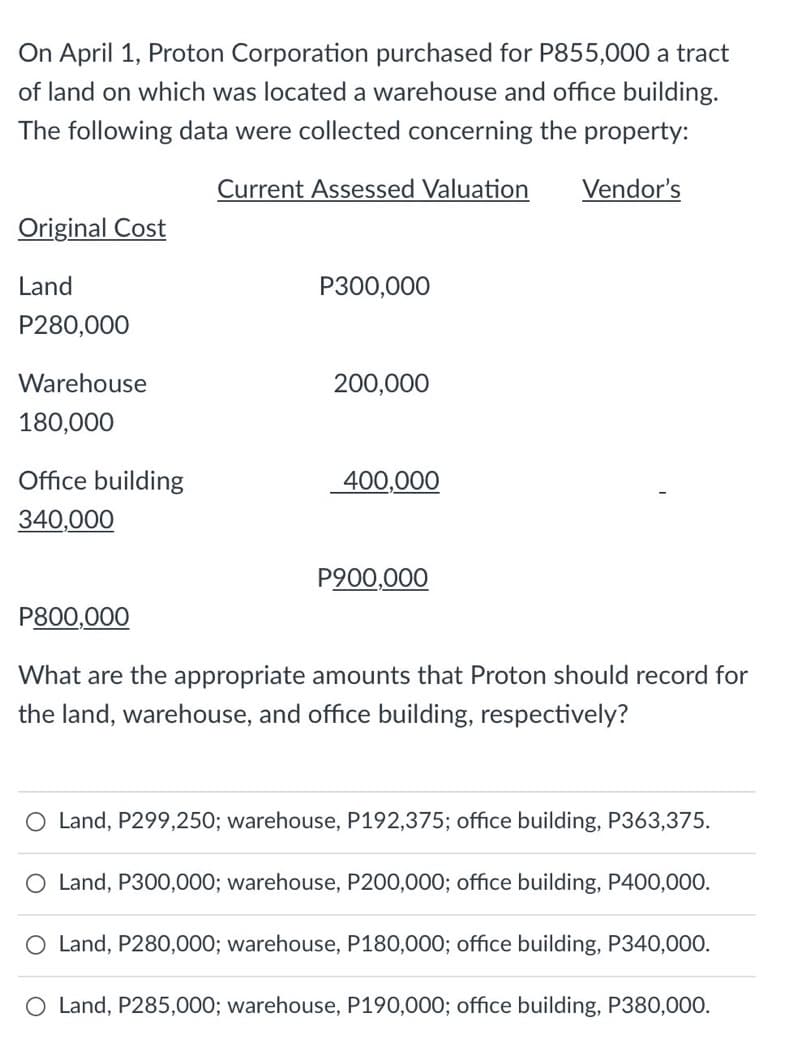

On April 1, Proton Corporation purchased for P855,000 a tract of land on which was located a warehouse and office building. The following data were collected concerning the property: Current Assessed Valuation Vendor's Original Cost Land P300,000 P280,000 Warehouse 200,000 180,000 Office building 400,000 340,000 P900,000 P800,000 What are the appropriate amounts that Proton should record for the land, warehouse, and office building, respectively? O Land, P299,250; warehouse, P192,375; office building, P363,375. O Land, P300,000; warehouse, P200,000; office building, P400,000. O Land, P280,000; warehouse, P180,000; office building, P340,000. O Land, P285,000; warehouse, P190,000; office building, P380,000.

On April 1, Proton Corporation purchased for P855,000 a tract of land on which was located a warehouse and office building. The following data were collected concerning the property: Current Assessed Valuation Vendor's Original Cost Land P300,000 P280,000 Warehouse 200,000 180,000 Office building 400,000 340,000 P900,000 P800,000 What are the appropriate amounts that Proton should record for the land, warehouse, and office building, respectively? O Land, P299,250; warehouse, P192,375; office building, P363,375. O Land, P300,000; warehouse, P200,000; office building, P400,000. O Land, P280,000; warehouse, P180,000; office building, P340,000. O Land, P285,000; warehouse, P190,000; office building, P380,000.

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 3PA: During the current year, Alanna Co. had the following transactions pertaining to its new office...

Related questions

Question

Transcribed Image Text:On April 1, Proton Corporation purchased for P855,000 a tract

of land on which was located a warehouse and office building.

The following data were collected concerning the property:

Current Assessed Valuation

Vendor's

Original Cost

Land

P300,000

P280,000

Warehouse

200,000

180,000

Office building

340,000

P900,000

P800,000

What are the appropriate amounts that Proton should record for

the land, warehouse, and office building, respectively?

O Land, P299,250; warehouse, P192,375; office building, P363,375.

O Land, P300,000; warehouse, P200,000; office building, P400,000.

O Land, P280,000; warehouse, P180,000; office building, P340,000.

O Land, P285,000; warehouse, P190,000; office building, P380,000.

400,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College