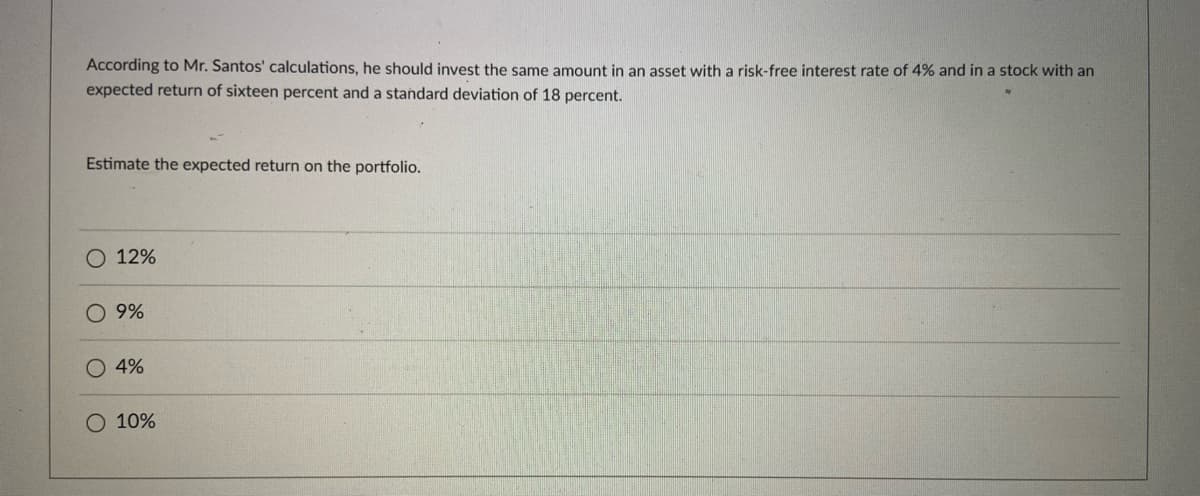

According to Mr. Santos' calculations, he should invest the same amount in an asset with a risk-free interest rate of 4% and in a stock with an expected return of sixteen percent and a standard deviation of 18 percent. Estimate the expected return on the portfolio. 12% O 9% O 4% O 10%

Q: Repaying a Loan While Mary Corens was a student at the University of Tennessee, she borrowed $11,000…

A: Present value of annuity is the current value of the future payments that are calculated using the…

Q: A financial instrument just paid the investor $127 last year. The cash flow is expected to last…

A: The price that an investor is willing to pay for the financial instrument is the present value of…

Q: Vigour Pharmaceuticals Ltd. is considering investing in a new production line for its pain-reliever…

A: A company's capital structure indicates all the sources from where the entity has acquired funding.…

Q: The Isis Company considers introducing a new lower-end olive oil brand with cheaper packaging in…

A: Market cannibalization Market cannibalization is basically a loss in sales of the existing old…

Q: A donor gives $1000.00 shares in Apple stock and stipulates the proceeds of the stock that are not…

A: The donation of shares in Apple stock with the stipulation that the proceeds are not to be spent but…

Q: A donor gives the oroganization cash and specifies that the money is to be usedin 4 years. Is this…

A: Step 1 Net Asset The sum of all contributions received with donor restrictions is known as net…

Q: Explain the Internal Rate of Return (IRR). Write down in your language what you understood. Don’t…

A: The Internal Rate of Return (IRR) is a financial metric used to measure the profitability of a…

Q: Discuss how the Credit Metrics model can mitigate future credit risk issues for Washington Mutual

A: The Credit Metrics model is a risk management tool developed by JP Morgan Chase in 1999 to help…

Q: Perpetuities. The Canadian Government has once again decided to issue a consol (a bond with a…

A: Step 1 A perpetuity is a kind of annuity that is perpetual, lasting eternally. An endless amount of…

Q: rate to evaluate the project. The following information about the company's sources of financing is…

A: A company's capital structure indicates all the sources from where the entity has acquired funding.…

Q: Salem has borrowed $1,000,000 from MQ Bank for 10 years at an interest rate of j2=3.91%. She will…

A: When the lender lends a loan to the borrower, he charges a rate of interest on the borrowed amount.…

Q: Below is information regarding the capital structure of Micro Advantage Incorporated. On the basis…

A: The WACC refers to the average return that the company provides to all its stakeholders. It takes…

Q: Dina loans $24,000 to her daughter Erin and does not charge any interest. Erin has investment income…

A: To avoid gift tax consequences, the IRS requires that a minimum interest rate, called the Applicable…

Q: Discuss the findings and conclusions of Miller (1977) when personal taxes are incorporated in the…

A: In 1977, economist Merton Miller extended the famous Modigliani and Miller (M&M) theorem by…

Q: Compared to the 1960 and 1973 period, average real earnings of workers ______ from 1973 to 1995 and…

A: Real earnings refer to the income consumption by an individual after considering the effect of…

Q: A loan of $4200 is due in 7 years. If money is worth 3.7% compounded annually, find the equivalent…

A: Note : As per the guidelines, only first question will be answered. Given information : Amount…

Q: Your daughter just turned 5 years old. You plan to send her to college beginning on her 18th…

A: First, we need to determine the PV of the college expenses at age 18 using the PV of annuity due…

Q: Apollo Enterprises has been awarded an insurance settlement of $3,000 at the end of each 6 month…

A: Present value refers to the money received today being more valuable than the money will receive in…

Q: Which of the following is true concerning short sales of exchange-listed stocks? Question 6…

A: Short selling is when you borrow a stock you don't own from the broker and sell it. Then when the…

Q: You have a Visa credit card account with a 20.98% annual percentage rate calculated on the average…

A: The daily balances on a credit card is summed up and the result is divided by the number of days in…

Q: You've observed the following returns on Yamauchi Corporation's stock over the past five years:…

A: An investor or analyst can learn about historical returns for a company, security, or collection of…

Q: Fama (2018) updated his original efficient market hypothesis by arguing that markets are…

A: In 1970, Eugene Fama introduced the Efficient Market Hypothesis (EMH), which argued that financial…

Q: Given the following information and assuming a 20% CCA class, what is the NPV for this project?…

A: CCA tax shield The reduction in taxes owed as a result of CCA is known as the CCA tax shield (or…

Q: Grace is a self-employed sales consultant who spends significant time entertaining potential…

A: Meals and entertainment expenses are business expenses incurred by an individual or a company to…

Q: The required return on the market portfolio is 18 percent. The beta of stock A is 1.5. The required…

A: Data given: Rm=Required return on the market portfolio=18% Beta=1.5 Required return on the stock=20%…

Q: You need a 30-year, fixed-rate mortgage to buy a new home for $400,000. Your mortgage bank will lend…

A: The value of the home loan is $400,000. The monthly payment is $1,000. The annual interest rate is…

Q: If the yield curve is downward sloping, what would the expectations theory suggest about expected…

A: Yield Curve: It represents a plotting of interest rates of bonds with equal credit & different…

Q: Property values in your neighborhood are predicted to increase at a rate of 7 percent per year. If…

A: Step 1 A current asset's future value (FV), which is based on an estimated rate of growth, is its…

Q: Which of the following statements about payback (payback period) is most correct? a. Payback…

A: Payback period is a financial metric that measures the length of time it takes for an investment to…

Q: A board sets aside resources to earn investment income to support general operations. Would the…

A: In most cases, the money that has been set aside by the Board with the intention of producing…

Q: Dallus Car Rental costs $280,000. It is expected to generate a net income of $70,000 at the end of…

A: The payback period refers to the time consumed for recovery of the amount of the initial…

Q: use an example to describe how you would be analys past performance, recognise opportunities and…

A: Step 1 Performance analysis is defined to as a specialist field that offers people and organizations…

Q: how much interest you will owe on your purchase.

A: To determine the interest amount, we need to calculate the following: Loan Balance = Furniture cost…

Q: Suppose that the beta of Coca-Cola's common stock is 0.84 and the firm's current debt-to-equity…

A: The beta of a stock is a measure of its volatility or systematic risk in comparison to the overall…

Q: You are advising a high income client and speaking on the advantages of investing in Municipal…

A: When investing in municipal bonds, one of the advantages is that the interest income is typically…

Q: The impact of COVID-19 on the efficiency of financial institutions? can you provide…

A: COVID-19 has had a significant impact on the efficiency of financial institutions. The pandemic has…

Q: Emmanuel Macron has the following budgeted business transactions for the month of May 2020:…

A: Budgeted cash position = Starting bank balance + Total cash inflows - Total cash outflows…

Q: Bobby Whitaker wants to save money to meet three objectives. First, he would like to be able to…

A: Present value is the estimation of the current value of future cash value which is likely to be…

Q: A loan is to be repaid with n level payments of X, where n> 5. The amount of interest in the 1st,…

A: Let the principal in payment 1, 3 and 5 be P1, P3 and P5. Since, the principal repaid, X-interest,…

Q: An investor purchased a 91-day, $10,000.00 T-bill on its issue date for $9915 98. After holding it…

A: A T-bill is a debt instrument used by the government to raise short-term capital. The usual duration…

Q: (a) Without making any calculations can you determine which is greater: the redemption yield or the…

A: Price of a bond is the PV of future coupons and par value discounted at the YTM. Given the remaining…

Q: Rhoda Rabs emigrated from the Caribbean to Toronto in her twenties to pursue employment…

A: Kerron's response to his aunt Rhoda's investment and retirement plans is based on common perceptions…

Q: Mrs. Lee recently lost her beloved Old English Sheepdog, Mr. Snuffles. After searching for Mr.…

A: A contract is a legally binding agreement between two or more parties, in which each party agrees to…

Q: Revenues = $18,277. Cost of Goods Sold = $5,112. Depreciation Expense = $2,914, Interest = $532 and…

A: Operating cash flow (OCF) is a financial metric that represents the amount of cash a company…

Q: Yosemite Corporation has an outstanding debt of $10.03 million on which it pays a 5 percent fixed…

A: Step 1 The difference between interest receipts and interest outlays is referred to as net interest…

Q: Jessica is single and owns her own home. She makes $120,000 per year from her job and has no other…

A: Mortgage lenders use the overall debt service percentage as a lending metric to determine a…

Q: What is the modified duration of a semiannual-pay 10.3 percent coupon bond with 11 years to maturity…

A: The modified duration of a bond is used to find out the change in the price of the bond for every…

Q: Noel has $490,000 with which to purchase an ordinary annuity delivering monthly payments for 20…

A: To calculate the monthly payment Noel will receive, we can use the formula for the present value of…

Q: Calculate the terminal cash flow of the project Taking into consideration all the information…

A: As this is a threaded question, we are taking the values of operating cash flow and WACC from the…

Q: You decide to sell short 100 shares of Charlotte Horse Farms when it is selling at its yearly high…

A: Rate of return on investment is the return expressed in percentage terms that is expected on the…

Step by step

Solved in 2 steps

- Your client has decided that the risk of the bond portfolio is acceptable and wishes to leave it as it is. Now your client has asked you to use historical returns to estimate the standard deviation of Blandy’s stock returns. (Note: Many analysts use 4 to 5 years of monthly returns to estimate risk, and many use 52 weeks of weekly returns; some even use a year or less of daily returns. For the sake of simplicity, use Blandy’s 10 annual returns.)If you invest 70 percent your savings (out of a total of 100 percent) in a secutity with 13 percent expected return and a standard deviation of 16 percent and invest all of the remaining percentage of your savings in a security with 18 percent expected return and a standard deviation of 23 percent, what is the standard deviation of returns in percentage from his portfolio of two securities (to two decimal places)? Assume that the risk free rate of return is 5 percent and the correlation between the two securities is -0.0. (Your answer should be entered as a number and not after dividing by 100. So if the answer comes out to be, say, 2 percent, your should enter 2.00 and not 0.02)An investor invests 30 percent of his wealth in a risky asset with an expected rate of return of 0.14 and a standard deviation of .35 and 70 percent in a T-bill that pays 3 percent. His portfolio's expected return and standard deviation are __________ and __________, respectively. Please show the formula

- You invest 70% of your funds in stock X with an expected return of 16% and a standard deviation of returns of 20%, and 30% of your fund in a risk-free asset with an interest rate of 4%; calculate the expected return on the resulting portfolio:Your employer has asked you to investigate the firm’s portfolio risk and return. The portfolio comprises three stocks. It is invested 50 percent in stock A, 30 percent in stock B and 20 percent in stock C. You gathered the following information: a) Determine what is the portfolio’s expected return b) Determine the portfolio’s variance and standard deviation c) Assume that the expected risk-free rate is 2.75 percent. Determine the expected risk premium on the portfolio.A portfolio that combines the risk-free asset and the market portfolio has an expected return of 7 percent and a standard deviation of 10 percent.The risk-free rate is 4 percent, and the expected return on the market portfolio is 12 percent. Assume the capital asset pricing model holds. Compute and justify the expected rate of return would a security earn if it had a 0.45 correlation with the market portfolio and a standard deviation of 55 percent.

- Your employer has asked you to investigate the firm’s portfolio risk and return. The portfolio comprises three stocks. It is invested 50 percent in stock A, 30 percent in stock B and 20 percent in stock C. (a) Determine what is the portfolio’s expected return. (b) Determine the portfolio’s variance and standard deviation. (c) Assume that the expected risk-free rate is 2.75 percent. Determine the expected risk premium on the portfolio.Assume that you have just received information from your investment advisor that your portfolio has reached a value of $1,250,000. Your portfolio consists of three stocks, as follows: Stock Amount Invested % of Total Beta A $250,000 20% 1.12 B $400,000 32% .85 C $600,000 48% .55 Total: $1,250,000 100% Calculate the beta of this investment portfolio. Assume that the expected market return ( r m ) is 9 percent and the expected risk- free rate ( RF ) is 2 percent. What is the expected return ( r j ) for this investment portfolio?You invest 80% of your portfolio in a risky portfolio that has an expected rate of return of 15% and a standard deviation of 21%, and the rest in T-bill with a 2% rate. What is the expected return of your portfolio? Enter your answer as a decimal number, rounded to three decimal places.

- Your employer has asked you to investigate the firm’s portfolio risk and return. The portfolio comprises three stocks. It is invested 50 percent in stock A, 30 percent in stock B and 20 percent in stock C. Please show your workings carefully. You gathered the following information: (a) Determine what is the portfolio’s expected return.(b) Determine the portfolio’s variance and standard deviation. (c) Assume that the expected risk-free rate is 2.75 percent. Determine the expected risk premium on the portfolio.You form a complete portfolio by investing 30% of your portfolio in a risky portfolio that has an expected rate of return of 9% and a standard deviation of 19%, and the rest in T-bill with a 2% rate. What is the standard deviation of your complete portfolio? Enter your answer as a decimal number, rounded to three decimal places.You are considering investing in a combination of a stock and a risk-free asset. The stock has an expected return of 17% with a standard deviation of 11% and the riskfree return is 3%. (a) Complete the table below and plot the expected portfolio return as a function of the portfolio standard deviation. (b) Suppose you are investing £1000. What is the meaning of a portfolio invested 150% in the risky asset?