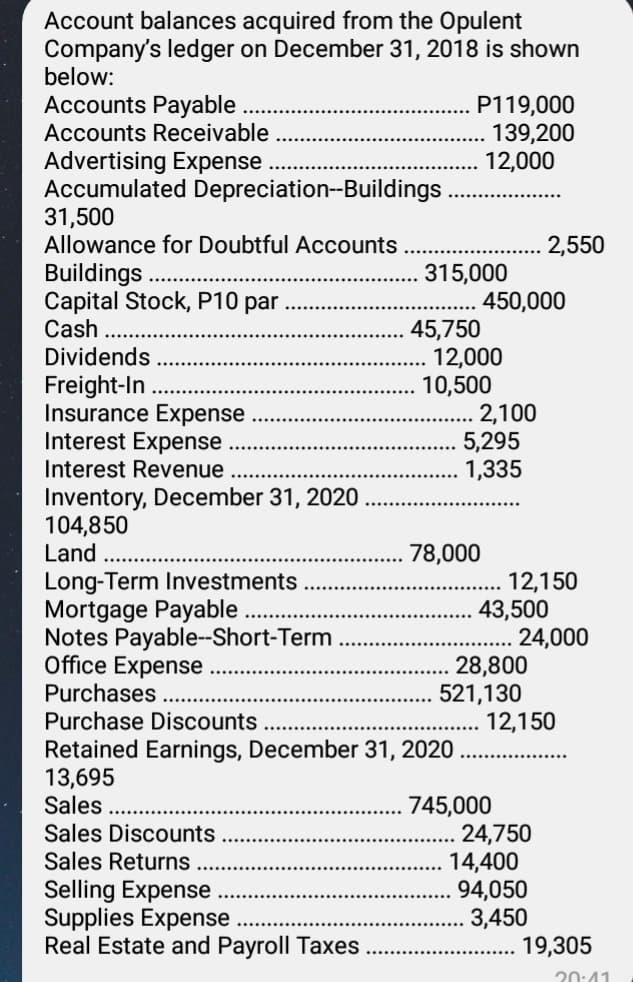

Account balances acquired from the Opulent Company's ledger on December 31, 2018 is shown below: Accounts Payable Accounts Receivable P119,000 139,200 12,000 Advertising Expense Accumulated Depreciation-Buildings. 31,500 Allowance for Doubtful Accounts 2,550 Buildings. Capital Stock, P10 par Cash Dividends 315,000 450,000 Freight-In Insurance Expense Interest Expense Interest Revenue 45,750 12,000 10,500 2,100 5,295 1,335 Inventory, December 31, 2020 104,850 Land Long-Term Investments Mortgage Payable. Notes Payable--Short-Term Office Expense. Purchases Purchase Discounts Retained Earnings, December 31, 2020 13,695 Sales Sales Discounts Sales Returns 78,000 12,150 43,500 24,000 28,800 521,130 12,150 745,000 24,750 14,400 94,050 3,450 19,305 Selling Expense Supplies Expense Real Estate and Payroll Taxes

Account balances acquired from the Opulent Company's ledger on December 31, 2018 is shown below: Accounts Payable Accounts Receivable P119,000 139,200 12,000 Advertising Expense Accumulated Depreciation-Buildings. 31,500 Allowance for Doubtful Accounts 2,550 Buildings. Capital Stock, P10 par Cash Dividends 315,000 450,000 Freight-In Insurance Expense Interest Expense Interest Revenue 45,750 12,000 10,500 2,100 5,295 1,335 Inventory, December 31, 2020 104,850 Land Long-Term Investments Mortgage Payable. Notes Payable--Short-Term Office Expense. Purchases Purchase Discounts Retained Earnings, December 31, 2020 13,695 Sales Sales Discounts Sales Returns 78,000 12,150 43,500 24,000 28,800 521,130 12,150 745,000 24,750 14,400 94,050 3,450 19,305 Selling Expense Supplies Expense Real Estate and Payroll Taxes

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.23E: Unusual income statement items Assume that the amount of each of the following items is material to...

Related questions

Question

100%

Please help me answer it all. Thankyou

Transcribed Image Text:Account balances acquired from the Opulent

Company's ledger on December 31, 2018 is shown

below:

Accounts Payable

P119,000

139,200

12,000

Accounts Receivable

Advertising Expense

Accumulated Depreciation--Buildings .

31,500

Allowance for Doubtful Accounts

2,550

Buildings

Capital Stock, P10 par

Cash

Dividends

315,000

450,000

Freight-In.

Insurance Expense

Interest Expense

45,750

12,000

10,500

2,100

5,295

1,335

Interest Revenue

Inventory, December 31, 2020

104,850

Land

78,000

Long-Term Investments

Mortgage Payable

Notes Payable--Short-Term

Office Expense

Purchases

Purchase Discounts

12,150

43,500

24,000

28,800

521,130

12,150

Retained Earnings, December 31, 2020

13,695

Sales .

Sales Discounts

Sales Returns

Selling Expense

Supplies Expense

Real Estate and Payroll Taxes

745,000

24,750

14,400

94,050

3,450

19,305

20:41

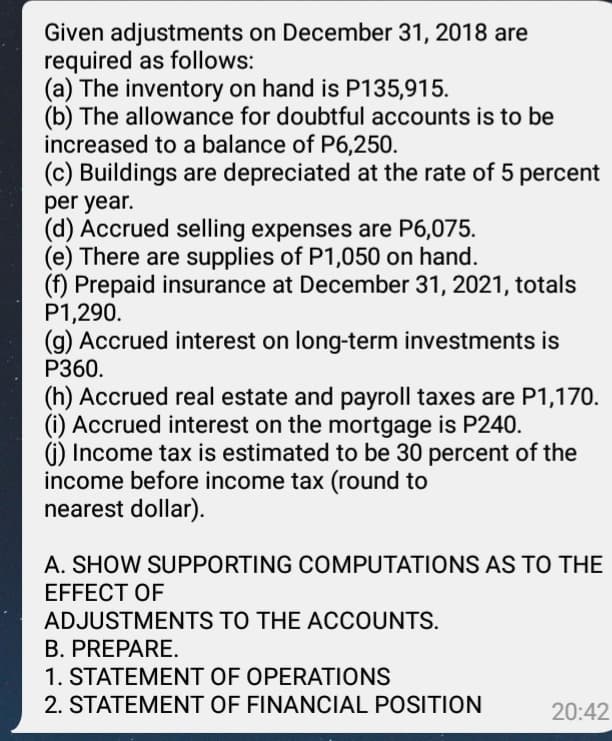

Transcribed Image Text:Given adjustments on December 31, 2018 are

required as follows:

(a) The inventory on hand is P135,915.

(b) The allowance for doubtful accounts is to be

increased to a balance of P6,250.

(c) Buildings are depreciated at the rate of 5 percent

per year.

(d) Accrued selling expenses are P6,075.

(e) There are supplies of P1,050 on hand.

(f) Prepaid insurance at December 31, 2021, totals

P1,290.

(g) Accrued interest on long-term investments is

Р360.

(h) Accrued real estate and payroll taxes are P1,170.

(i) Accrued interest on the mortgage is P240.

() Income tax is estimated to be 30 percent of the

income before income tax (round to

nearest dollar).

A. SHOW SUPPORTING COMPUTATIONS AS TO THE

EFFECT OF

ADJUSTMENTS TO THE ACCOUNTS.

B. PREPARE.

1. STATEMENT OF OPERATIONS

2. STATEMENT OF FINANCIAL POSITION

20:42

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning