Account Titles Cash Accounts receivable Prepaid insurance Machinery Accumulated depreciation Accounts payable Wages payable Income taxes payable Contributed capital Retained earnings (deficit) Revenues (not detailed) Expenses (not detailed) Totals Debit $ 56 27 9 140 7 Credit $ 14 27 119 129 50 $289 $289 Debit Credit Debit Credit $ 56 27 51 51 7 7 10 27 ▶▶▶ 2 140 7 $ 21 27 10 27 119 129 101 51 $333 $ 333

Account Titles Cash Accounts receivable Prepaid insurance Machinery Accumulated depreciation Accounts payable Wages payable Income taxes payable Contributed capital Retained earnings (deficit) Revenues (not detailed) Expenses (not detailed) Totals Debit $ 56 27 9 140 7 Credit $ 14 27 119 129 50 $289 $289 Debit Credit Debit Credit $ 56 27 51 51 7 7 10 27 ▶▶▶ 2 140 7 $ 21 27 10 27 119 129 101 51 $333 $ 333

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter1: The Role Of Accounting In Business

Section: Chapter Questions

Problem 1.1.3P: Income statement, retained earnings statement, and balance sheet The amounts of the assets and...

Related questions

Question

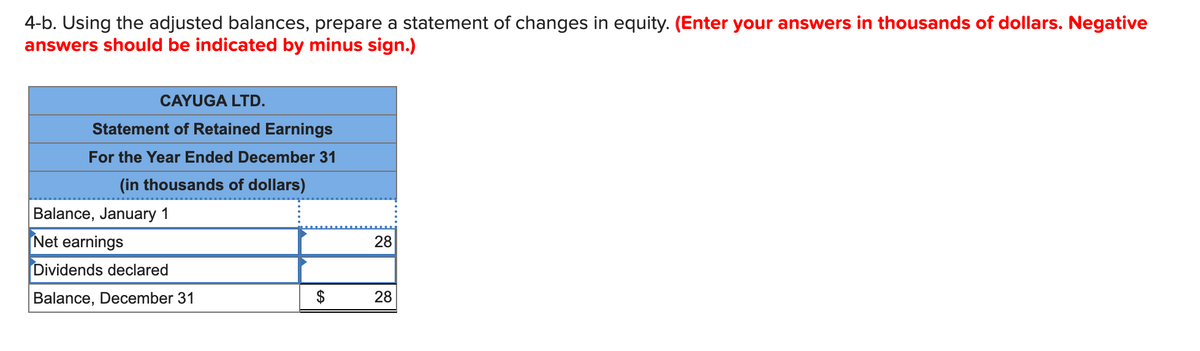

Using the adjusted balances, prepare a statement of changes in equity. (Enter your answers in thousands of dollars. Negative answers should be indicated by minus sign.)

Has an Earnings per share of $4.00 (7000 shares)

Transcribed Image Text:4-b. Using the adjusted balances, prepare a statement of changes in equity. (Enter your answers in thousands of dollars. Negative

answers should be indicated by minus sign.)

CAYUGA LTD.

Statement of Retained Earnings

For the Year Ended December 31

(in thousands of dollars)

Balance, January 1

Net earnings

Dividends declared

Balance, December 31

$

28

28

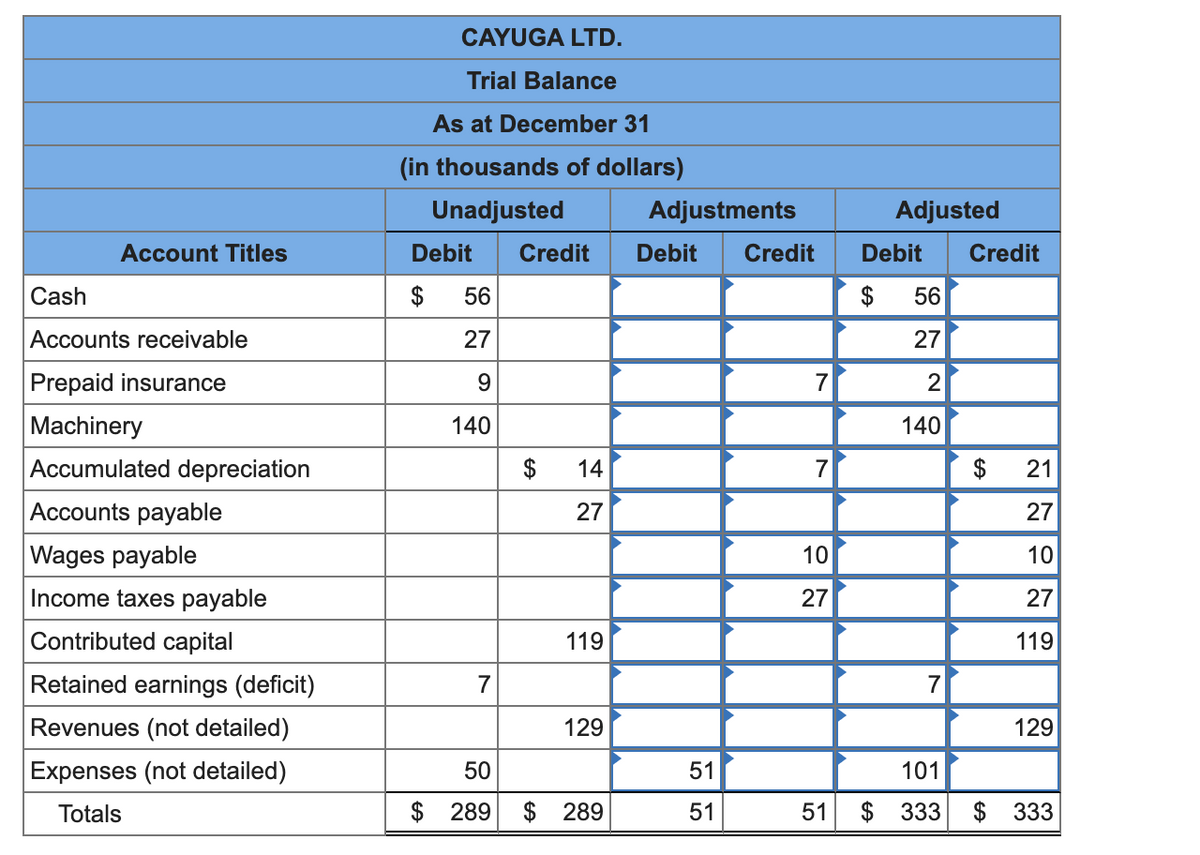

Transcribed Image Text:Account Titles

Cash

Accounts receivable

Prepaid insurance

Machinery

Accumulated depreciation

Accounts payable

Wages payable

Income taxes payable

Contributed capital

Retained earnings (deficit)

Revenues (not detailed)

Expenses (not detailed)

Totals

CAYUGA LTD.

Trial Balance

As at December 31

(in thousands of dollars)

Unadjusted

Debit

$

56

27

9

140

7

50

$ 289

Credit

$

14

27

119

129

$289

Adjustments

Debit

51

51

Credit

7

7

10

27

Adjusted

Debit Credit

$ 56

27

2

140

7

$

21

27

10

27

119

129

101

51 $ 333 $ 333

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning