Accounting for Consideration Payable Furniture Manufacturer Inc. sells 1,000 chairs to a retailer for $400,000 (with a cost of $240,000) in June 2020. Additionally, Furniture Manufacturer Inc. agrees to pay $4,000 toward an advertising promotion campaign that the retailer will provide. The retailer will provide the advertising electronically and through local print media. The cost for the advertising campaign was negotiated as part of the revenue contract. a. Prepare the entry for June 2020 to record Furniture Manufacturer Inc.'s sales revenue and cost of sales, assuming cash collected is net of the advertising fee. b. Prepare the entry in June 2020 to record Furniture Manufacturer Inc.'s sales revenue and cost of sales now assuming that $500,000 cash is collected this month. The advertising fee will be paid next month to the customer. Note: If a journal entry (or a line of a journal entry) isn't required for the transaction, select "N/A"as the account name and leave the Dr. and Cr. answers blank (zero). a. Account Name Dr. Cr. Sales Revenue To record the sale of product. To record the cost of sales. b. Account Name Dr. Cr. Sales Revenue To record the sale of product. 0 x To record the cost of sales.

Accounting for Consideration Payable Furniture Manufacturer Inc. sells 1,000 chairs to a retailer for $400,000 (with a cost of $240,000) in June 2020. Additionally, Furniture Manufacturer Inc. agrees to pay $4,000 toward an advertising promotion campaign that the retailer will provide. The retailer will provide the advertising electronically and through local print media. The cost for the advertising campaign was negotiated as part of the revenue contract. a. Prepare the entry for June 2020 to record Furniture Manufacturer Inc.'s sales revenue and cost of sales, assuming cash collected is net of the advertising fee. b. Prepare the entry in June 2020 to record Furniture Manufacturer Inc.'s sales revenue and cost of sales now assuming that $500,000 cash is collected this month. The advertising fee will be paid next month to the customer. Note: If a journal entry (or a line of a journal entry) isn't required for the transaction, select "N/A"as the account name and leave the Dr. and Cr. answers blank (zero). a. Account Name Dr. Cr. Sales Revenue To record the sale of product. To record the cost of sales. b. Account Name Dr. Cr. Sales Revenue To record the sale of product. 0 x To record the cost of sales.

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 8PB: Air Compressors Inc. purchases compressor parts for its inventory from a supplier. The following...

Related questions

Question

please give complete and correct answer show full working step by step give narrations also and please please do not copy paste

Transcribed Image Text:Accounting for Consideration Payable

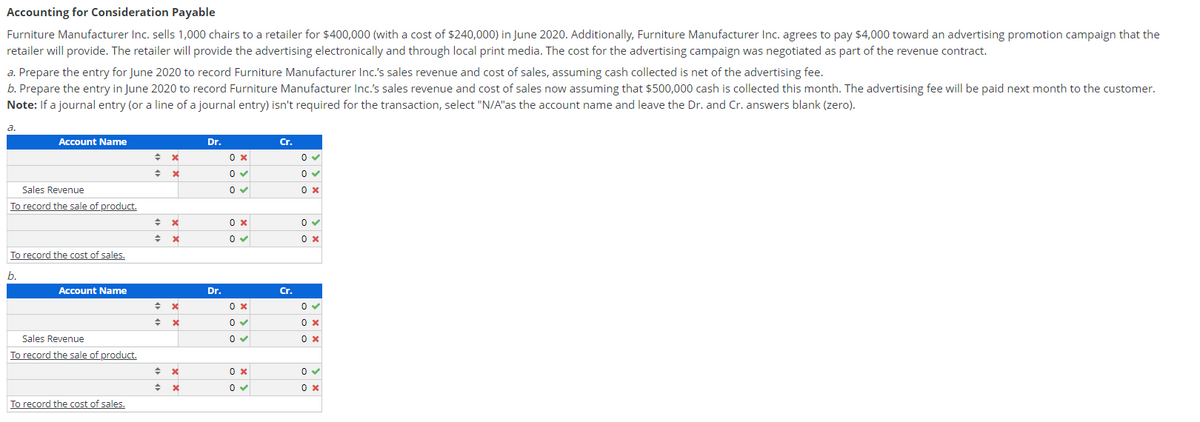

Furniture Manufacturer Inc. sells 1,000 chairs to a retailer for $400,000 (with a cost of $240,000) in June 2020. Additionally, Furniture Manufacturer Inc. agrees to pay $4,000 toward an advertising promotion campaign that the

retailer will provide. The retailer will provide the advertising electronically and through local print media. The cost for the advertising campaign was negotiated as part of the revenue contract.

a. Prepare the entry for June 2020 to record Furniture Manufacturer Inc.'s sales revenue and cost of sales, assuming cash collected is net of the advertising fee.

b. Prepare the entry in June 2020 to record Furniture Manufacturer Inc.'s sales revenue and cost of sales now assuming that $500,000 cash is collected this month. The advertising fee will be paid next month to the customer.

Note: If a journal entry (or a line of a journal entry) isn't required for the transaction, select "N/A"as the account name and leave the Dr. and Cr. answers blank (zero).

a.

Account Name

Dr.

Cr.

0 x

Sales Revenue

To record the sale of product.

0 x

To record the cost of sales.

b.

Account Name

Dr.

Cr.

Sales Revenue

To record the sale of product.

To record the cost of sales.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning