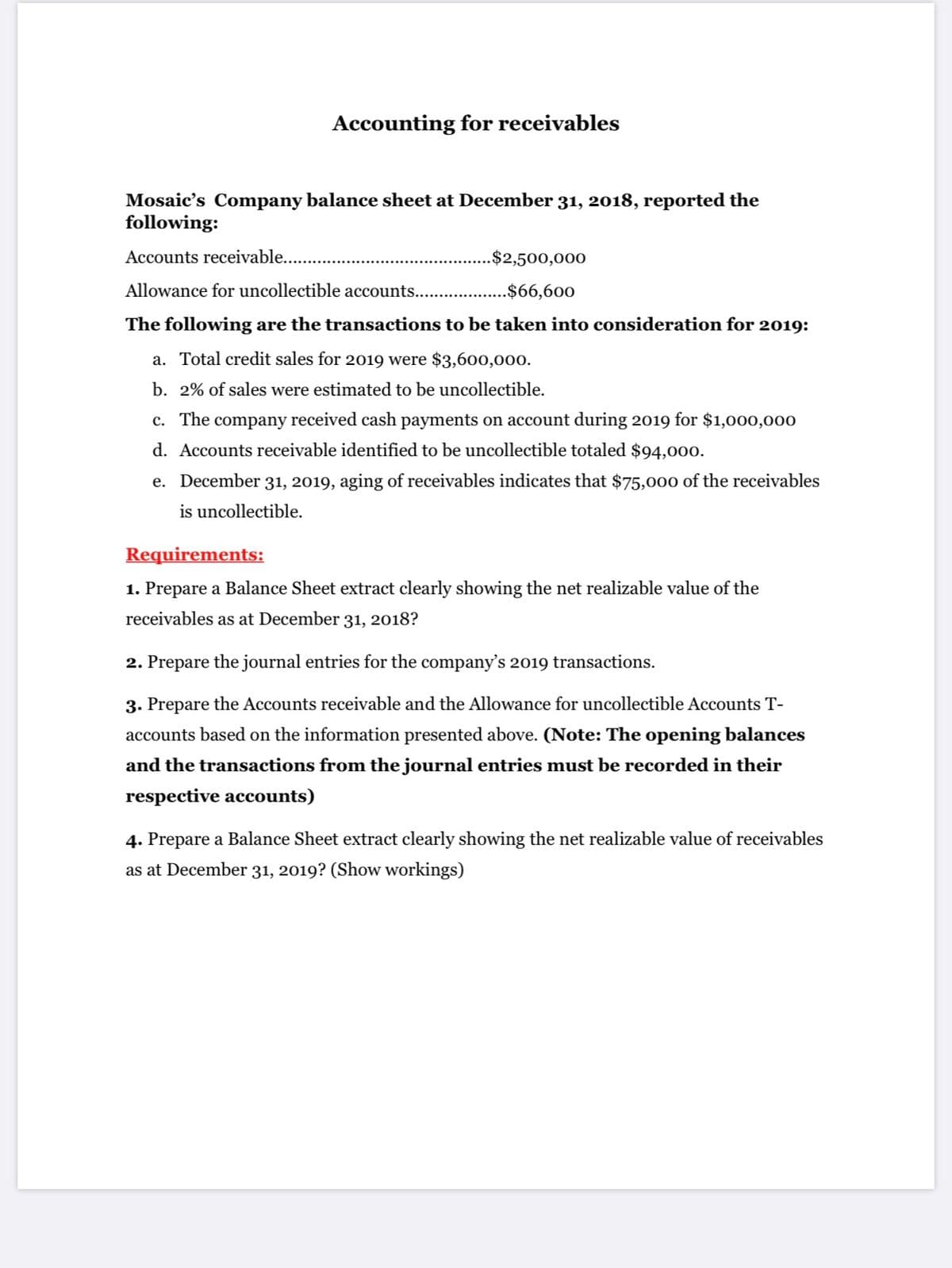

Accounting for receivables Mosaic's Company balance sheet at December 31, 2018, reported the following: Accounts receivable.. .$2,500,000 Allowance for uncollectible accounts... ..$66,600 The following are the transactions to be taken into consideration for 20o19: a. Total credit sales for 2019 were $3,600,000. b. 2% of sales were estimated to be uncollectible. c. The company received cash payments on account during 2019 for $1,000,000 d. Accounts receivable identified to be uncollectible totaled $94,000. e. December 31, 2019, aging of receivables indicates that $75,000 of the receivables is uncollectible. Requirements: 1. Prepare a Balance Sheet extract clearly showing the net realizable value of the receivables as at December 31, 2018? 2. Prepare the journal entries for the company's 2019 transactions. 3. Prepare the Accounts receivable and the Allowance for uncollectible Accounts T- accounts based on the information presented above. (Note: The opening balances and the transactions from the journal entries must be recorded in their respective accounts) 4. Prepare a Balance Sheet extract clearly showing the net realizable value of receivables as at December 31, 2019? (Show workings)

Accounting for receivables Mosaic's Company balance sheet at December 31, 2018, reported the following: Accounts receivable.. .$2,500,000 Allowance for uncollectible accounts... ..$66,600 The following are the transactions to be taken into consideration for 20o19: a. Total credit sales for 2019 were $3,600,000. b. 2% of sales were estimated to be uncollectible. c. The company received cash payments on account during 2019 for $1,000,000 d. Accounts receivable identified to be uncollectible totaled $94,000. e. December 31, 2019, aging of receivables indicates that $75,000 of the receivables is uncollectible. Requirements: 1. Prepare a Balance Sheet extract clearly showing the net realizable value of the receivables as at December 31, 2018? 2. Prepare the journal entries for the company's 2019 transactions. 3. Prepare the Accounts receivable and the Allowance for uncollectible Accounts T- accounts based on the information presented above. (Note: The opening balances and the transactions from the journal entries must be recorded in their respective accounts) 4. Prepare a Balance Sheet extract clearly showing the net realizable value of receivables as at December 31, 2019? (Show workings)

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter16: Financial Statements And Closing Entries For A Corporation

Section: Chapter Questions

Problem 5AP

Related questions

Question

Please provide a narrative when doing questions 1-4. Thank you.

Transcribed Image Text:Accounting for receivables

Mosaic's Company balance sheet at December 31, 2018, reported the

following:

Accounts receivable..

.$2,500,000

Allowance for uncollectible accounts.. .$66,600

The following are the transactions to be taken into consideration for 2019:

a. Total credit sales for 2019 were $3,600,000.

b. 2% of sales were estimated to be uncollectible.

c. The company received cash payments on account during 2019 for $1,000,000

d. Accounts receivable identified to be uncollectible totaled $94,000.

e. December 31, 2019, aging of receivables indicates that $75,000 of the receivables

is uncollectible.

Requirements:

1. Prepare a Balance Sheet extract clearly showing the net realizable value of the

receivables as at December 31, 2018?

2. Prepare the journal entries for the company's 2019 transactions.

3. Prepare the Accounts receivable and the Allowance for uncollectible Accounts T-

accounts based on the information presented above. (Note: The opening balances

and the transactions from the journal entries must be recorded in their

respective accounts)

4. Prepare a Balance Sheet extract clearly showing the net realizable value of receivables

as at December 31, 2019? (Show workings)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT