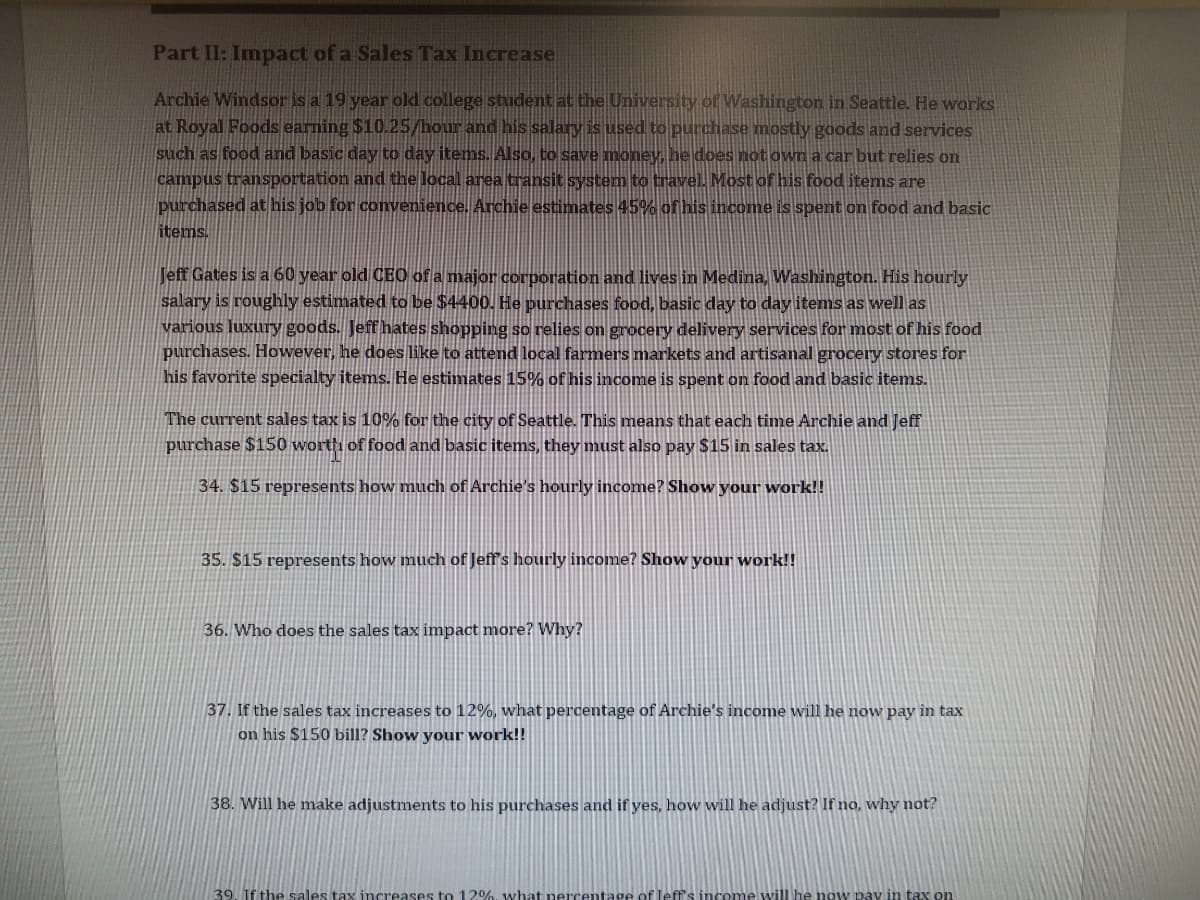

Part II: Impact of a Sales Tax Increase Archie Windsor is a 19 year old college student at the University of Washington in Seattle. He works at Royal Foods earning $10.25/hour and his salary is used to purchase mostly goods and services such as food and basic day to day items. Also, to save money, he does not own a car but relies on campus transportation and the local area transit system to travel. Most of his food items are purchased at his job for convenience. Archie estimates 45% of his income is spent on food and basic items. Jeff Gates is a 60 year old CEO of a major corporation and lives in Medina, Washington. His hourly salary is roughly estimated to be $4400. He purchases food, basic day to day items as well as various luxury goods. Jeff hates shopping so relies on grocery delivery services for most of his food purchases. However, he does like to attend local farmers markets and artisanal grocery stores for his favorite specialty items. He estimates 15% of his income is spent on food and basic items. The current sales tax is 10% for the city of Seattle. This means that each time Archie and Jeff purchase $150 worth of food and basic items, they must also pay $15 in sales tax. 34. $15 represents how much of Archie's hourly income? Show your work!! 35. $15 represents how much of Jeff's hourly income? Show your work!! 36. Who does the sales tax impact more? Why? 37. If the sales tax increases to 12%, what percentage of Archie's income will he now pay in tax on his $150 bill? Show your work!! 38. Will he make adjustments to his purchases and if yes, how will he adjust? If no, why not? 39. If the sales tax increases to 12%, what percentage of leff's income will he now pay in tax on

Part II: Impact of a Sales Tax Increase Archie Windsor is a 19 year old college student at the University of Washington in Seattle. He works at Royal Foods earning $10.25/hour and his salary is used to purchase mostly goods and services such as food and basic day to day items. Also, to save money, he does not own a car but relies on campus transportation and the local area transit system to travel. Most of his food items are purchased at his job for convenience. Archie estimates 45% of his income is spent on food and basic items. Jeff Gates is a 60 year old CEO of a major corporation and lives in Medina, Washington. His hourly salary is roughly estimated to be $4400. He purchases food, basic day to day items as well as various luxury goods. Jeff hates shopping so relies on grocery delivery services for most of his food purchases. However, he does like to attend local farmers markets and artisanal grocery stores for his favorite specialty items. He estimates 15% of his income is spent on food and basic items. The current sales tax is 10% for the city of Seattle. This means that each time Archie and Jeff purchase $150 worth of food and basic items, they must also pay $15 in sales tax. 34. $15 represents how much of Archie's hourly income? Show your work!! 35. $15 represents how much of Jeff's hourly income? Show your work!! 36. Who does the sales tax impact more? Why? 37. If the sales tax increases to 12%, what percentage of Archie's income will he now pay in tax on his $150 bill? Show your work!! 38. Will he make adjustments to his purchases and if yes, how will he adjust? If no, why not? 39. If the sales tax increases to 12%, what percentage of leff's income will he now pay in tax on

Chapter5: Introduction To Business Expenses

Section: Chapter Questions

Problem 49P

Related questions

Question

I need help with question 34 -38 if you can

Transcribed Image Text:Part II: Impact of a Sales Tax Increase

Archie Windsor is a 19 year old college student at the University of Washington in Seattle. He works

at Royal Foods earning $10.25/hour and his salary is used to purchase mostly goods and services

such as food and basic day to day items. Also, to save money, he does not own a car but relies on

campus transportation and the local area transit system to travel. Most of his food items are

purchased at his job for convenience. Archie estimates 45% of his income is spent on food and basic

items.

Jeff Gates is a 60 year old CEO of a major corporation and lives in Medina, Washington. His hourly

salary is roughly estimated to be $4400. He purchases food, basic day to day items as well as

various luxury goods. Jeff hates shopping so relies on grocery delivery services for most of his food

purchases. However, he does like to attend local farmers markets and artisanal grocery stores for

his favorite specialty items. He estimates 15% of his income is spent on food and basic items.

The current sales tax is 10% for the city of Seattle. This means that each time Archie and Jeff

purchase $150 worth of food and basic items, they must also pay $15 in sales tax.

34. $15 represents how much of Archie's hourly income? Show your work!!

35. $15 represents how much of Jeff's hourly income? Show your work!!

36. Who does the sales tax impact more? Why?

37. If the sales tax increases to 12%, what percentage of Archie's income will he now pay in tax

on his $150 bill? Show your work!!

38. Will he make adjustments to his purchases and if yes, how will he adjust? If no, why not?

39. If the sales tax increases to 12%, what percentage of leff's income will he now pay in tax on

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT