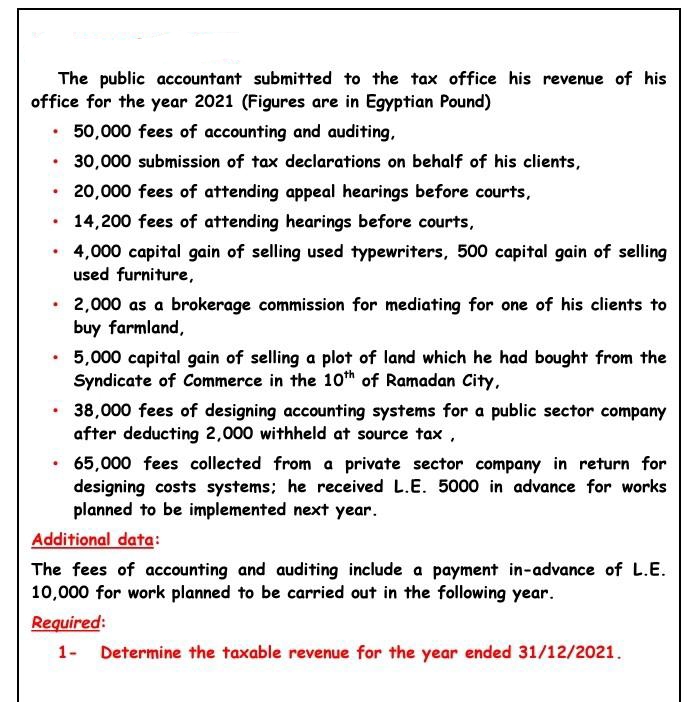

The public accountant submitted to the tax office his revenue of his office for the year 2021 (Figures are in Egyptian Pound) 50,000 fees of accounting and auditing, 30,000 submission of tax declarations on behalf of his clients, 20,000 fees of attending appeal hearings before courts, • 14,200 fees of attending hearings before courts, 4,000 capital gain of selling used typewriters, 500 capital gain of selling used furniture, 2,000 as a brokerage commission for mediating for one of his clients to buy farmland, 5,000 capital gain of selling a plot of land which he had bought from the Syndicate of Commerce in the 10th of Ramadan City, 38,000 fees of designing accounting systems for a public sector company after deducting 2,000 withheld at source tax , 65,000 fees collected from a private sector company in return for designing costs systems; he received L.E. 5000 in advance for works planned to be implemented next year. Additional data: The fees of accounting and auditing include a payment in-advance of L.E. 10,000 for work planned to be carried out in the following year. Required: 1- Determine the taxable revenue for the year ended 31/12/2021.

The public accountant submitted to the tax office his revenue of his office for the year 2021 (Figures are in Egyptian Pound) 50,000 fees of accounting and auditing, 30,000 submission of tax declarations on behalf of his clients, 20,000 fees of attending appeal hearings before courts, • 14,200 fees of attending hearings before courts, 4,000 capital gain of selling used typewriters, 500 capital gain of selling used furniture, 2,000 as a brokerage commission for mediating for one of his clients to buy farmland, 5,000 capital gain of selling a plot of land which he had bought from the Syndicate of Commerce in the 10th of Ramadan City, 38,000 fees of designing accounting systems for a public sector company after deducting 2,000 withheld at source tax , 65,000 fees collected from a private sector company in return for designing costs systems; he received L.E. 5000 in advance for works planned to be implemented next year. Additional data: The fees of accounting and auditing include a payment in-advance of L.E. 10,000 for work planned to be carried out in the following year. Required: 1- Determine the taxable revenue for the year ended 31/12/2021.

Chapter11: The Corporate Income Tax

Section: Chapter Questions

Problem 11MCQ

Related questions

Question

4

Transcribed Image Text:The public accountant submitted to the tax office his revenue of his

office for the year 2021 (Figures are in Egyptian Pound)

50,000 fees of accounting and auditing,

30,000 submission of tax declarations on behalf of his clients,

20,000 fees of attending appeal hearings before courts,

14,200 fees of attending hearings before courts,

4,000 capital gain of selling used typewriters, 500 capital gain of selling

used furniture,

2,000 as a brokerage commission for mediating for one of his clients to

buy farmland,

5,000 capital gain of selling a plot of land which he had bought from the

Syndicate of Commerce in the 10th of Ramadan City,

38,000 fees of designing accounting systems for a public sector company

after deducting 2,000 withheld at source tax ,

65,000 fees collected from a private sector company in return for

designing costs systems; he received L.E. 5000 in advance for works

planned to be implemented next year.

Additional data:

The fees of accounting and auditing include a payment in-advance of L.E.

10,000 for work planned to be carried out in the following year.

Required:

1- Determine the taxable revenue for the year ended 31/12/2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you