salarıes of P80,000. The total factory utilities expense incurred for the period was P360,000, repair and maintenance of factory equipment, P20,000 and depreciation on factory equipment was reported to be P120,000. The company uses the actual costing method of accumulating costs and it maintains a 35% mark up on costs for establishing its selling price. rofit ctions. olden Compute for: a) The total factory costs for the period. b) The cost of goods sold for the period. c) The net income or (loss) for the period. Problem 1-5. The following costs were actually incurred in the production of 10,000 units of Product A: ai bassouo oRaw materials, of which 10% is indirect Factory labor, of which 20% is indirect labor P1,200,500 1,045,000 900,000 19vsd Factory overhead, other than indirect materials and indirect labor les. ine Factory overhead charged to production is equivalent to 110% of direct labor costs. At the end of the period, inspection revealed that the total costs of goods manufactured is equal to P2,837,500 while costs of unfinished job is 20% of total factory costs. Compute for the work in process at the beginning of the period. Problem 1-6. West Virginia Company reported a net income of P55,500 for the period just ended. The goods available for sale was P259,500 of which P237,000 come from goods produced during the current period.

salarıes of P80,000. The total factory utilities expense incurred for the period was P360,000, repair and maintenance of factory equipment, P20,000 and depreciation on factory equipment was reported to be P120,000. The company uses the actual costing method of accumulating costs and it maintains a 35% mark up on costs for establishing its selling price. rofit ctions. olden Compute for: a) The total factory costs for the period. b) The cost of goods sold for the period. c) The net income or (loss) for the period. Problem 1-5. The following costs were actually incurred in the production of 10,000 units of Product A: ai bassouo oRaw materials, of which 10% is indirect Factory labor, of which 20% is indirect labor P1,200,500 1,045,000 900,000 19vsd Factory overhead, other than indirect materials and indirect labor les. ine Factory overhead charged to production is equivalent to 110% of direct labor costs. At the end of the period, inspection revealed that the total costs of goods manufactured is equal to P2,837,500 while costs of unfinished job is 20% of total factory costs. Compute for the work in process at the beginning of the period. Problem 1-6. West Virginia Company reported a net income of P55,500 for the period just ended. The goods available for sale was P259,500 of which P237,000 come from goods produced during the current period.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter2: Basic Cost Management Concepts

Section: Chapter Questions

Problem 22E: Ellerson Company provided the following information for the last calendar year: During the year,...

Related questions

Question

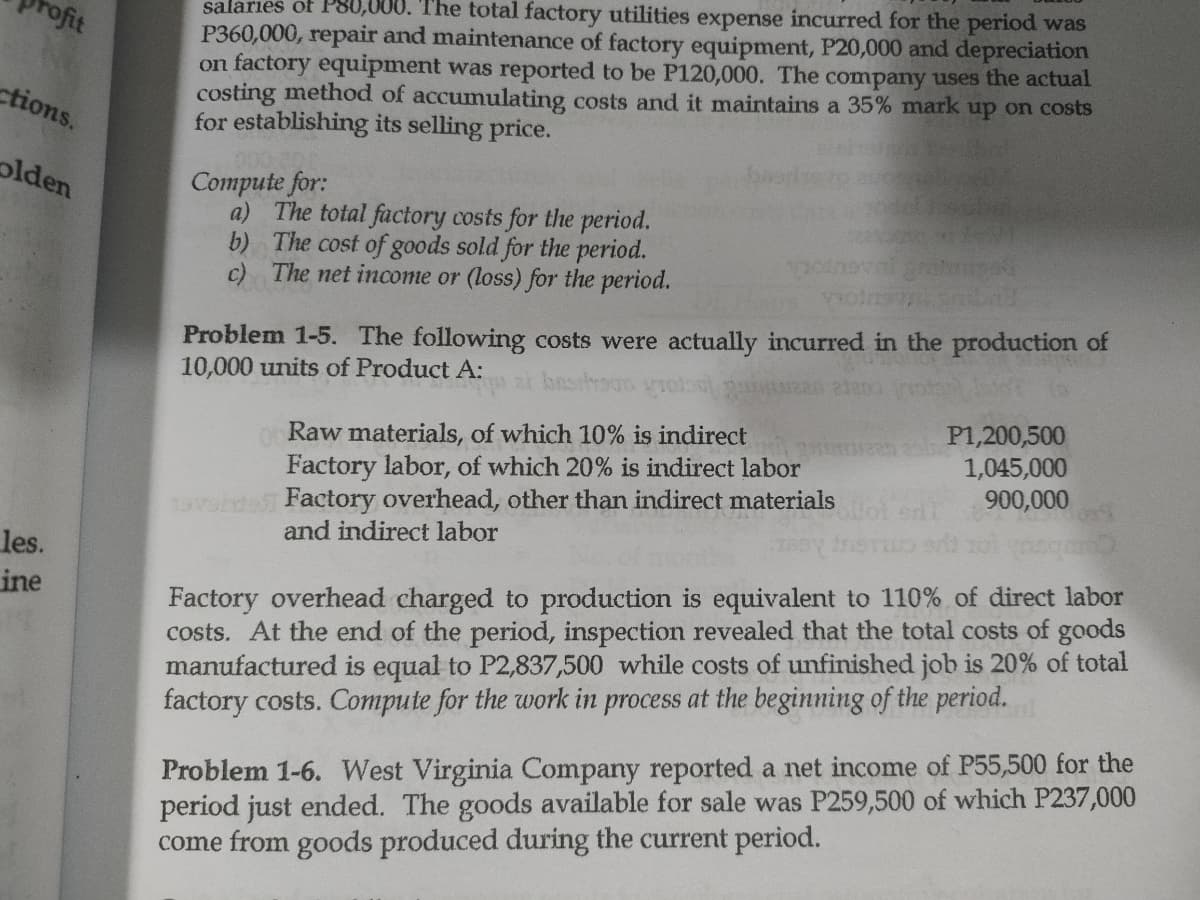

Transcribed Image Text:salarıes of P80,000. The total factory utilities expense incurred for the period was

P360,000, repair and maintenance of factory equipment, P20,000 and depreciation

on factory equipment was reported to be P120,000. The company uses the actual

costing method of accumulating costs and it maintains a 35% mark up on costs

for establishing its selling price.

rofit

ctions.

olden

Compute for:

a) The total factory costs for the period.

b) The cost of goods sold for the period.

c) The net income or (loss) for the period.

Problem 1-5. The following costs were actually incurred in the production of

10,000 units of Product A:

ai bassouo

oRaw materials, of which 10% is indirect

Factory labor, of which 20% is indirect labor

P1,200,500

1,045,000

900,000

19vsd Factory overhead, other than indirect materials

and indirect labor

les.

ine

Factory overhead charged to production is equivalent to 110% of direct labor

costs. At the end of the period, inspection revealed that the total costs of goods

manufactured is equal to P2,837,500 while costs of unfinished job is 20% of total

factory costs. Compute for the work in process at the beginning of the period.

Problem 1-6. West Virginia Company reported a net income of P55,500 for the

period just ended. The goods available for sale was P259,500 of which P237,000

come from goods produced during the current period.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning