Part Il: ProbleHS 1. If the salary of an employee is 2,000 Birr and the tax Rate 15% and deduction = 142.50. Instruction: a. Calculate the income tax Income Tax (2,000 Birr x 15%)- 142.50 Birr= 157.50 Birr b. Record the payment of salary to the employee Salary expense 2000 Employment income tax 157.50 Cash 1842.5 C Record the payment of withholding tax to the tax authority Employment income tax 157.50 Cash 157.50 Assume that the revenue from Karamara Share Company is Br 2,000,000 during Tax Year ended Sene 30, 2012. Cost and Expense were Br 1,000,000 and Br S60,000, respectively. Determine the Taxable Business Profit and Compute the Business Profit Tax Liability of this Share Company. Mr. Ayub has a building that is available for rent The following are the details of the property let out He has let out for twelve months. Actual rent for a month is birr 2000, He paid 15% of the 2. 3. 1

Part Il: ProbleHS 1. If the salary of an employee is 2,000 Birr and the tax Rate 15% and deduction = 142.50. Instruction: a. Calculate the income tax Income Tax (2,000 Birr x 15%)- 142.50 Birr= 157.50 Birr b. Record the payment of salary to the employee Salary expense 2000 Employment income tax 157.50 Cash 1842.5 C Record the payment of withholding tax to the tax authority Employment income tax 157.50 Cash 157.50 Assume that the revenue from Karamara Share Company is Br 2,000,000 during Tax Year ended Sene 30, 2012. Cost and Expense were Br 1,000,000 and Br S60,000, respectively. Determine the Taxable Business Profit and Compute the Business Profit Tax Liability of this Share Company. Mr. Ayub has a building that is available for rent The following are the details of the property let out He has let out for twelve months. Actual rent for a month is birr 2000, He paid 15% of the 2. 3. 1

Chapter4: Income Tax Withholding

Section: Chapter Questions

Problem 3SSQ

Related questions

Question

Question 1 and 2

Transcribed Image Text:Part Il: ProbleHS

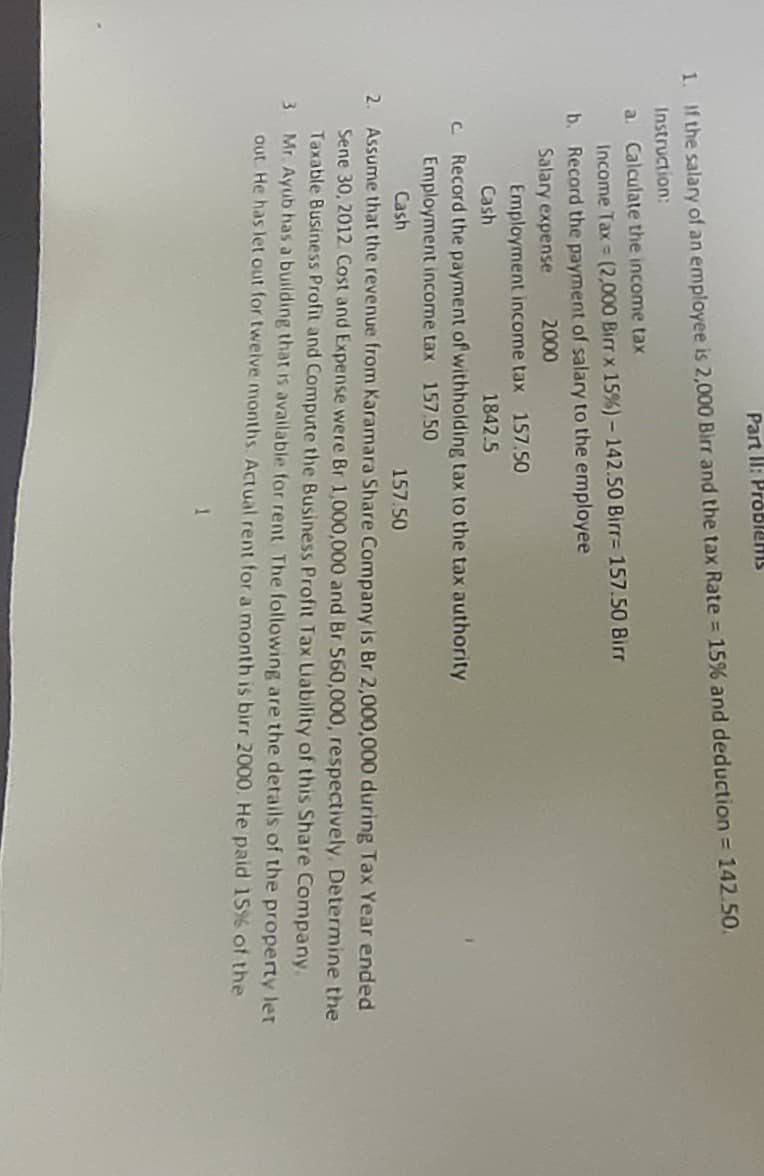

1. If the salary of an employee is 2,000 Birr and the tax Rate 15% and deduction = 142.50.

Instruction:

a. Calculate the income tax

Income Tax (2,000 Birr x 15%)- 142.50 Birr= 157.50 Birr

b. Record the payment of salary to the employee

Salary expense

2000

Employment income tax 157.50

Cash

1842.5

C Record the payment of withholding tax to the tax authority

Employment income tax 157.50

Cash

157.50

Assume that the revenue from Karamara Share Company is Br 2,000,000 during Tax Year ended

Sene 30, 2012. Cost and Expense were Br 1,000,000 and Br S60,000, respectively. Determine the

Taxable Business Profit and Compute the Business Profit Tax Liability of this Share Company.

Mr. Ayub has a building that is available for rent The following are the details of the property let

out He has let out for twelve months. Actual rent for a month is birr 2000, He paid 15% of the

2.

3.

1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning