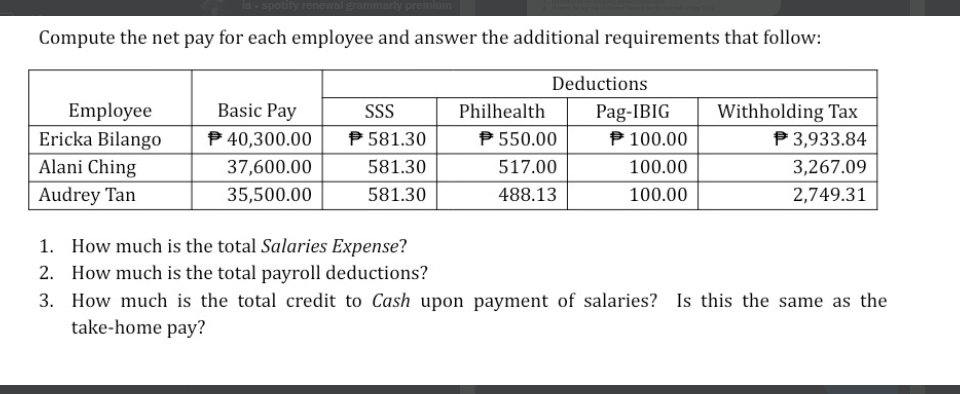

Compute the net pay for each employee and answer the additional requirements that follow: Deductions Employee Basic Pay SSS Philhealth Withholding Tax P 3,933.84 Ericka Bilango P40,300.00 P581.30 P550.00 P100.00 Alani Ching 37,600.00 581.30 517.00 100.00 3,267.09 Audrey Tan 35,500.00 581.30 488.13 100.00 2,749.31 1. How much is the total Salaries Expense? 2. How much is the total payroll deductions? 3. How much is the total credit to Cash upon payment of salaries? Is this the same as the take-home pay? Pag-IBIG

Compute the net pay for each employee and answer the additional requirements that follow: Deductions Employee Basic Pay SSS Philhealth Withholding Tax P 3,933.84 Ericka Bilango P40,300.00 P581.30 P550.00 P100.00 Alani Ching 37,600.00 581.30 517.00 100.00 3,267.09 Audrey Tan 35,500.00 581.30 488.13 100.00 2,749.31 1. How much is the total Salaries Expense? 2. How much is the total payroll deductions? 3. How much is the total credit to Cash upon payment of salaries? Is this the same as the take-home pay? Pag-IBIG

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 15EA: In EA14, you prepared the journal entries for the employee of Toren Inc. You have now been given the...

Related questions

Question

Transcribed Image Text:Compute the net pay for each employee and answer the additional requirements that follow:

Deductions

Employee

Basic Pay

SSS

Philhealth

Withholding Tax

Ericka Bilango

40,300.00

581.30

550.00

100.00

P 3,933.84

Alani Ching

37,600.00

581.30

517.00

100.00

3,267.09

Audrey Tan

35,500.00

581.30

488.13

100.00

2,749.31

1. How much is the total Salaries Expense?

2. How much is the total payroll deductions?

3. How much is the total credit to Cash upon payment of salaries? Is this the same as the

take-home pay?

Pag-IBIG

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College