A v2.cengagenow.com Entries for Sale of Fixed Asset Equipment acquired on January 8 at a cost of $128,850 has an estimated useful life of 13 years, has an estimated residual value of $9,900, and is depreciated by the straight-line method. a. What was the book value of the equipment at December 31 the end of the fourth year? 24 b. Assume that the equipment was sold on April 1 of the fifth year for $84,147. 1. Journalize the entry to record depreciation for the three months until the sale date. If an amount box does not require an entry, leave it blank. Round your answers to the nearest whole dollar if required. 88 2. Journalize the entry to record the sale of the equipment. If an amount box does not require an entry, leave it blank. Do not round intermediate calculations. heck My Work ( Previous Next All work saved. Save and Exit Submit Assignment for Grading

A v2.cengagenow.com Entries for Sale of Fixed Asset Equipment acquired on January 8 at a cost of $128,850 has an estimated useful life of 13 years, has an estimated residual value of $9,900, and is depreciated by the straight-line method. a. What was the book value of the equipment at December 31 the end of the fourth year? 24 b. Assume that the equipment was sold on April 1 of the fifth year for $84,147. 1. Journalize the entry to record depreciation for the three months until the sale date. If an amount box does not require an entry, leave it blank. Round your answers to the nearest whole dollar if required. 88 2. Journalize the entry to record the sale of the equipment. If an amount box does not require an entry, leave it blank. Do not round intermediate calculations. heck My Work ( Previous Next All work saved. Save and Exit Submit Assignment for Grading

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 71BPSB: Depreciation Schedules Dunn Corporation acquired a new depreciable asset for $135,000. The asset has...

Related questions

Question

Transcribed Image Text:A v2.cengagenow.com

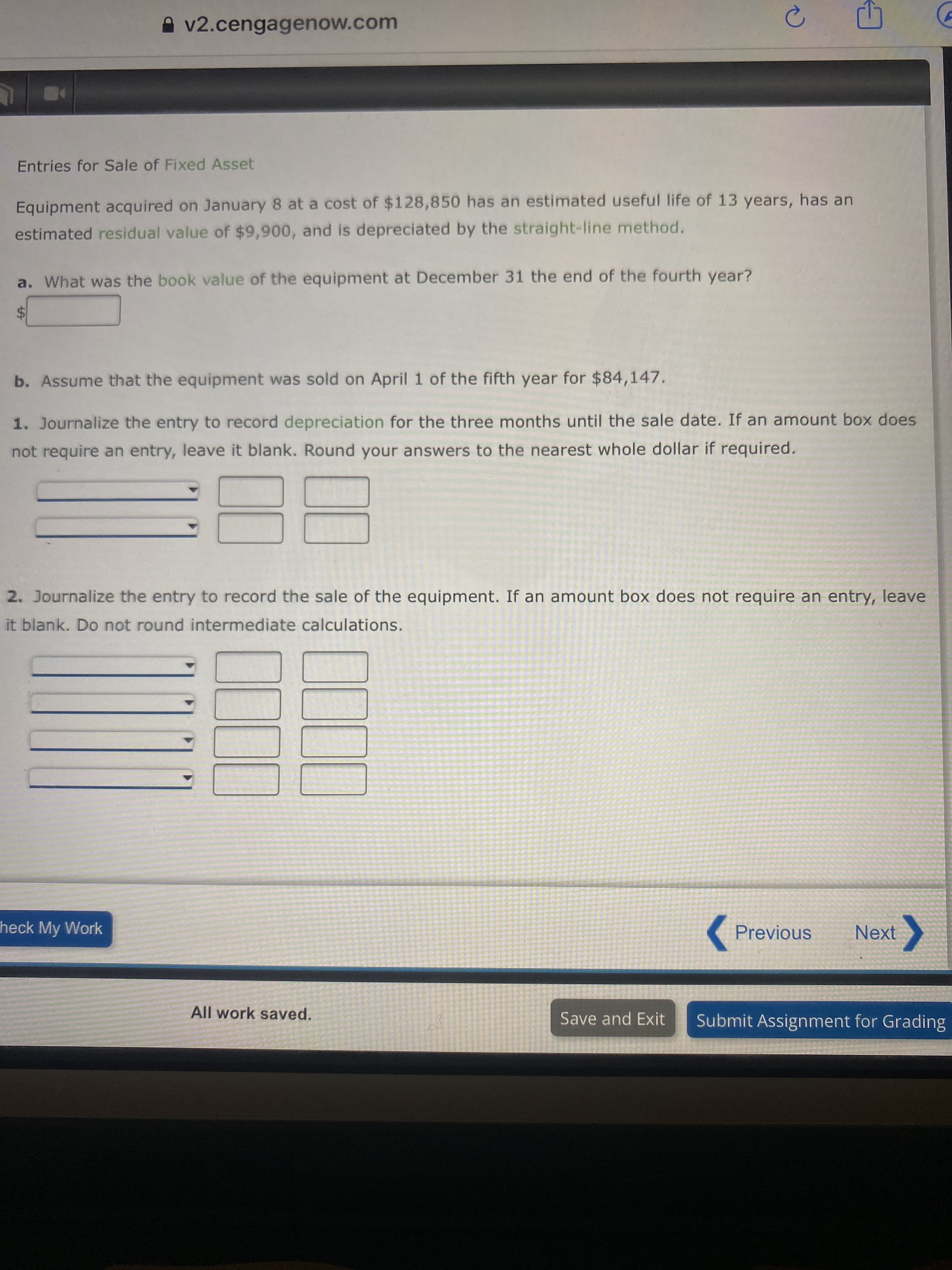

Entries for Sale of Fixed Asset

Equipment acquired on January 8 at a cost of $128,850 has an estimated useful life of 13 years, has an

estimated residual value of $9,900, and is depreciated by the straight-line method.

a. What was the book value of the equipment at December 31 the end of the fourth year?

24

b. Assume that the equipment was sold on April 1 of the fifth year for $84,147.

1. Journalize the entry to record depreciation for the three months until the sale date. If an amount box does

not require an entry, leave it blank. Round your answers to the nearest whole dollar if required.

88

2. Journalize the entry to record the sale of the equipment. If an amount box does not require an entry, leave

it blank. Do not round intermediate calculations.

heck My Work

( Previous

Next

All work saved.

Save and Exit

Submit Assignment for Grading

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT