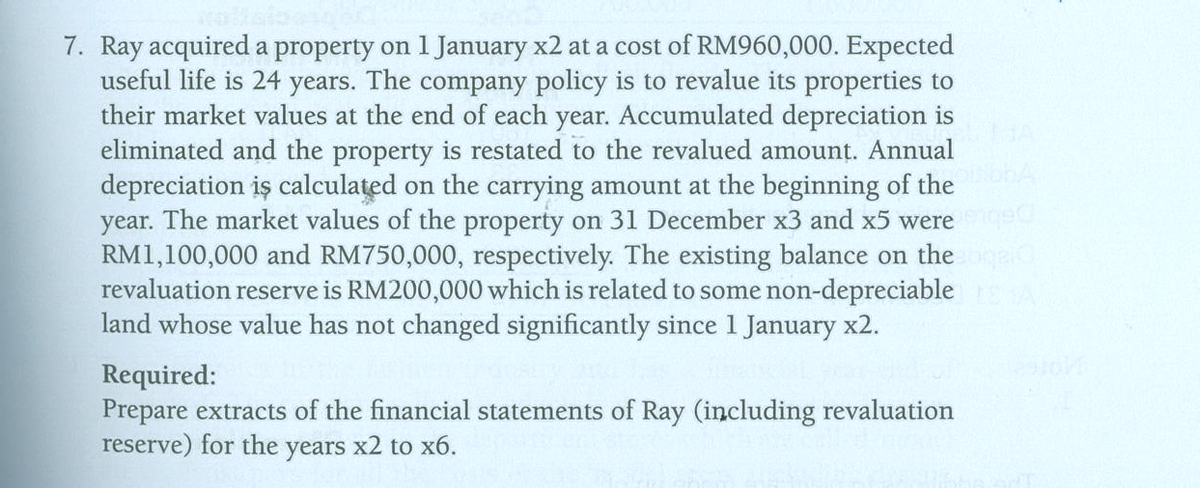

7. Ray acquired a property on 1 January x2 at a cost of RM960,000. Expected useful life is 24 years. The company policy is to revalue its properties to their market values at the end of each year. Accumulated depreciation is eliminated and the property is restated to the revalued amount. Annual depreciation iş calculated on the carrying amount at the beginning of the year. The market values of the property on 31 December x3 and x5 were RM1,100,000 and RM750,000, respectively. The existing balance on the revaluation reserve is RM200,000 which is related to some non-depreciable land whose value has not changed significantly since 1 January x2. Required: Prepare extracts of the financial statements of Ray (including revaluation reserve) for the years x2 to x6.

7. Ray acquired a property on 1 January x2 at a cost of RM960,000. Expected useful life is 24 years. The company policy is to revalue its properties to their market values at the end of each year. Accumulated depreciation is eliminated and the property is restated to the revalued amount. Annual depreciation iş calculated on the carrying amount at the beginning of the year. The market values of the property on 31 December x3 and x5 were RM1,100,000 and RM750,000, respectively. The existing balance on the revaluation reserve is RM200,000 which is related to some non-depreciable land whose value has not changed significantly since 1 January x2. Required: Prepare extracts of the financial statements of Ray (including revaluation reserve) for the years x2 to x6.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 11E: On May 10, 2019, Horan Company purchased equipment for 25,000. The equipment has an estimated...

Related questions

Question

This question related with MFRS 116

Transcribed Image Text:7. Ray acquired a property on 1 January x2 at a cost of RM960,000. Expected

useful life is 24 years. The company policy is to revalue its properties to

their market values at the end of each year. Accumulated depreciation is

eliminated and the property is restated to the revalued amount. Annual

depreciation iş calculated on the carrying amount at the beginning of the

year. The market values of the property on 31 December x3 and x5 werege

RM1,100,000 and RM750,000, respectively. The existing balance on the

revaluation reserve is RM200,000 which is related to some non-depreciable

land whose value has not changed significantly since 1 January x2.

Required:

Prepare extracts of the financial statements of Ray (including revaluation

reserve) for the years x2 to x6.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College