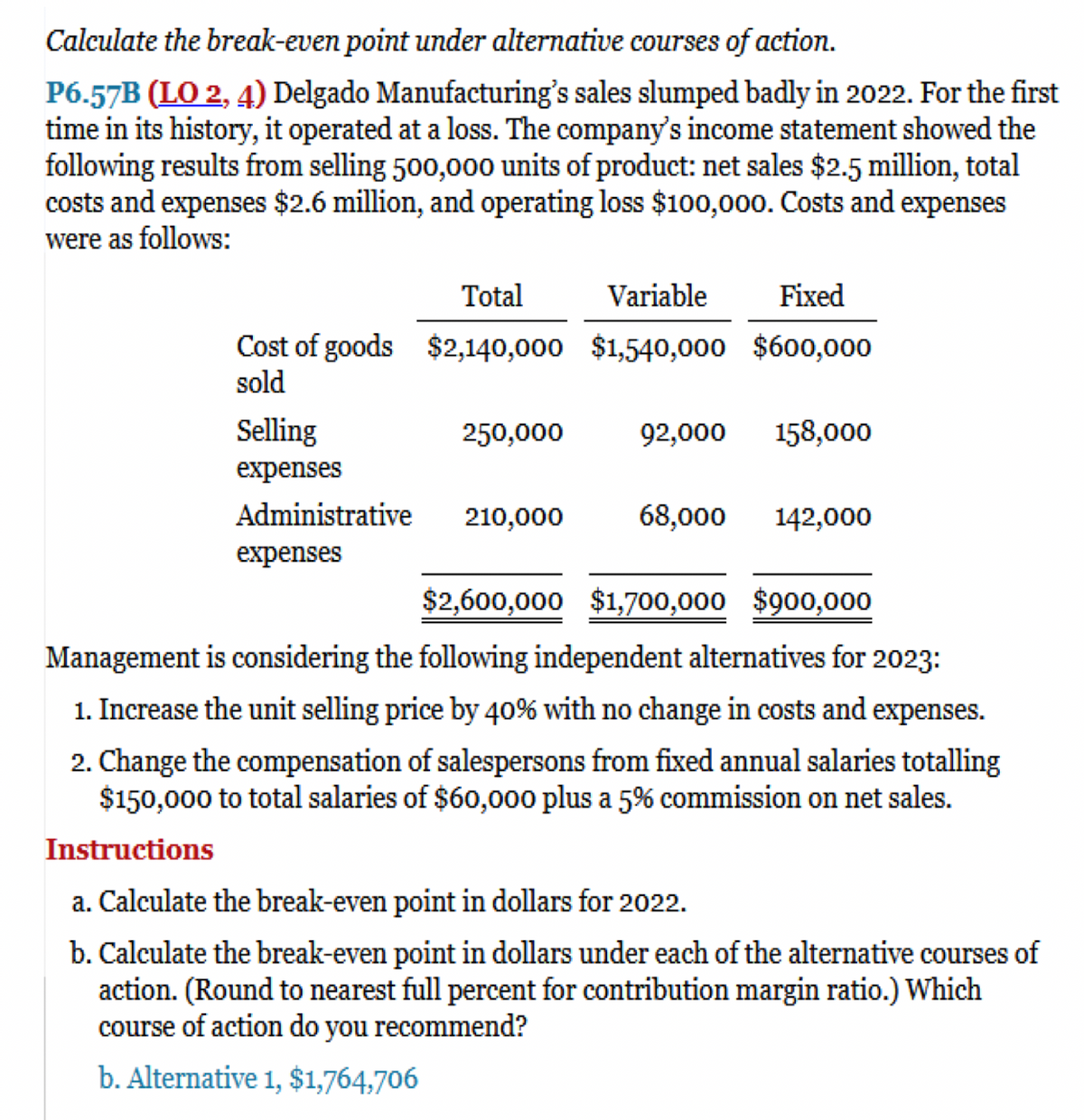

Calculate the break-even point under alternative courses of action. P6.57B (LO 2, 4) Delgado Manufacturing's sales slumped badly in 2022. For the first time in its history, it operated at a loss. The company's income statement showed the following results from selling 500,000 units of product: net sales $2.5 million, total costs and expenses $2.6 million, and operating loss $100,000. Costs and expenses were as follows: Total Variable Fixed Cost of goods $2,140,000 $1,540,000 $600,000 sold Selling 250,000 92,000 158,000 expenses Administrative 210,000 68,000 142,000 expenses $2,600,000 $1,700,000 $900,000 Management is considering the following independent alternatives for 2023: 1. Increase the unit selling price by 40% with no change in costs and expenses. 2. Change the compensation of salespersons from fixed annual salaries totalling $150,000 to total salaries of $60,000 plus a 5% commission on net sales. Instructions a. Calculate the break-even point in dollars for 2022. b. Calculate the break-even point in dollars under each of the alternative courses of action. (Round to nearest full percent for contribution margin ratio.) Which course of action do you recommend? b. Alternative 1, $1,764,706

Calculate the break-even point under alternative courses of action. P6.57B (LO 2, 4) Delgado Manufacturing's sales slumped badly in 2022. For the first time in its history, it operated at a loss. The company's income statement showed the following results from selling 500,000 units of product: net sales $2.5 million, total costs and expenses $2.6 million, and operating loss $100,000. Costs and expenses were as follows: Total Variable Fixed Cost of goods $2,140,000 $1,540,000 $600,000 sold Selling 250,000 92,000 158,000 expenses Administrative 210,000 68,000 142,000 expenses $2,600,000 $1,700,000 $900,000 Management is considering the following independent alternatives for 2023: 1. Increase the unit selling price by 40% with no change in costs and expenses. 2. Change the compensation of salespersons from fixed annual salaries totalling $150,000 to total salaries of $60,000 plus a 5% commission on net sales. Instructions a. Calculate the break-even point in dollars for 2022. b. Calculate the break-even point in dollars under each of the alternative courses of action. (Round to nearest full percent for contribution margin ratio.) Which course of action do you recommend? b. Alternative 1, $1,764,706

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter21: Supply Chains And Working Capital Management

Section: Chapter Questions

Problem 16P: The Thompson Corporation projects an increase in sales from 1.5 million to 2 million, but it needs...

Related questions

Question

please explain in steps thanks

Transcribed Image Text:Calculate the break-even point under alternative courses of action.

P6.57B (LO 2, 4) Delgado Manufacturing's sales slumped badly in 2022. For the first

time in its history, it operated at a loss. The company's income statement showed the

following results from selling 500,000 units of product: net sales $2.5 million, total

costs and expenses $2.6 million, and operating loss $100,000. Costs and expenses

were as follows:

Total

Variable

Fixed

Cost of goods $2,140,000

$1,540,000 $600,000

sold

Selling

250,000

92,000 158,000

expenses

Administrative 210,000

68,000 142,000

expenses

$2,600,000 $1,700,000 $900,000

Management is considering the following independent alternatives for 2023:

1. Increase the unit selling price by 40% with no change in costs and expenses.

2. Change the compensation of salespersons from fixed annual salaries totalling

$150,000 to total salaries of $60,000 plus a 5% commission on net sales.

Instructions

a. Calculate the break-even point in dollars for 2022.

b. Calculate the break-even point in dollars under each of the alternative courses of

action. (Round to nearest full percent for contribution margin ratio.) Which

course of action do you recommend?

b. Alternative 1, $1,764,706

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning