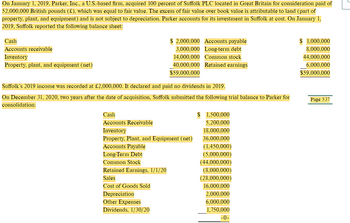

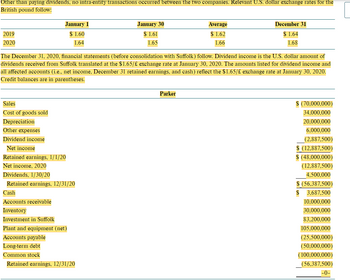

Parker's chief financial officer (CFO) wishes to determine the effects that a change in the value of the British pound would have on consolidated net income and consolidated stockholders equity. To help assess the foreign currency exposure associated with the investment in Suffolk, the CFO requests assistance in comparing consolidated results under actual exchange rate fluctuations with results that would have occurred had the dollar value of the pound remained constant or declined during the first two years of Parker's ownership. REQUIRED Use Excel to comprete the following four parts: Part 1: Given the relevant exchange rates presented: a. Translate Suffolk's December 31, 2020, trial balance from British pounds to U. S. Dollars. The British pound is Suffolk's functional currency. b. Prepare a schedule that details the change in Suffolk's cumulative translation adjustment (beginning net assets, income, dividents, etc) for 2019 and 2020. C. Prepare the December 31, 2020, consolidation worksheet for Parker and Suffolk. d. Prepare the 2020 consolidated income statement and the December 31, 2020, consolidated balance sheet.

Parker's chief financial officer (CFO) wishes to determine the effects that a change in the value of the British pound would have on consolidated net income and consolidated

REQUIRED

Use Excel to comprete the following four parts:

Part 1: Given the relevant exchange rates presented:

a. Translate Suffolk's December 31, 2020,

b. Prepare a schedule that details the change in Suffolk's cumulative translation adjustment (beginning net assets, income, dividents, etc) for 2019 and 2020.

C. Prepare the December 31, 2020, consolidation worksheet for Parker and Suffolk.

d. Prepare the 2020 consolidated income statement and the December 31, 2020, consolidated balance sheet.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Parker's chief financial officer (CFO) wishes to determine the effects that a change in the value of the British pound would have on consolidated net income and consolidated

REQUIRED

Use Excel to comprete the following four parts:

Part 1: Given the relevant exchange rates presented:

b. Prepare a schedule that details the change in Suffolk's cumulative translation adjustment (beginning net assets, income, dividents, etc) for 2019 and 2020.

C. Prepare the December 31, 2020, consolidation worksheet for Parker and Suffolk.

d. Prepare the 2020 consolidated income statement and the December 31, 2020, consolidated balance sheet.