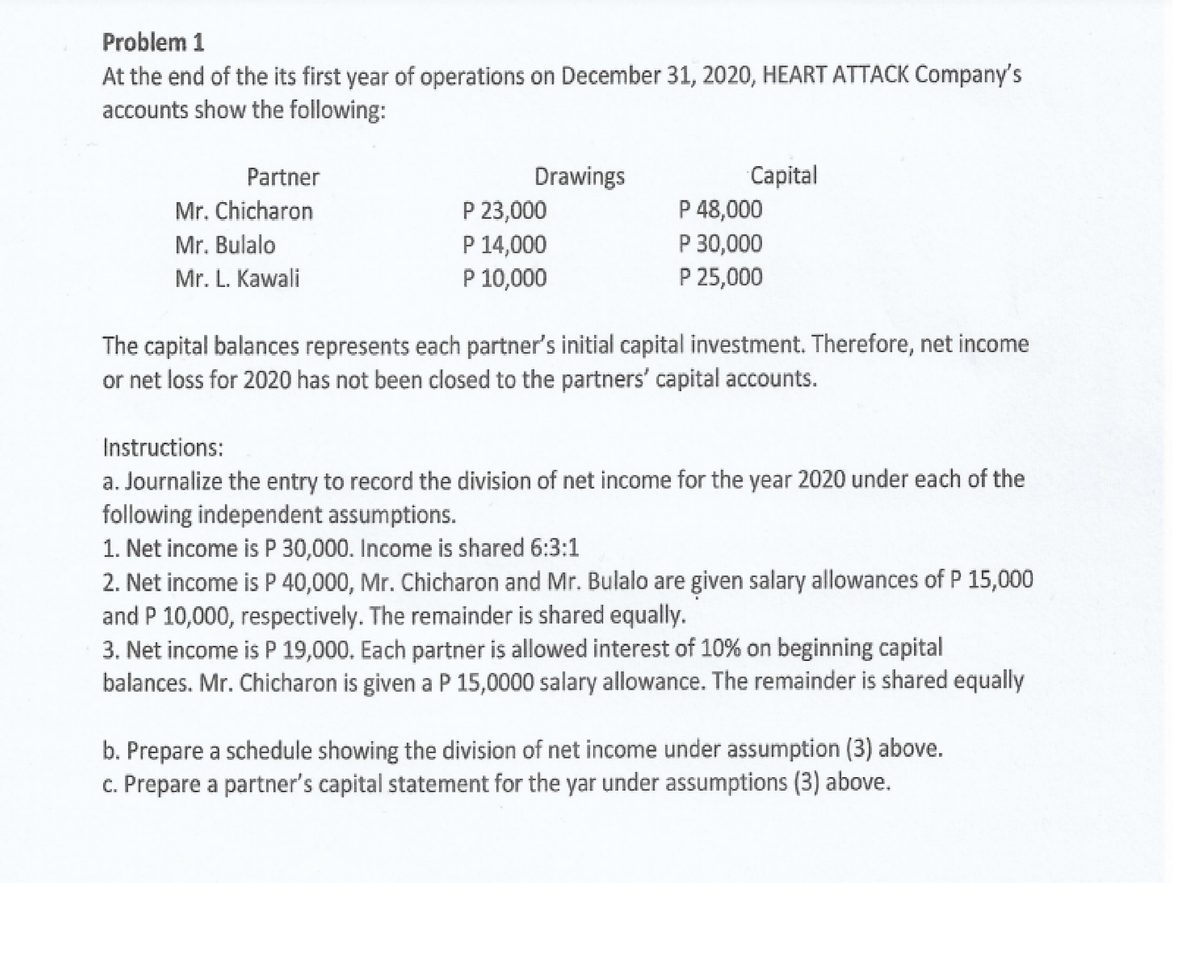

Problem 1 At the end of the its first year of operations on December 31, 2020, HEART ATTACK Company's accounts show the following: Capital P 48,000 P 30,000 P 25,000 Partner Drawings Mr. Chicharon P 23,000 P 14,000 P 10,000 Mr. Bulalo Mr. L. Kawali The capital balances represents each partner's initial capital investment. Therefore, net income or net loss for 2020 has not been closed to the partners' capital accounts. Instructions: a. Journalize the entry to record the division of net income for the year 2020 under each of the following independent assumptions. 1. Net income is P 30,000. Income is shared 6:3:1 2. Net income is P 40,000, Mr. Chicharon and Mr. Bulalo are given salary allowances of P 15,000 and P 10,000, respectively. The remainder is shared equally. 3. Net income is P 19,000. Each partner is allowed interest of 10% on beginning capital balances. Mr. Chicharon is given a P 15,0000 salary allowance. The remainder is shared equally b. Prepare a schedule showing the division of net income under assumption (3) above. c. Prepare a partner's capital statement for the yar under assumptions (3) above.

Problem 1 At the end of the its first year of operations on December 31, 2020, HEART ATTACK Company's accounts show the following: Capital P 48,000 P 30,000 P 25,000 Partner Drawings Mr. Chicharon P 23,000 P 14,000 P 10,000 Mr. Bulalo Mr. L. Kawali The capital balances represents each partner's initial capital investment. Therefore, net income or net loss for 2020 has not been closed to the partners' capital accounts. Instructions: a. Journalize the entry to record the division of net income for the year 2020 under each of the following independent assumptions. 1. Net income is P 30,000. Income is shared 6:3:1 2. Net income is P 40,000, Mr. Chicharon and Mr. Bulalo are given salary allowances of P 15,000 and P 10,000, respectively. The remainder is shared equally. 3. Net income is P 19,000. Each partner is allowed interest of 10% on beginning capital balances. Mr. Chicharon is given a P 15,0000 salary allowance. The remainder is shared equally b. Prepare a schedule showing the division of net income under assumption (3) above. c. Prepare a partner's capital statement for the yar under assumptions (3) above.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter1: Accounting And The Financial Statements

Section: Chapter Questions

Problem 46E: OBJECTIVE 6 Exercise 1-46 Income Statement ERS Inc. maintains and repairs office equipment. ERS had...

Related questions

Question

Transcribed Image Text:Problem 1

At the end of the its first year of operations on December 31, 2020, HEART ATTACK Company's

accounts show the following:

Capital

P 48,000

P 30,000

P 25,000

Partner

Drawings

Mr. Chicharon

P 23,000

P 14,000

P 10,000

Mr. Bulalo

Mr. L. Kawali

The capital balances represents each partner's initial capital investment. Therefore, net income

or net loss for 2020 has not been closed to the partners' capital accounts.

Instructions:

a. Journalize the entry to record the division of net income for the year 2020 under each of the

following independent assumptions.

1. Net income is P 30,000. Income is shared 6:3:1

2. Net income is P 40,000, Mr. Chicharon and Mr. Bulalo are given salary allowances of P 15,000

and P 10,000, respectively. The remainder is shared equally.

3. Net income is P 19,000. Each partner is allowed interest of 10% on beginning capital

balances. Mr. Chicharon is given a P 15,0000 salary allowance. The remainder is shared equally

b. Prepare a schedule showing the division of net income under assumption (3) above.

c. Prepare a partner's capital statement for the yar under assumptions (3) above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning