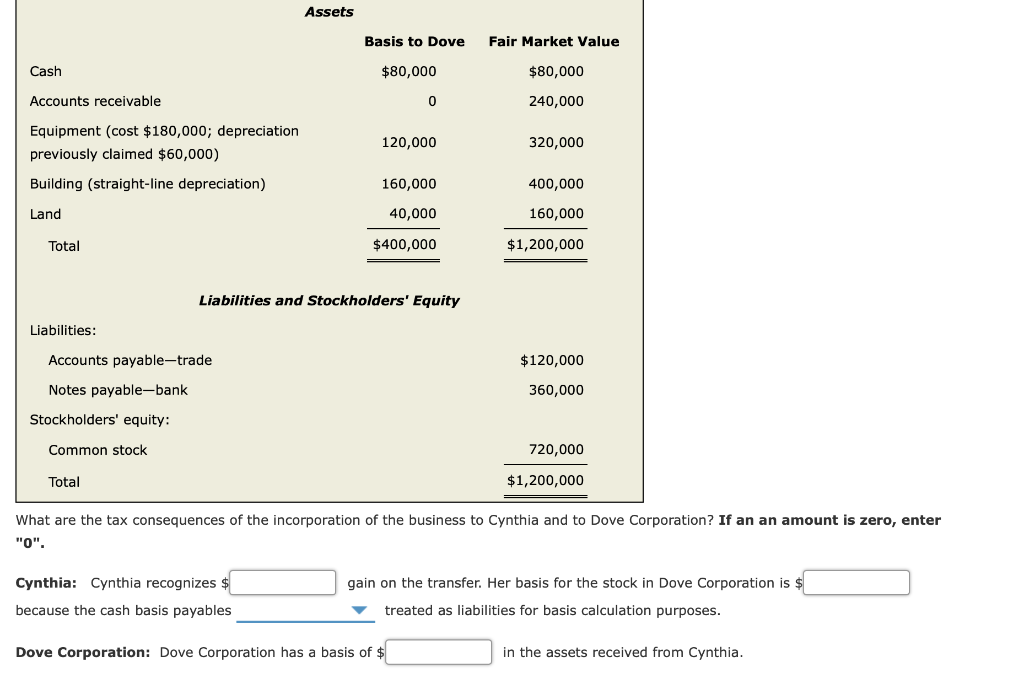

Assets Basis to Dove Fair Market Value Cash $80,000 $80,000 Accounts receivable 240,000 Equipment (cost $180,000; depreciation 120,000 320,000 previously claimed $60,000) Building (straight-line depreciation) 160,000 400,000 Land 40,000 160,000 Total $400,000 $1,200,000 Liabilities and Stockholders' Equity Liabilities: Accounts payable-trade $120,000 Notes payable-bank 360,000 Stockholders' equity: Common stock 720,000 Total $1,200,000 What are the tax consequences of the incorporation of the business to Cynthia and to Dove Corporation? If an an amount is zero, enter "о". Cynthia: Cynthia recognizes $ gain on the transfer. Her basis for the stock in Dove Corporation is $ because the cash basis payables treated as liabilities for basis calculation purposes. Dove Corporation: Dove Corporation has a basis of $ in the assets received from Cynthia.

Assets Basis to Dove Fair Market Value Cash $80,000 $80,000 Accounts receivable 240,000 Equipment (cost $180,000; depreciation 120,000 320,000 previously claimed $60,000) Building (straight-line depreciation) 160,000 400,000 Land 40,000 160,000 Total $400,000 $1,200,000 Liabilities and Stockholders' Equity Liabilities: Accounts payable-trade $120,000 Notes payable-bank 360,000 Stockholders' equity: Common stock 720,000 Total $1,200,000 What are the tax consequences of the incorporation of the business to Cynthia and to Dove Corporation? If an an amount is zero, enter "о". Cynthia: Cynthia recognizes $ gain on the transfer. Her basis for the stock in Dove Corporation is $ because the cash basis payables treated as liabilities for basis calculation purposes. Dove Corporation: Dove Corporation has a basis of $ in the assets received from Cynthia.

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter8: Investing Activities

Section: Chapter Questions

Problem 1.3AIC: Estimate the average total estimated useful life of depreciable property, plant, and equipment....

Related questions

Question

Transcribed Image Text:Assets

Basis to Dove

Fair Market Value

Cash

$80,000

$80,000

Accounts receivable

240,000

Equipment (cost $180,000; depreciation

120,000

320,000

previously claimed $60,000)

Building (straight-line depreciation)

160,000

400,000

Land

40,000

160,000

Total

$400,000

$1,200,000

Liabilities and Stockholders' Equity

Liabilities:

Accounts payable-trade

$120,000

Notes payable-bank

360,000

Stockholders' equity:

Common stock

720,000

Total

$1,200,000

What are the tax consequences of the incorporation of the business to Cynthia and to Dove Corporation? If an an amount is zero, enter

"о".

Cynthia: Cynthia recognizes $

gain on the transfer. Her basis for the stock in Dove Corporation is $

because the cash basis payables

treated as liabilities for basis calculation purposes.

Dove Corporation: Dove Corporation has a basis of $

in the assets received from Cynthia.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning