Assets Current assets: Cash.. $ (1,100) $ 3,950 Accounts recelvable. 4,100 2,300 Inventory.. 3,250 1,150 Prepald insurance. Total current assets. 90 210 3 6,340 5 7,610 Land, buildings, and equipment: Land ... $15,200 $15,200 Buildings .. Less: Accumulated depreciation. Equipment... Less: Accumulated depreciation... Total land, buildings, and equipment. Total assets .. $ 35,000 (15,000) इ24,150 $ 35,000 (16,500) 18,500 20,000 $ 28,350 (20,900) (17,900) 6,250 $41,450 $49,060 7,450 341,150 $47,490 Liabilities and Stockholders' Equity Current liabilities: $ 3,600 $ 2,800 Accounts payable . Income taxes payable. Wages payable.. Notes payable-current portion.... 950 1,850 1,100 2,150 3,000 4,500 Total current liabilities.. $ 8,650 $11,300 Long-term liabilities: Notes payable... 11,250 14,250 Stockholders' equity: $ 19,500 $ 18,000 Capital stock.. Retained earnings. Total stockholders' equity. Total labilities and stockholders' equity. 8,090 5,510 27,590 23,510 347,490 349,060 tructions: Prepare a statement of cash flows using the indirect method.

Assets Current assets: Cash.. $ (1,100) $ 3,950 Accounts recelvable. 4,100 2,300 Inventory.. 3,250 1,150 Prepald insurance. Total current assets. 90 210 3 6,340 5 7,610 Land, buildings, and equipment: Land ... $15,200 $15,200 Buildings .. Less: Accumulated depreciation. Equipment... Less: Accumulated depreciation... Total land, buildings, and equipment. Total assets .. $ 35,000 (15,000) इ24,150 $ 35,000 (16,500) 18,500 20,000 $ 28,350 (20,900) (17,900) 6,250 $41,450 $49,060 7,450 341,150 $47,490 Liabilities and Stockholders' Equity Current liabilities: $ 3,600 $ 2,800 Accounts payable . Income taxes payable. Wages payable.. Notes payable-current portion.... 950 1,850 1,100 2,150 3,000 4,500 Total current liabilities.. $ 8,650 $11,300 Long-term liabilities: Notes payable... 11,250 14,250 Stockholders' equity: $ 19,500 $ 18,000 Capital stock.. Retained earnings. Total stockholders' equity. Total labilities and stockholders' equity. 8,090 5,510 27,590 23,510 347,490 349,060 tructions: Prepare a statement of cash flows using the indirect method.

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 18MC: Michelle Company reports $345,000 in credit sales and $267,500 in accounts receivable at the end of...

Related questions

Question

Transcribed Image Text:Annotatior

ACCOU ng

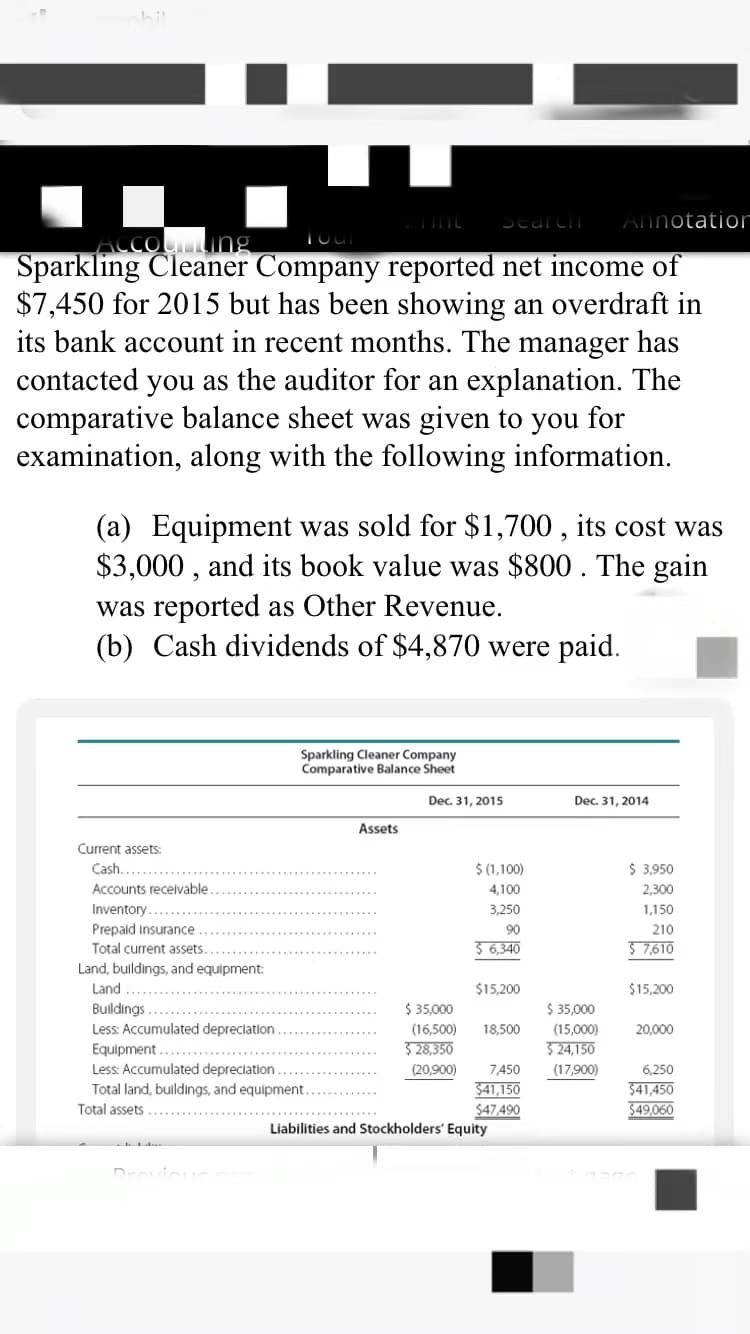

Sparkling Cleaner Company reported net income of

$7,450 for 2015 but has been showing an overdraft in

its bank account in recent months. The manager has

contacted you as the auditor for an explanation. The

comparative balance sheet was given to you for

examination, along with the following information.

(a) Equipment was sold for $1,700 , its cost was

$3,000 , and its book value was $800 . The gain

was reported as Other Revenue.

(b) Cash dividends of $4,870 were paid.

Sparkling Cleaner Company

Comparative Balance Sheet

Dec. 31, 2015

Dec. 31, 2014

Assets

Current assets:

Cash.

$ (1,100)

$ 3,950

Accounts recelvable.

4,100

2,300

Inventory.

3,250

1,150

Prepaid insurance

Total current assets

90

210

3 6,340

$ 7,610

Land, buildings, and equipment:

Land

$15,200

$15,200

$ 35,000

$ 35,000

Buildings.

Less: Accumulated depreciation

(16,500)

18,500

(15,000)

20,000

Equipment.

5 28,350

$ 24,150

Less: Accumulated depreciation...

(20,900)

7,450

(17,900)

6,250

Total land, buildings, and equipment.

$41,150

$47,490

Liabilities and Stockholders' Equity

$41,450

$49,060

Total assets

Transcribed Image Text:Latior

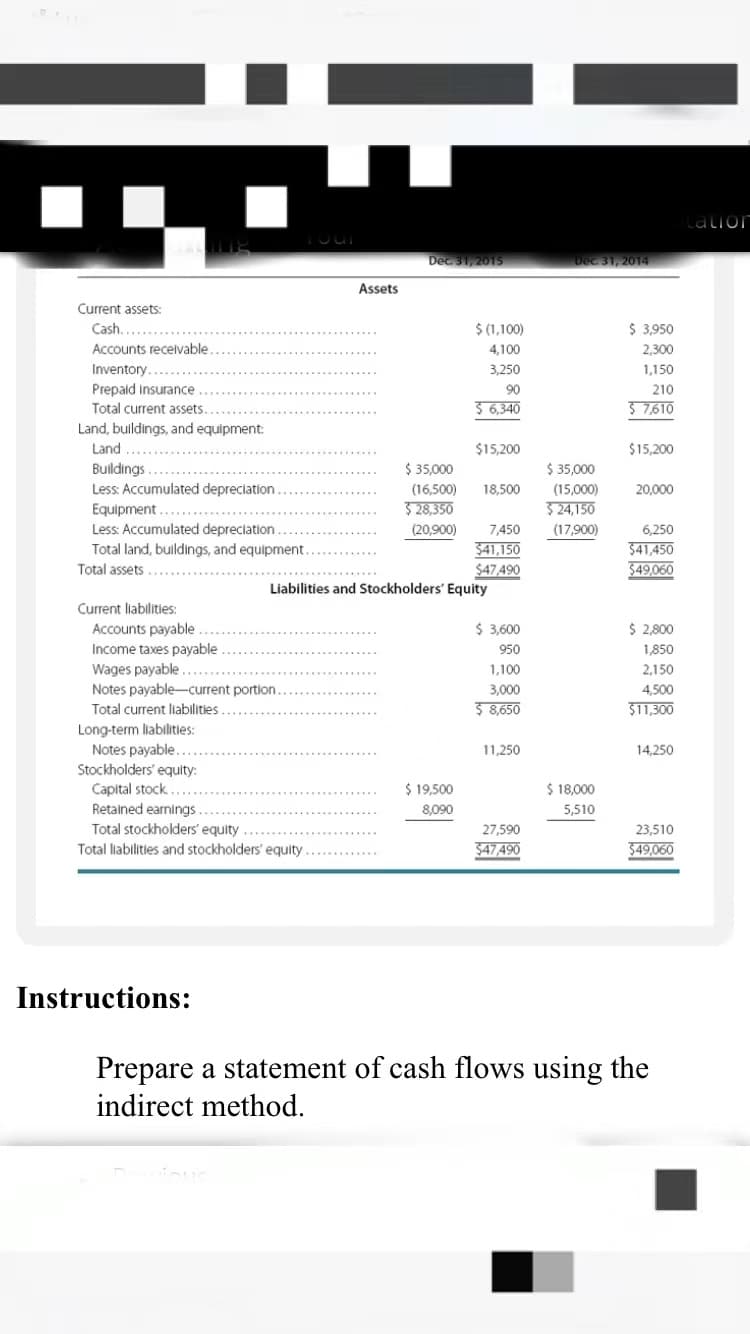

Dec. 31, 2015

Dec 31, 2014

Assets

Current assets:

Cash.

$ (1,100)

$ 3,950

Accounts recelvable.

4,100

2,300

Inventory.

3,250

1,150

Prepaid insurance

Total current assets.

90

210

Š 6,340

5 7,610

Land, buildings, and equipment:

Land ...

Buildings .

Less: Accumulated depreciation...

$15,200

$15,200

$ 35,000

$ 35,000

(16,500)

18,500

(15,000)

20,000

5 28,350

3 24,150

Equipment .....

Less: Accumulated depreciation...

(20,900)

7,450

(17,900)

6,250

Total land, buildings, and equipment.

$41,150

$47,490

Liabilities and Stockholders' Equity

$41,450

$49,060

Total assets

Current liabilities:

$ 3,600

$ 2,800

Accounts payable

Income taxes payable .

Wages payable.

Notes payable-current portion.

950

1,850

1,100

2,150

3,000

4,500

Total current liabilities

$ 8,650

इ11,300

Long-term liabilities:

Notes payable..

Stockholders' equity:

Capital stock.

Retained earnings.

Total stockholders' equity

Total liabilities and stockholders' equity.

11,250

14,250

$ 19,500

$ 18,000

8,090

5,510

27,590

23,510

347,490

349,060

......

Instructions:

Prepare a statement of cash flows using the

indirect method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning