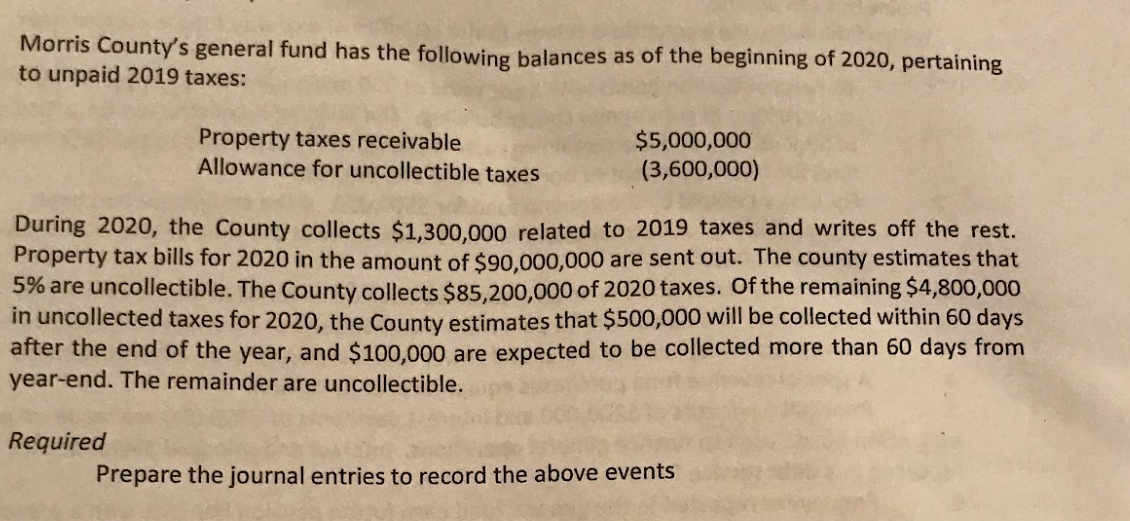

Morris County's general fund has the following balances as of the beginning of 2020, pertaining to unpaid 2019 taxes: Property taxes receivable Allowance for uncollectible taxes $5,000,000 (3,600,000) During 2020, the County collects $1,300,000 related to 2019 taxes and writes off the rest. Property tax bills for 2020 in the amount of $90.000,000 are sent out. The county estimates that 5% are uncollectible. The County collects $85,200,000 of 2020 taxes. Of the remaining $4,800,000 in uncollected taxes for 2020, the County estimates that $500,000 will be collected within 60 days after the end of the year, and $100,000 are expected to be collected more than 60 days from year-end. The remainder are uncollectible. Required Prepare the journal entries to record the above events

Morris County's general fund has the following balances as of the beginning of 2020, pertaining to unpaid 2019 taxes: Property taxes receivable Allowance for uncollectible taxes $5,000,000 (3,600,000) During 2020, the County collects $1,300,000 related to 2019 taxes and writes off the rest. Property tax bills for 2020 in the amount of $90.000,000 are sent out. The county estimates that 5% are uncollectible. The County collects $85,200,000 of 2020 taxes. Of the remaining $4,800,000 in uncollected taxes for 2020, the County estimates that $500,000 will be collected within 60 days after the end of the year, and $100,000 are expected to be collected more than 60 days from year-end. The remainder are uncollectible. Required Prepare the journal entries to record the above events

Chapter17: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 9DQ

Related questions

Question

Transcribed Image Text:Morris County's general fund has the following balances as of the beginning of 2020, pertaining

to unpaid 2019 taxes:

Property taxes receivable

Allowance for uncollectible taxes

$5,000,000

(3,600,000)

During 2020, the County collects $1,300,000 related to 2019 taxes and writes off the rest.

Property tax bills for 2020 in the amount of $90.000,000 are sent out. The county estimates that

5% are uncollectible. The County collects $85,200,000 of 2020 taxes. Of the remaining $4,800,000

in uncollected taxes for 2020, the County estimates that $500,000 will be collected within 60 days

after the end of the year, and $100,000 are expected to be collected more than 60 days from

year-end. The remainder are uncollectible.

Required

Prepare the journal entries to record the above events

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you