Redwood Company sells craft kits and supplies to retail outlets and through its catalog. Some of the items are manufactured by Redwood, while others are purchased for resale. For the products it manufactures, the company currently bases its selling prices on a product-costing system that accounts for direct material, direct labor, and the associated overhead costs. In addition to these product costs, Redwood incurs substantial selling costs, and Roger Jackson, controller, has suggested that these selling costs should be included in the product pricing structure. After studying the costs incurred over the past two years for one of its products, skeins of knitting yarn, Jackson has selected four categories of selling costs and chosen cost drivers for each of these costs. The selling costs actually incurred during the past year and the cost drivers are as follows: Cost Category Sales commissions Catalogs Cost of catalog sales Amount Cost Driver 675,000 Boxes of yarn sold to retail stores 295, 400 Catalogs distributed 105,000 Skeins sold through catalog 60,000 Number of retail orders Credit and collection Total selling costs $1,135, 400 The knitting yarn is sold to retail outlets in boxes, each containing 12 skeins of yarn. The sale of partial boxes is not permitted. Commissions are paid on sales to retail outlets but not on catalog sales. The cost of catalog sales includes telephone costs and the wages of personnel who take the catalog orders. Jackson believes that the selling costs vary significantly with the size of the order. Order sizes are divided into three categories as follows: Retail Sales 1-10 boxeз Order Size Catalog Sales 1-10 skeins 11-20 skeins Small Medium 11-20 boxes Large Over 20 skeins Over 20 boxes An analysis of the previous year's records produced the following statistics. Order Size Medium Retail sales in boxes (12 skeins per box) Catalog sales in skeins Number of retail orders Small 2,000 79,000 Large 178,000 44,000 3,100 125, 200 Total 225,000 175,000 6,000 590, 800 45,000 52,000 2,415 254,300 211,300 485 Catalogs distributed Required: 1. Prepare a schedule showing Redwood Company's total selling cost for each order size and the per-skein selling cost within each order size. (Round your intermediate calculations and unit cost per order to 2 decimal places.) Answer is not complete. REDWOOD COMPANY Computation of Selling Costs By Order Size And Per Skein Within Each Order Size Order Size Small Medium Large Total 6,000 Os 135,000 O $ 534,000 Os 675,000 Sales commissions Catalogs Cost of catalog sales Credit and collection Total cost for all orders of a given $ 47,400 x 31,200 8 26.400 X 105,000 127,150 8 105,650 X 62,600 X 295,400 4,850 O 24,150 31,000 O 60,000 $ 185,400 $ 296,000 $ 654,000 $ 1,135,400 size Units (skeins) sold Unit cost per order of a given size

Redwood Company sells craft kits and supplies to retail outlets and through its catalog. Some of the items are manufactured by Redwood, while others are purchased for resale. For the products it manufactures, the company currently bases its selling prices on a product-costing system that accounts for direct material, direct labor, and the associated overhead costs. In addition to these product costs, Redwood incurs substantial selling costs, and Roger Jackson, controller, has suggested that these selling costs should be included in the product pricing structure. After studying the costs incurred over the past two years for one of its products, skeins of knitting yarn, Jackson has selected four categories of selling costs and chosen cost drivers for each of these costs. The selling costs actually incurred during the past year and the cost drivers are as follows: Cost Category Sales commissions Catalogs Cost of catalog sales Amount Cost Driver 675,000 Boxes of yarn sold to retail stores 295, 400 Catalogs distributed 105,000 Skeins sold through catalog 60,000 Number of retail orders Credit and collection Total selling costs $1,135, 400 The knitting yarn is sold to retail outlets in boxes, each containing 12 skeins of yarn. The sale of partial boxes is not permitted. Commissions are paid on sales to retail outlets but not on catalog sales. The cost of catalog sales includes telephone costs and the wages of personnel who take the catalog orders. Jackson believes that the selling costs vary significantly with the size of the order. Order sizes are divided into three categories as follows: Retail Sales 1-10 boxeз Order Size Catalog Sales 1-10 skeins 11-20 skeins Small Medium 11-20 boxes Large Over 20 skeins Over 20 boxes An analysis of the previous year's records produced the following statistics. Order Size Medium Retail sales in boxes (12 skeins per box) Catalog sales in skeins Number of retail orders Small 2,000 79,000 Large 178,000 44,000 3,100 125, 200 Total 225,000 175,000 6,000 590, 800 45,000 52,000 2,415 254,300 211,300 485 Catalogs distributed Required: 1. Prepare a schedule showing Redwood Company's total selling cost for each order size and the per-skein selling cost within each order size. (Round your intermediate calculations and unit cost per order to 2 decimal places.) Answer is not complete. REDWOOD COMPANY Computation of Selling Costs By Order Size And Per Skein Within Each Order Size Order Size Small Medium Large Total 6,000 Os 135,000 O $ 534,000 Os 675,000 Sales commissions Catalogs Cost of catalog sales Credit and collection Total cost for all orders of a given $ 47,400 x 31,200 8 26.400 X 105,000 127,150 8 105,650 X 62,600 X 295,400 4,850 O 24,150 31,000 O 60,000 $ 185,400 $ 296,000 $ 654,000 $ 1,135,400 size Units (skeins) sold Unit cost per order of a given size

Financial & Managerial Accounting

14th Edition

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter18: Activity-Based Costing

Section: Chapter Questions

Problem 2ADM

Related questions

Question

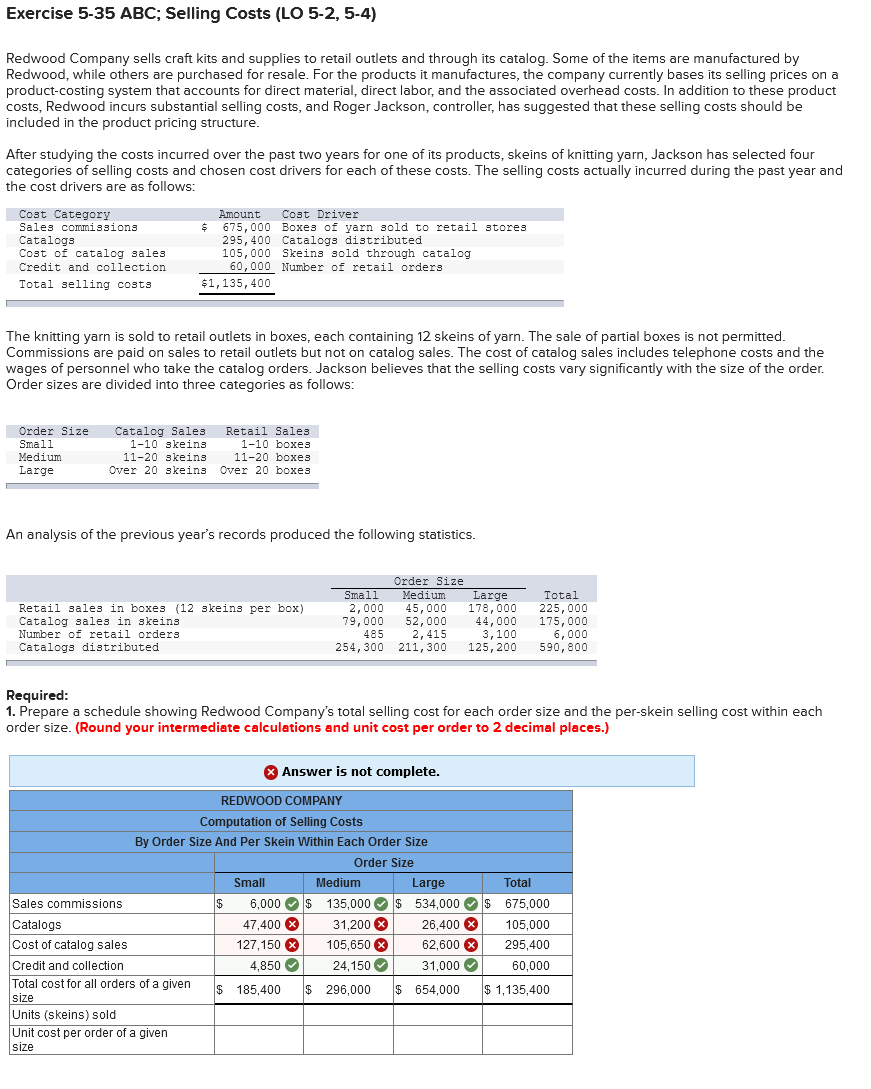

Transcribed Image Text:Exercise 5-35 ABC; Selling Costs (LO 5-2, 5-4)

Redwood Company sells craft kits and supplies to retail outlets and through its catalog. Some of the items are manufactured by

Redwood, while others are purchased for resale. For the products it manufactures, the company currently bases its selling prices on a

product-costing system that accounts for direct material, direct labor, and the associated overhead costs. In addition to these product

costs, Redwood incurs substantial selling costs, and Roger Jackson, controller, has suggested that these selling costs should be

included in the product pricing structure.

After studying the costs incurred over the past two years for one of its products, skeins of knitting yarn, Jackson has selected four

categories of selling costs and chosen cost drivers for each of these costs. The selling costs actually incurred during the past year and

the cost drivers are as follows:

Cost Category

Sales commissions

Amount

Cost Driver

Catalogs

Cost of catalog sales

Credit and collection

675,000 Boxes of yarn sold to retail stores

295, 400 Catalogs distributed

105,000 Skeins sold through catalog

60,000 Number of retail orders

Total selling costs

$1,135,400

The knitting yarn is sold to retail outlets in boxes, each containing 12 skeins of yarn. The sale of partial boxes is not permitted.

Commissions are paid on sales to retail outlets but not on catalog sales. The cost of catalog sales includes telephone costs and the

wages of personnel who take the catalog orders. Jackson believes that the selling costs vary significantly with the size of the order.

Order sizes are divided into three categories as follows:

Order Size

Small

Catalog Sales

Retail Sales

1-10 boxes

1-10 skeins

Medium

11-20 skeins

11-20 boxes

Large

Over 20 skeins

Over 20 boxes

An analysis of the previous year's records produced the following statistics.

Order Size

Small

2,000

79,000

485

254,300 211, 300

Medium

45,000

52,000

2,415

Large

178,000

Retail sales in boxes (12 skeins per box)

Catalog sales in skeins

Number of retail orders

44,000

3,100

125, 200

Total

225,000

175,000

6,000

590,800

Catalogs distributed

Required:

1. Prepare a schedule showing Redwood Company's total selling cost for each order size and the per-skein selling cost within each

order size. (Round your intermediate calculations and unit cost per order to 2 decimal places.)

* Answer is not complete.

REDWOOD COMPANY

Computation of Selling Costs

By Order Size And Per Skein Within Each Order Size

Order Size

Small

Medium

Large

Total

Sales commissions

6,000 O$ 135,000 O $

534,000 O$ 675,000

Catalogs

Cost of catalog sales

Credit and collection

47,400 X

127,150 X

31,200 8

105,650 X

26,400 O

62,600 x

105,000

295,400

4,850

O

24,150 O

31,000 O

60,000

Total cost for all orders of a given

size

Units (skeins) sold

Unit cost per order of a given

$ 185,400

$ 296,000

$ 654,000

$ 1,135,400

size

e

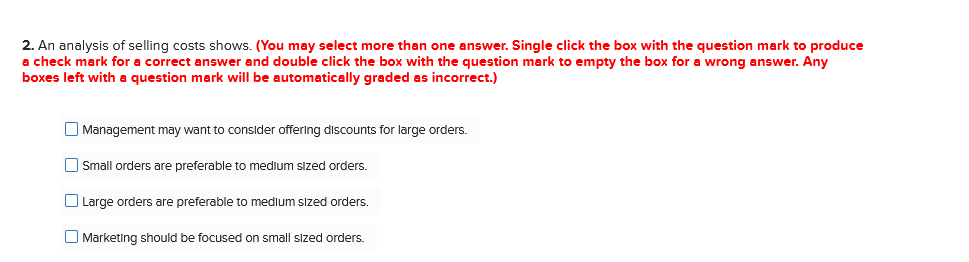

Transcribed Image Text:2. An analysis of selling costs shows. (You may select more than one answer. Single click the box with the question mark to produce

a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any

boxes left with a question mark will be automatically graded as incorrect.)

O Management may want to consider offering discounts for large orders.

O Small orders are preferable to medium sized orders.

O Large orders are preferable to medium sized orders.

O Marketing should be focused on small sized orders.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning