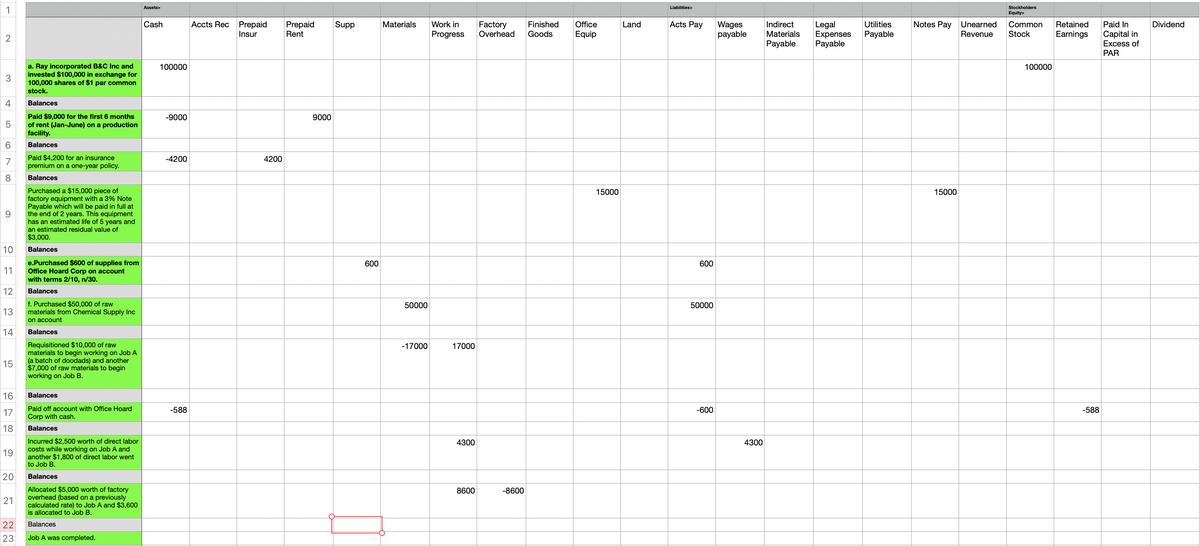

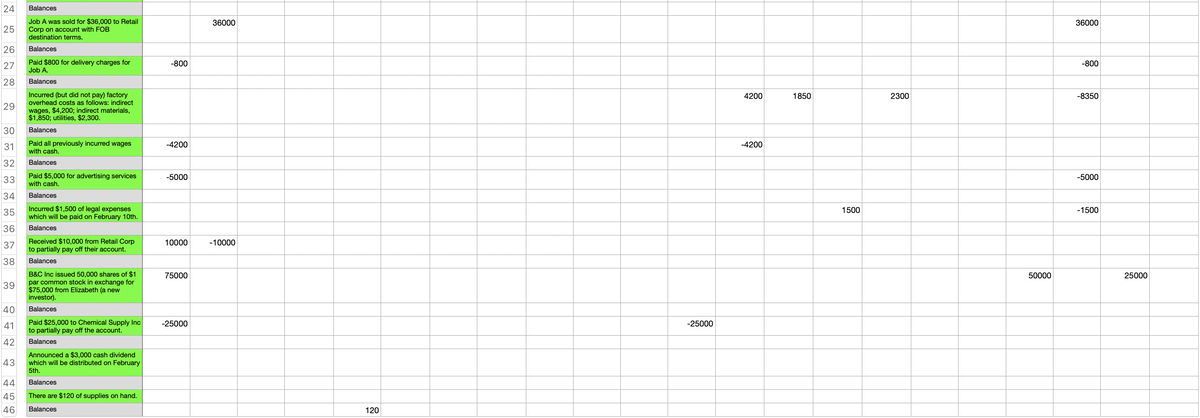

Assets> Liabilities> Stockholders 1 Equity> Acts Pay Wages рayable Cash Accts Rec Prepaid Insur Prepaid Rent Work in Finished Goods Land Utilities Notes Pay Unearned Revenue Supp Materials Factory Overhead Office Indirect Materials Payable Legal Expenses Payable Common Retained Paid In Dividend Progress Equip Payable Stock Earnings Capital in Excess of 2 PAR a. Ray incorporated B&C Inc and invested $100,000 in exchange for 100,000 shares of $1 par common 100000 100000 3 stock. 4 Balances Paid $9,000 for the first 6 months of rent (Jan-June) on a production facility. -9000 9000 Balances Paid $4,200 for an insurance premium on a one-year policy. 7 -4200 4200 8 Balances Purchased a $15,000 piece of factory equipment with a 3% Note Payable which will be paid in full at the end of 2 years. This equipment has an estimated life of 5 years and 15000 15000 an estimated residual value of $3,000. 10 Balances e.Purchased $600 of supplies from Office Hoard Corp on account with terms 2/10, n/30. 600 600 11 12 Balances f. Purchased $50,000 of raw materials from Chemical Supply Inc on account 50000 50000 13 14 Balances Requisitioned $10,000 of raw materials to begin working on Job A (a batch of doodads) and another $7,000 of raw materials to begin working on Job B. -17000 17000 15 16 Balances 17 Paid off account with Office Hoard -588 -600 -588 Corp with cash. 18 Balances Incurred $2,500 worth of direct labor costs while working on Job A and another $1,800 of direct labor went to Job B. 4300 4300 19 20 Balances Allocated $5,000 worth of factory overhead (based on a previously calculated rate) to Job A and $3,600 is allocated to Job B. 8600 -8600 21 22 Balances 23 Job A was completed. LO 24 Balances Job A was sold for $36,000 to Retail Corp on account with FOB 36000 36000 25 destination terms. 26 Balances Paid $800 for delivery charges for Job A. 27 -800 -800 28 Balances Incurred (but did not pay) factory overhead costs as follows: indirect 4200 1850 2300 -8350 29 wages, $4,200; indirect materials, $1,850; utilities, $2,300. 30 Balances Paid all previously incurred wages with cash. 31 -4200 -4200 32 Balances Paid $5,000 for advertising services with cash. 33 -5000 -5000 34 Balances Incurred $1,500 of legal expenses which will be paid on February 10th. 35 1500 -1500 36 Balances Received $10,000 from Retail Corp to partially pay off their account. 37 10000 -10000 38 Balances B&C Inc issued 50,000 shares of $1 par common stock in exchange for $75,000 from Elizabeth (a new investor). 75000 50000 25000 39 40 Balances Paid $25,000 to Chemical Supply Inc to partially pay off the account. |41 -25000 -25000 42 Balances Announced a $3,000 cash dividend which will be distributed on February 43 5th. 44 Balances 45 There are $120 of supplies on hand. 46 Balances 120

Can you please check my work, I was supposes to record all of the transactions in green for the month of operations

1/1 Ray incorporated B&C Inc and invested $100,000 in exchange for 100,000 shares of $1 par common stock.

1/1 Paid $9,000 for the first 6 months of rent (Jan-June) on a production facility.

1/1 Paid $4,200 for an insurance premium on a one-year policy.

1/1 Purchased a $15,000 piece of factory equipment with a 3% Note Payable which will be paid in full at the end of 2 years. This equipment has an estimated life of 5 years and an estimated residual value of $3,000.

1/2 Purchased $600 of supplies from Office Hoard Corp on account with terms 2/10, n/30.

1/3 Purchased $50,000 of raw materials from Chemical Supply Inc on account.

1/5 Requisitioned $10,000 of raw materials to begin working on Job A (a batch of doodads) and another $7,000 of raw materials to begin working on Job B.

1/8 Paid off account with Office Hoard Corp with cash.

1/10 Incurred $2,500 worth of direct labor costs while working on Job A and another $1,800 of direct labor went to Job B.

1/11 Allocated $5,000 worth of factory overhead (based on a previously calculated rate) to Job A and $3,600 is allocated to Job B.

1/13 Job A was completed.

1/16 Job A was sold for $36,000 to Retail Corp on account with FOB destination terms.

1/17 Paid $800 for delivery charges for Job A.

1/20 Incurred (but did not pay)

1/23 Paid all previously incurred wages with cash.

1/28 Paid $5,000 for advertising services with cash.

1/30 Incurred $1,500 of legal expenses which will be paid on February 10th.

1/30 Received $10,000 from Retail Corp to partially pay off their account.

1/30 B&C Inc issued 50,000 shares of $1 par common stock in exchange for $75,000 from Elizabeth (a new investor).

1/31 Paid $25,000 to Chemical Supply Inc to partially pay off the account.

1/31 Announced a $3,000 cash dividend which will be distributed on February 5th.

1/31 There are $120 of supplies on hand.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images