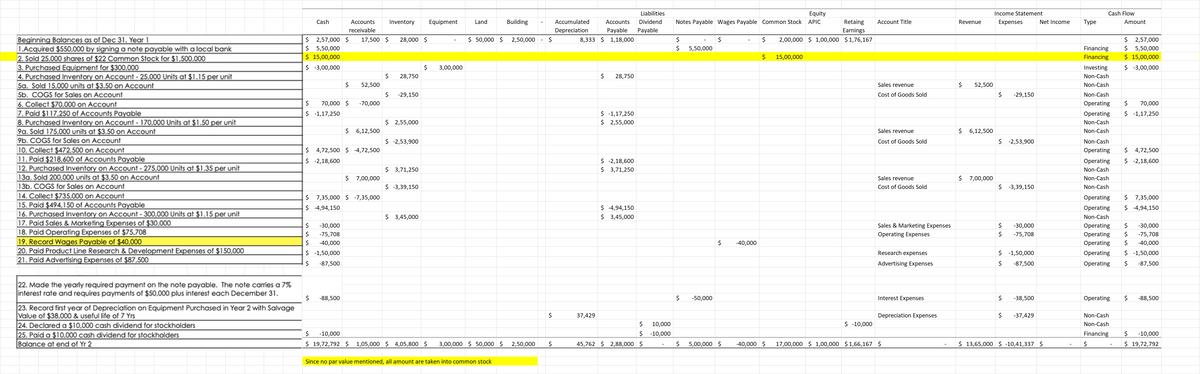

Liabilities Equity Notes Pavable Wages Payable Common Stock APIC Income Statement Cash Flow Cash Accounts Inventory Equipment Land Bulding Accumulated Accounts Dividend Retaing Account Title Revenue Expenses Net income Type Amount receivable Depreciation Payable Payable Eamings Beginning talonces.os.of Dec 31, Year LAcquired $550.000 by signing a note payable with a local bank 2. Sold 25.000 shares of $22 Common Stock for $1. S00.000 3. Purchased taioment for $300.000 4. Purchased inventory on Account - 25.000 Units ot $1.15 per unit Sa. Sold 15.000 units at $3.50 on Account Sb. COGS for Sales on Account 6. Colect $70.000 on Account Z. Pold $117.250 of Accounts Payoble 8. Purchased inventory on Account - 170.000 Units ot $1.50 per unit 90. Sold 175.000 units at $3 50 on Account 9b. COGS for Sales on Account 10. Collect $472.500 on Account 1. Paid $218.600 of Accounts Payable 12. Purchosed inventory on Account- 275.000 Units at $1.35 per unit 130. Sold 200.000 units at $3.50 on Account 13b. COGS for Sales on Account 14. Collect $735.000 on Account 15. Paid $494150 of Accounts Payable 16. Purchased Inventory on Account -300.000 Units at $1.15per unit 17. Paid Soles& Morketing Expenses of $30.000 18. Paid Operating Expenses of S75.708 19. Record Woges Payable of $40.000 20. Paid Product Line Research & Development Expenses of $150.000 21. Paid Advertising Expenses of 87.500 S 50.000 S 2.50.000S 2.00.000 S 1.00.000 S176.167 S 2,57,000 S S 5,50,000 $ 15,00.000 $ 2,57,000 $ S 15,00,000 S 3,00,000 17,500 S 28.000 S 8,333 S 1,18,000 $ 5,50,000 Financing Financing 5.50.000 $ 15,00,000 S 3,00,000 3,00,000 Investing $ 21,750 $ 28,750 28,750 Non-Cash 52,500 Sales revenue $ $2.500 Non-Cash Non Cash Operating 29,150 Cost of Goods Sold 29,150 $ 70,000 S S 1,17,250 $ S 1.17.250 -70,000 70,000 S 4,17.250 $ 2,55,000 Operating $ 2,55,000 Non-Cash $ 12.500 Sales revenue $ 612.500 Non-Cash S 2.53,900 Cost of Goods Sold $ 2.53.900 Non-Cash $ 4,72,500 S 4,72,500 Operating $ 4,72,500 $ 2,18,600 Operating Non Cash Non Cash $ 2,18,600 S 3,71,250 S 3,71,250 S 7.00,000 Sales revenue $ 7.00.000 $ ,150 Cost of Goods Sold $ 3,39,150 Non-Cash S 7,35,000 S 7,35,000 S 7,35,000 $ 494.150 Operating $ 4,54,150 Operating $ 345,000 $ 3,45,000 Non-Cash 30,000 Is Sales & Marketing Expenses Operating Expenses 30.000 Operating Operating S Operating 30,000 -75,708 $ 40,000 Is 4,50,000 -75,708 -75,708 $ 40,000 $ 4,50,000 $ 47.500 40,000 Research expenses $ 1,50.000 Operating 47,500 Advertising Expenses 47.500 Operatine 22. Mode the yeaty required payment on the note payable. The note caries a 75 nterest rate and requires payments of $50.000 plus interest each December 31. 4500 -50,000 Interest Expenses -38.500 Operating 48,500 23. Record first year of Deprecialion on Equipment Purchased in Year 2 with Salvage Value of $38.00 & useful ite of 7 Ys 24. Declored a $10.000 cash dividend for stockholders P5Paid a $10.000 coh dividend for stockholders Balance ot end of Y 2 37,429 Depreciation Expenses 37,429 Non-Cash $ 10,000 S 10,000 $-10,000 Non-Cash S $ 19,72,792 S 10,000 Financing 10.000 $ 19,72.792 S 105,000 $ 4.05,800 $ 1.00,000 S s0.000 S 2,50.000 3,00,000 $ S0.000 $ 2,50,000 45,762 $ 288.000 S 40,000 $ 17,00,000 $ 100.000 $166,167 S $ 11,65,000 S-10,41,337 S 5,00,000 S

Liabilities Equity Notes Pavable Wages Payable Common Stock APIC Income Statement Cash Flow Cash Accounts Inventory Equipment Land Bulding Accumulated Accounts Dividend Retaing Account Title Revenue Expenses Net income Type Amount receivable Depreciation Payable Payable Eamings Beginning talonces.os.of Dec 31, Year LAcquired $550.000 by signing a note payable with a local bank 2. Sold 25.000 shares of $22 Common Stock for $1. S00.000 3. Purchased taioment for $300.000 4. Purchased inventory on Account - 25.000 Units ot $1.15 per unit Sa. Sold 15.000 units at $3.50 on Account Sb. COGS for Sales on Account 6. Colect $70.000 on Account Z. Pold $117.250 of Accounts Payoble 8. Purchased inventory on Account - 170.000 Units ot $1.50 per unit 90. Sold 175.000 units at $3 50 on Account 9b. COGS for Sales on Account 10. Collect $472.500 on Account 1. Paid $218.600 of Accounts Payable 12. Purchosed inventory on Account- 275.000 Units at $1.35 per unit 130. Sold 200.000 units at $3.50 on Account 13b. COGS for Sales on Account 14. Collect $735.000 on Account 15. Paid $494150 of Accounts Payable 16. Purchased Inventory on Account -300.000 Units at $1.15per unit 17. Paid Soles& Morketing Expenses of $30.000 18. Paid Operating Expenses of S75.708 19. Record Woges Payable of $40.000 20. Paid Product Line Research & Development Expenses of $150.000 21. Paid Advertising Expenses of 87.500 S 50.000 S 2.50.000S 2.00.000 S 1.00.000 S176.167 S 2,57,000 S S 5,50,000 $ 15,00.000 $ 2,57,000 $ S 15,00,000 S 3,00,000 17,500 S 28.000 S 8,333 S 1,18,000 $ 5,50,000 Financing Financing 5.50.000 $ 15,00,000 S 3,00,000 3,00,000 Investing $ 21,750 $ 28,750 28,750 Non-Cash 52,500 Sales revenue $ $2.500 Non-Cash Non Cash Operating 29,150 Cost of Goods Sold 29,150 $ 70,000 S S 1,17,250 $ S 1.17.250 -70,000 70,000 S 4,17.250 $ 2,55,000 Operating $ 2,55,000 Non-Cash $ 12.500 Sales revenue $ 612.500 Non-Cash S 2.53,900 Cost of Goods Sold $ 2.53.900 Non-Cash $ 4,72,500 S 4,72,500 Operating $ 4,72,500 $ 2,18,600 Operating Non Cash Non Cash $ 2,18,600 S 3,71,250 S 3,71,250 S 7.00,000 Sales revenue $ 7.00.000 $ ,150 Cost of Goods Sold $ 3,39,150 Non-Cash S 7,35,000 S 7,35,000 S 7,35,000 $ 494.150 Operating $ 4,54,150 Operating $ 345,000 $ 3,45,000 Non-Cash 30,000 Is Sales & Marketing Expenses Operating Expenses 30.000 Operating Operating S Operating 30,000 -75,708 $ 40,000 Is 4,50,000 -75,708 -75,708 $ 40,000 $ 4,50,000 $ 47.500 40,000 Research expenses $ 1,50.000 Operating 47,500 Advertising Expenses 47.500 Operatine 22. Mode the yeaty required payment on the note payable. The note caries a 75 nterest rate and requires payments of $50.000 plus interest each December 31. 4500 -50,000 Interest Expenses -38.500 Operating 48,500 23. Record first year of Deprecialion on Equipment Purchased in Year 2 with Salvage Value of $38.00 & useful ite of 7 Ys 24. Declored a $10.000 cash dividend for stockholders P5Paid a $10.000 coh dividend for stockholders Balance ot end of Y 2 37,429 Depreciation Expenses 37,429 Non-Cash $ 10,000 S 10,000 $-10,000 Non-Cash S $ 19,72,792 S 10,000 Financing 10.000 $ 19,72.792 S 105,000 $ 4.05,800 $ 1.00,000 S s0.000 S 2,50.000 3,00,000 $ S0.000 $ 2,50,000 45,762 $ 288.000 S 40,000 $ 17,00,000 $ 100.000 $166,167 S $ 11,65,000 S-10,41,337 S 5,00,000 S

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter10: Stockholder's Equity

Section: Chapter Questions

Problem 38CE: Stockholder Payout Ratios The following information pertains to Milo Mindbender Corporation:...

Related questions

Question

whats the income statement?

Transcribed Image Text:Liabilities

Equity

Notes Payable wages Payable Common Stock APIC

Income Statement

Cash Flow

Cash

Equipment

Building

Accounts Dividend

Expenses

Net income

Retaing

Eaming

2,00,000 $ 1,00,000 $116,167

Accounts

Inventory

Land

Accumulated

Account Title

Revenue

Type

Amount

receivable

Depreciation

Payable Payable

8.333 S 1.18.000

$ 2.57.000

$ 5,50,000

$ 15,00,000

S 3,00,000

Beginning Bolonces as of Dec 31, Year 1

LAcquired $550.000 by signing a note payable wilth a local bank

2. Sold 25.000 shares of $22 Common Stock for $1.SO0.000

3. Purchased Eauipment for $300.000

4. Purchased inventory on Account - 25.000 Units ot $1.15 per unit

Sa. Sold 15.000 units at $3.50 on Account

Sb. COGS for Sales on Account

6. Colect 70.000 on Account

7. Pold $117.250 of Accounts Payoble

8. Purchased inventory on Account - 170.000 Units ot $1.50 per unit

9a. Sold 175.000 units at $3.50 on Account

9b. COGS for Sales on Account

10. Collect $472.500 on Account

1. Paid $218.600 of Accounts Payable

12. Purchosed Inventory on Account - 275.000 Units at $1.35 per unit

130. Sold 200.000 units ot $3.50 on Account

13b. COGS for Soles on Account

14. Collect $735.000 on Account

15. Paid $494.150 of Accounts Payable

16. Purchased Inventory on Account - 300.000 Units ot $1.15 per unit

17. Paid Soles & Morkeing Expenes of $30.000

18. Paid Operating Expenses of $75.708

19. Record Woges Payable of $40.000

20. Paid Product Line Reseorch & Development Expenses of $150.000

21. Paid Advertising Expenses of $87.500

S 2,57,000 S

5 5.50.000

$ 15,00,000

17,500 S 28,000

$

$ 50,000 S 2,50,000. S

5.50,000

$ 15,00,000

Financing

Financing

S 3,00,000

$ 3,00,000

Investine

28,750

2現750

Non-Cash

52,500

Sales revenue

52,500

Non-Cash

$ 29,150

Non Cash

Cost of Goods Sold

29.150

$ 70,000

$ 1,17,250

70,000 S

-70,000

Operating

S 1,17,250

S 1,17,250

$ 2,55,000

Operating

$ 2,55,000

Non-Cash

$ 6,12,500

Sales revenue

$ 6.12500

Non Cash

S 2,53,900

Cost of Goods Sold

S 2,53.900

Non-Cash

$ 4,72,500 S 4,72,500

$ 2,18,600

$ 4,72,500

S 2.18.600

Operating

$ 3,18600

$ 3,71,250

Operating

S 3,71,250

Non Cash

$ 7,00,000

Sales revenue

$ 7,00,000

Non-Cash

S 3.39.150

Cost of Goods Sold

$ 3,39,150

Non-Cash

S 7,35,000 S -7,35,000

$ 4,54,150

$ 7,35,000

$ 4,94,150

Operating

$ 4,4.150

$ 3,45,000

Operating

$ 345,000

Non-Cash

30,000

$ 75,708

$ 40,000

$ -1,50,000

S 47,500

30,000

Sales & Marketing Expenses

Operating Expensses

30,000

Operating

Operating

Operating

-75,708

-75,708

$ 40,000

40.000

$ -1,50,000

Research expenses

$ 1,50.000

Operating

Is 47,500

Advertising Expenses

87,500

Operating

22. Mode the yeaty required payment on the note payable. The note caries a 7%

nterest rate and requires payments of $50.000 plus interest each December 31.

$48.500

-50,000

Interest Expenses

-38.500

Operating

$ 48,500

23. Record first year of Depreciation on Equipment Purchased in Year 2 with Salvage

Value of $38.000 & useful ile of 7 Yrs

24. Declared a $10.000 cash dividend for stockholders

25. Poid a $10000 coh dividend for stockholders

Balance at end of Y 2

37,429

Depreciation Expenses

37,429

Non-Cash

$ 10,000

S 10,000

$ -10,000

Non-Cash

S 10,000

Financing

$ 10,000

S 19,72.792 S 1,05.000 S 4.05,800 S 300,000 S 50.000 S 2,50.000 s

45,762 $ 238.000 S

$ 5.00.000 $

40,000 $

17,00,000 $ 100.000 $1,66,167s

$ 11,65.000 $-10,41,337 S

$ 19,72,792

Since no par value mentioned, all amount are taken into common stock

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,