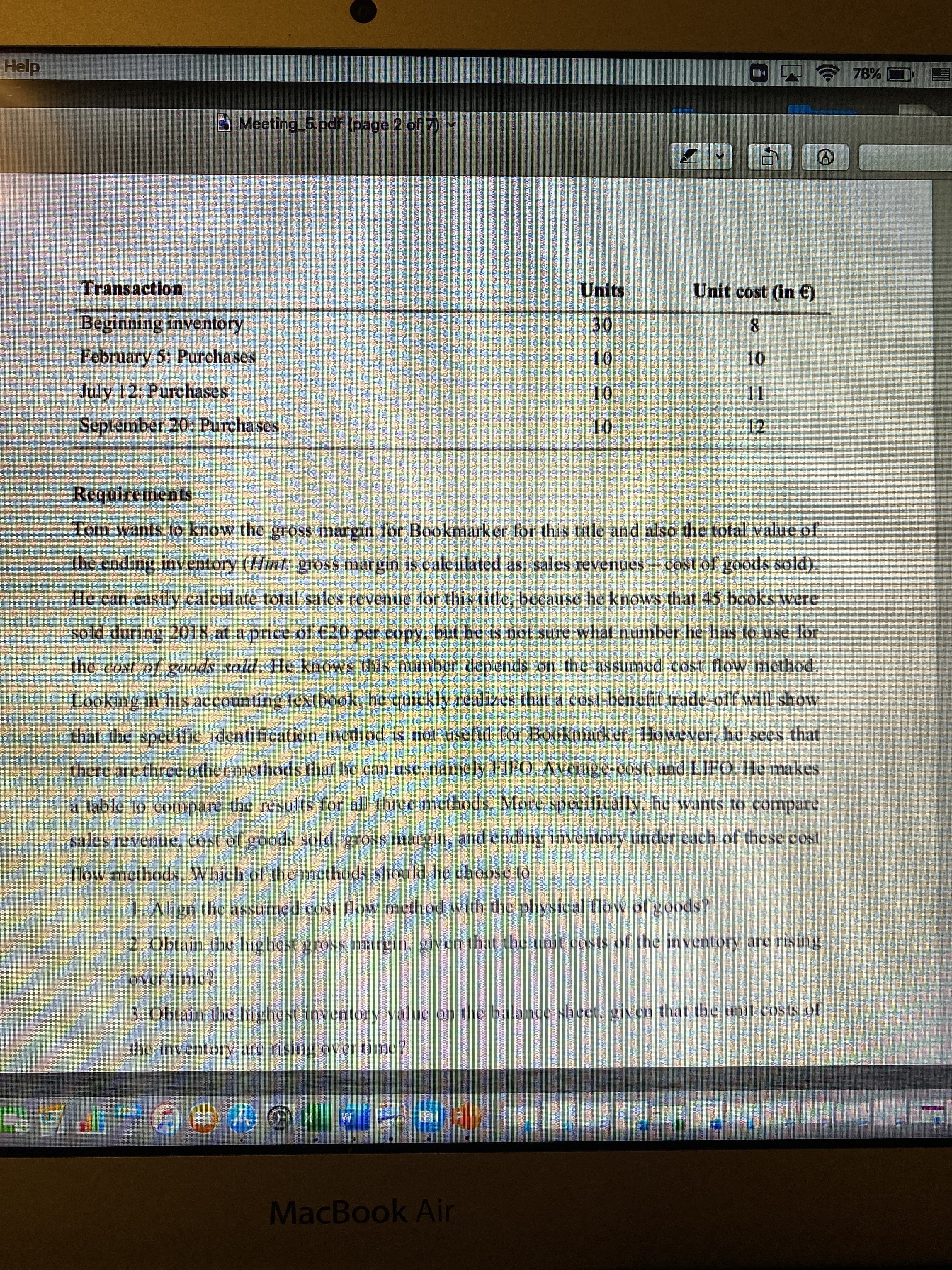

藝營 Help 四令78% B Meeting 5.pdf (page 2 of 7) Transaction Units Unit cost (in €) Beginning inventory 30 10 8. February 5: Purchases 1. 11 July 12: Purchases 10 September 20: Purchases 12 01 Requirements Tom wants to know the gross margin for Bookmarker for this title and also the total value of the ending inventory (Hint gross margin is caleulated as: sales revenues cost of goods sold). He can easily calculate total sales revenue for this title, because he knows that 45 books were sold during 2018 at a price of €20 per copy, but he is not sure what number he has to use for the cost of goods sold. He knows this number depends on the assumed cost flow method. Looking in his accounting textbook, he quickly realizes that a cost-benefit trade-off will show that the specific identification method is not useful for Bookmarker. However, he sees that there are three other methods that he can use, namely FIFO, Average-cost, and LIFO. He makes a table to compare the results for all three methods. More specifically, he wants to compare sales revenue, cost of goods sold, gross margin, and ending inventory under each of the se cost flow methods. Which of the methods should he choose to L. Align the assumed cost flow method with the physical flow of goods? 2. Obtain the highest gross margin, given that the unit costs of the inventory are rising over time? 3. Obtain the highest inventory value on the balance sheet, given that the unit costs of the inventory are rising over time? MacBook Air

藝營 Help 四令78% B Meeting 5.pdf (page 2 of 7) Transaction Units Unit cost (in €) Beginning inventory 30 10 8. February 5: Purchases 1. 11 July 12: Purchases 10 September 20: Purchases 12 01 Requirements Tom wants to know the gross margin for Bookmarker for this title and also the total value of the ending inventory (Hint gross margin is caleulated as: sales revenues cost of goods sold). He can easily calculate total sales revenue for this title, because he knows that 45 books were sold during 2018 at a price of €20 per copy, but he is not sure what number he has to use for the cost of goods sold. He knows this number depends on the assumed cost flow method. Looking in his accounting textbook, he quickly realizes that a cost-benefit trade-off will show that the specific identification method is not useful for Bookmarker. However, he sees that there are three other methods that he can use, namely FIFO, Average-cost, and LIFO. He makes a table to compare the results for all three methods. More specifically, he wants to compare sales revenue, cost of goods sold, gross margin, and ending inventory under each of the se cost flow methods. Which of the methods should he choose to L. Align the assumed cost flow method with the physical flow of goods? 2. Obtain the highest gross margin, given that the unit costs of the inventory are rising over time? 3. Obtain the highest inventory value on the balance sheet, given that the unit costs of the inventory are rising over time? MacBook Air

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter6: Cost Of Goods Sold And Inventory

Section: Chapter Questions

Problem 62E

Related questions

Topic Video

Question

How can i solve 1,2 and 3?

Transcribed Image Text:藝營

Help

四令78%

B Meeting 5.pdf (page 2 of 7)

Transaction

Units

Unit cost (in €)

Beginning inventory

30

10

8.

February 5: Purchases

1.

11

July 12: Purchases

10

September 20: Purchases

12

01

Requirements

Tom wants to know the gross margin for Bookmarker for this title and also the total value of

the ending inventory (Hint gross margin is caleulated as: sales revenues cost of goods sold).

He can easily calculate total sales revenue for this title, because he knows that 45 books were

sold during 2018 at a price of €20 per copy, but he is not sure what number he has to use for

the cost of goods sold. He knows this number depends on the assumed cost flow method.

Looking in his accounting textbook, he quickly realizes that a cost-benefit trade-off will show

that the specific identification method is not useful for Bookmarker. However, he sees that

there are three other methods that he can use, namely FIFO, Average-cost, and LIFO. He makes

a table to compare the results for all three methods. More specifically, he wants to compare

sales revenue, cost of goods sold, gross margin, and ending inventory under each of the se cost

flow methods. Which of the methods should he choose to

L. Align the assumed cost flow method with the physical flow of goods?

2. Obtain the highest gross margin, given that the unit costs of the inventory are rising

over time?

3. Obtain the highest inventory value on the balance sheet, given that the unit costs of

the inventory are rising over time?

MacBook Air

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College