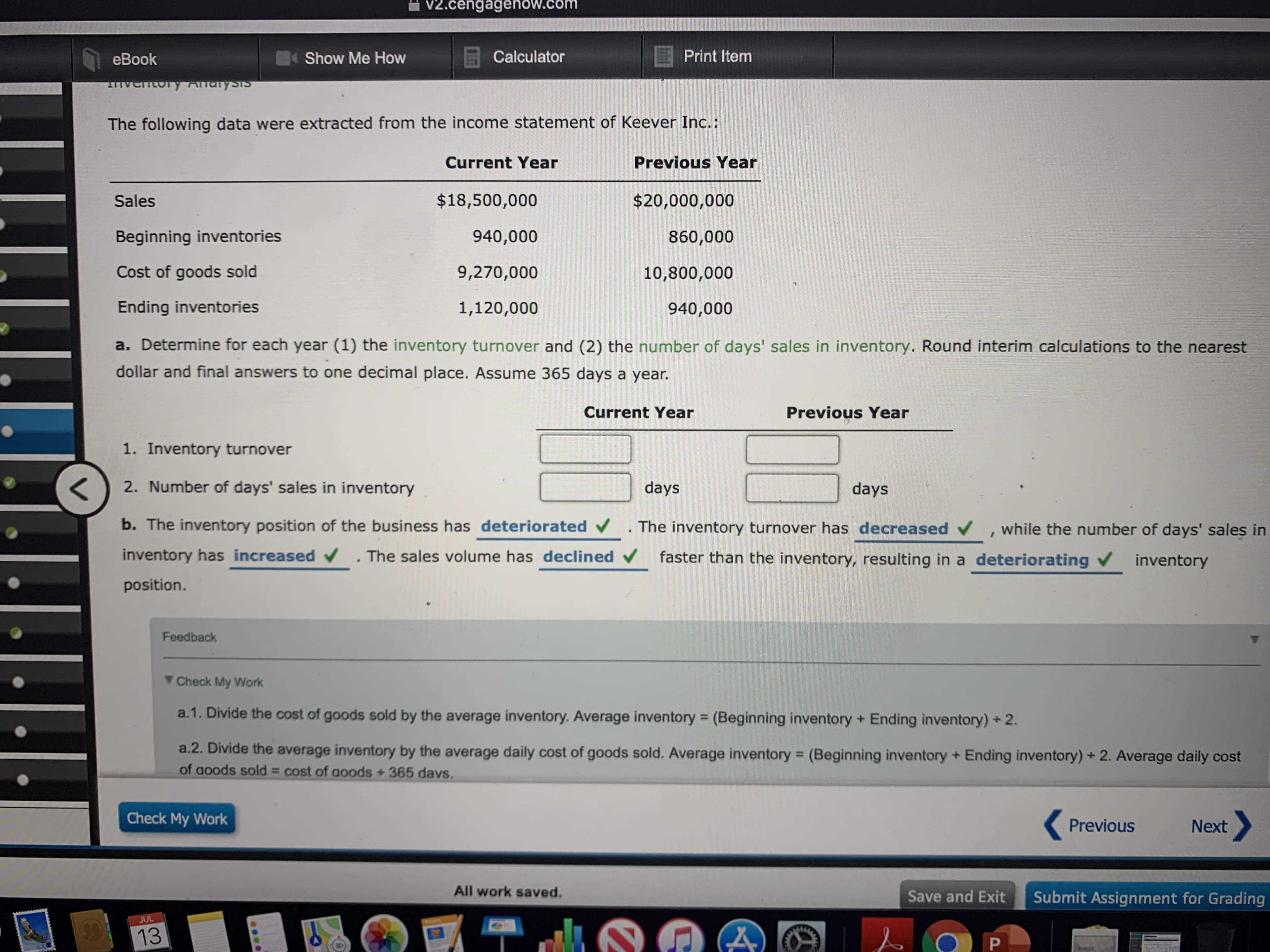

V2.cengagehðw.com Print Item Calculator Show Me How eBook Cntry AnalySis The following data were extracted from the income statement of Keever Inc.: Previous Year Current Year $18,500,000 $20,000,000 Sales 940,000 Beginning inventories 860,000 Cost of goods sold 9,270,000 10,800,000 Ending inventories 1,120,000 940,000 a. Determine for each year (1) the inventory turnover and (2) the number of days' sales in inventory. Round interim calculations to the nearest dollar and final answers to one decimal place. Assume 365 days a year. Current Year Previous Year 1. Inventory turnover 2. Number of days' sales in inventory days days b. The inventory position of the business has deteriorated The inventory turnover has decreased while the number of days' sales in inventory has increased The sales volume has declined faster than the inventory, resulting in a deteriorating inventory position. Feedback Check My Work a.1. Divide the cost of goods sold by the average inventory. Average inventory (Beginning inventory+ Ending inventory) + 2. a.2. Divide the average inventory by the average daily cost of goods sold. Average inventory of aoods sold = cost of goods + 365 davs. (Beginning inventory + Ending inventory) + 2. Average daily cost Check My Work Previous Next All work saved. Save and Exit Submit Assignment for Grading JUL 13 P

V2.cengagehðw.com Print Item Calculator Show Me How eBook Cntry AnalySis The following data were extracted from the income statement of Keever Inc.: Previous Year Current Year $18,500,000 $20,000,000 Sales 940,000 Beginning inventories 860,000 Cost of goods sold 9,270,000 10,800,000 Ending inventories 1,120,000 940,000 a. Determine for each year (1) the inventory turnover and (2) the number of days' sales in inventory. Round interim calculations to the nearest dollar and final answers to one decimal place. Assume 365 days a year. Current Year Previous Year 1. Inventory turnover 2. Number of days' sales in inventory days days b. The inventory position of the business has deteriorated The inventory turnover has decreased while the number of days' sales in inventory has increased The sales volume has declined faster than the inventory, resulting in a deteriorating inventory position. Feedback Check My Work a.1. Divide the cost of goods sold by the average inventory. Average inventory (Beginning inventory+ Ending inventory) + 2. a.2. Divide the average inventory by the average daily cost of goods sold. Average inventory of aoods sold = cost of goods + 365 davs. (Beginning inventory + Ending inventory) + 2. Average daily cost Check My Work Previous Next All work saved. Save and Exit Submit Assignment for Grading JUL 13 P

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter5: Accounting For Retail Businesses

Section: Chapter Questions

Problem 41E: Cost of goods sold and related items The following data were extracted from the accounting records...

Related questions

Question

Transcribed Image Text:V2.cengagehðw.com

Print Item

Calculator

Show Me How

eBook

Cntry AnalySis

The following data were extracted from the income statement of Keever Inc.:

Previous Year

Current Year

$18,500,000

$20,000,000

Sales

940,000

Beginning inventories

860,000

Cost of goods sold

9,270,000

10,800,000

Ending inventories

1,120,000

940,000

a. Determine for each year (1) the inventory turnover and (2) the number of days' sales in inventory. Round interim calculations to the nearest

dollar and final answers to one decimal place. Assume 365 days a year.

Current Year

Previous Year

1. Inventory turnover

2. Number of days' sales in inventory

days

days

b. The inventory position of the business has deteriorated

The inventory turnover has decreased

while the number of days' sales in

inventory has increased

The sales volume has declined

faster than the inventory, resulting in a deteriorating

inventory

position.

Feedback

Check My Work

a.1. Divide the cost of goods sold by the average inventory. Average inventory (Beginning inventory+ Ending inventory) + 2.

a.2. Divide the average inventory by the average daily cost of goods sold. Average inventory

of aoods sold = cost of goods + 365 davs.

(Beginning inventory + Ending inventory) + 2. Average daily cost

Check My Work

Previous

Next

All work saved.

Save and Exit

Submit Assignment for Grading

JUL

13

P

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning