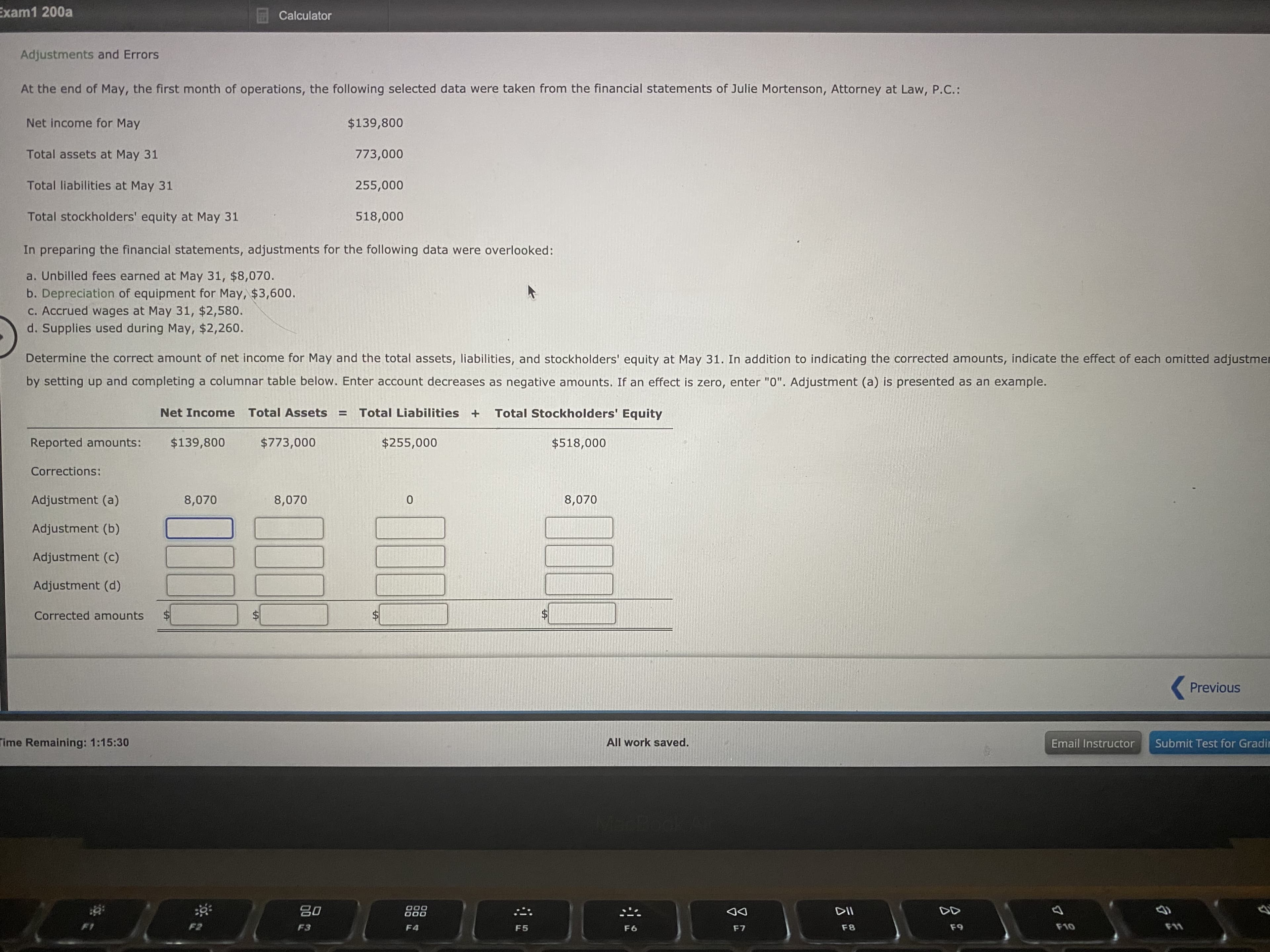

At the end of May, the first month of operations, the following selected data were taken from the financial statements of Julie Mortenson, Attorney at Law, P.C.: Net income for May $139,800 Total assets at May 31 773,000 Total liabilities at May 31 255,000 Total stockholders' equity at May 31 518,000 In preparing the financial statements, adjustments for the following data were overlooked: a. Unbilled fees earned at May 31, $8,070. b. Depreciation of equipment for May, $3,600. C. Accrued wages at May 31, $2,580. d. Supplies used during May, $2,260. Determine the correct amount of net income for May and the total assets, liabilities, and stockholders' equity at May 31. In addition to indicating the corrected amounts, indicate the effect of each omitted adjustmer by setting up and completing a columnar table below. Enter account decreases as negative amounts. If an effect is zero, enter "0". Adjustment (a) is presented as an example.

At the end of May, the first month of operations, the following selected data were taken from the financial statements of Julie Mortenson, Attorney at Law, P.C.: Net income for May $139,800 Total assets at May 31 773,000 Total liabilities at May 31 255,000 Total stockholders' equity at May 31 518,000 In preparing the financial statements, adjustments for the following data were overlooked: a. Unbilled fees earned at May 31, $8,070. b. Depreciation of equipment for May, $3,600. C. Accrued wages at May 31, $2,580. d. Supplies used during May, $2,260. Determine the correct amount of net income for May and the total assets, liabilities, and stockholders' equity at May 31. In addition to indicating the corrected amounts, indicate the effect of each omitted adjustmer by setting up and completing a columnar table below. Enter account decreases as negative amounts. If an effect is zero, enter "0". Adjustment (a) is presented as an example.

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter3: The Adjusting Process

Section: Chapter Questions

Problem 6PA: At the end of April, the first month of operations, the following selected data were taken from the...

Related questions

Question

Transcribed Image Text:At the end of May, the first month of operations, the following selected data were taken from the financial statements of Julie Mortenson, Attorney at Law, P.C.:

Net income for May

$139,800

Total assets at May 31

773,000

Total liabilities at May 31

255,000

Total stockholders' equity at May 31

518,000

In preparing the financial statements, adjustments for the following data were overlooked:

a. Unbilled fees earned at May 31, $8,070.

b. Depreciation of equipment for May, $3,600.

C. Accrued wages at May 31, $2,580.

d. Supplies used during May, $2,260.

Determine the correct amount of net income for May and the total assets, liabilities, and stockholders' equity at May 31. In addition to indicating the corrected amounts, indicate the effect of each omitted adjustmer

by setting up and completing a columnar table below. Enter account decreases as negative amounts. If an effect is zero, enter "0". Adjustment (a) is presented as an example.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning