%24 %23 <> AaBbCcDd AaBbCcDo - A A Aav Ap EE E EE Create and 11 I Normal I No Spac.. Heading 1 Heading 2 - A Select Signatures Adobe PDF ab x, x A DA. Sensi Adobe Acrobat Voice Editing Styles Paragraph Font 4. Giant Corp. purchased a truck on January 1, Year 1 for $75,000. The truck is estimated to have a 5 year life and salvage value of $15,000. The company uses the straight line method. a) At the beginning of Year 3, Giant revises the expected life to 7 years, what is the new annual depreciation expense? b) At the beginning of Year 3, Giant keeps the life the same, but changes the salvage value to $10,000. What is the new annual depreciation expense? 1020 words Type here to search A 73°F 61 LI 12 SUi prt sc delete 5. -> backspace unu lock enter pause ↑ shift alt ctrl

%24 %23 <> AaBbCcDd AaBbCcDo - A A Aav Ap EE E EE Create and 11 I Normal I No Spac.. Heading 1 Heading 2 - A Select Signatures Adobe PDF ab x, x A DA. Sensi Adobe Acrobat Voice Editing Styles Paragraph Font 4. Giant Corp. purchased a truck on January 1, Year 1 for $75,000. The truck is estimated to have a 5 year life and salvage value of $15,000. The company uses the straight line method. a) At the beginning of Year 3, Giant revises the expected life to 7 years, what is the new annual depreciation expense? b) At the beginning of Year 3, Giant keeps the life the same, but changes the salvage value to $10,000. What is the new annual depreciation expense? 1020 words Type here to search A 73°F 61 LI 12 SUi prt sc delete 5. -> backspace unu lock enter pause ↑ shift alt ctrl

Chapter6: Deductions And Losses: In General

Section: Chapter Questions

Problem 44P

Related questions

Question

Transcribed Image Text:%24

%23

<>

AaBbCcDd AaBbCcDo

- A A Aav Ap EE E EE

Create and

11

I Normal I No Spac.. Heading 1

Heading 2 -

A Select

Signatures

Adobe PDF

ab x, x A DA.

Sensi

Adobe Acrobat

Voice

Editing

Styles

Paragraph

Font

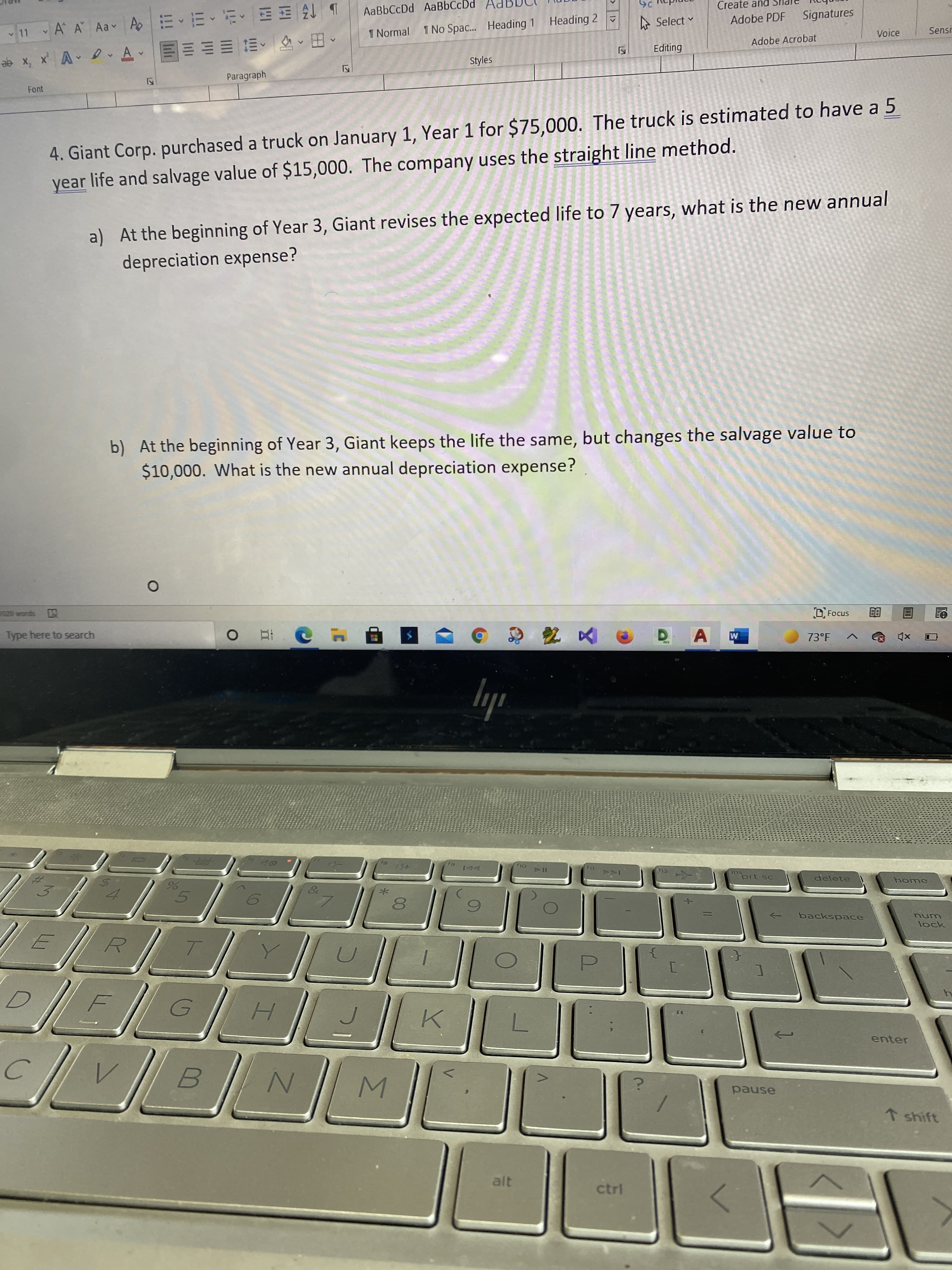

4. Giant Corp. purchased a truck on January 1, Year 1 for $75,000. The truck is estimated to have a 5

year life and salvage value of $15,000. The company uses the straight line method.

a) At the beginning of Year 3, Giant revises the expected life to 7 years, what is the new annual

depreciation expense?

b) At the beginning of Year 3, Giant keeps the life the same, but changes the salvage value to

$10,000. What is the new annual depreciation expense?

1020 words

Type here to search

A

73°F

61

LI

12

SUi

prt sc

delete

5.

->

backspace

unu

lock

enter

pause

↑ shift

alt

ctrl

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you