6. %24 iz/attempt.php?attempt3D216068&cmid3D185308&page=D1 The manufacturing capacity of Jordan Company's facilities is 30,000 units a year. A summary of operating results for last year follows: Sales (18,000 units @ 000'008 Variable costs 000'066 Contribution margin 000'018 Fixed costs Net operating income $315,000 A foreign distributor has offered to buy 12,000 units at $95 per unit next year. Jordan expects its regular sales next year to be 20,000 units at $100 per unit. If Jordan accepts this offer for 12,000 units and rejects some business from regular customers so as not to exceed capacity, what is the expected total net operating income for next year? (Assume that the total fixed costs would be the same no matter how many units are produced and sold.) Select one: $795,000 $735,000 Clear my choice pe here to search 81 15 f4 f3 #

6. %24 iz/attempt.php?attempt3D216068&cmid3D185308&page=D1 The manufacturing capacity of Jordan Company's facilities is 30,000 units a year. A summary of operating results for last year follows: Sales (18,000 units @ 000'008 Variable costs 000'066 Contribution margin 000'018 Fixed costs Net operating income $315,000 A foreign distributor has offered to buy 12,000 units at $95 per unit next year. Jordan expects its regular sales next year to be 20,000 units at $100 per unit. If Jordan accepts this offer for 12,000 units and rejects some business from regular customers so as not to exceed capacity, what is the expected total net operating income for next year? (Assume that the total fixed costs would be the same no matter how many units are produced and sold.) Select one: $795,000 $735,000 Clear my choice pe here to search 81 15 f4 f3 #

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter11: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 11.16E

Related questions

Question

Transcribed Image Text:6.

%24

iz/attempt.php?attempt3D216068&cmid3D185308&page=D1

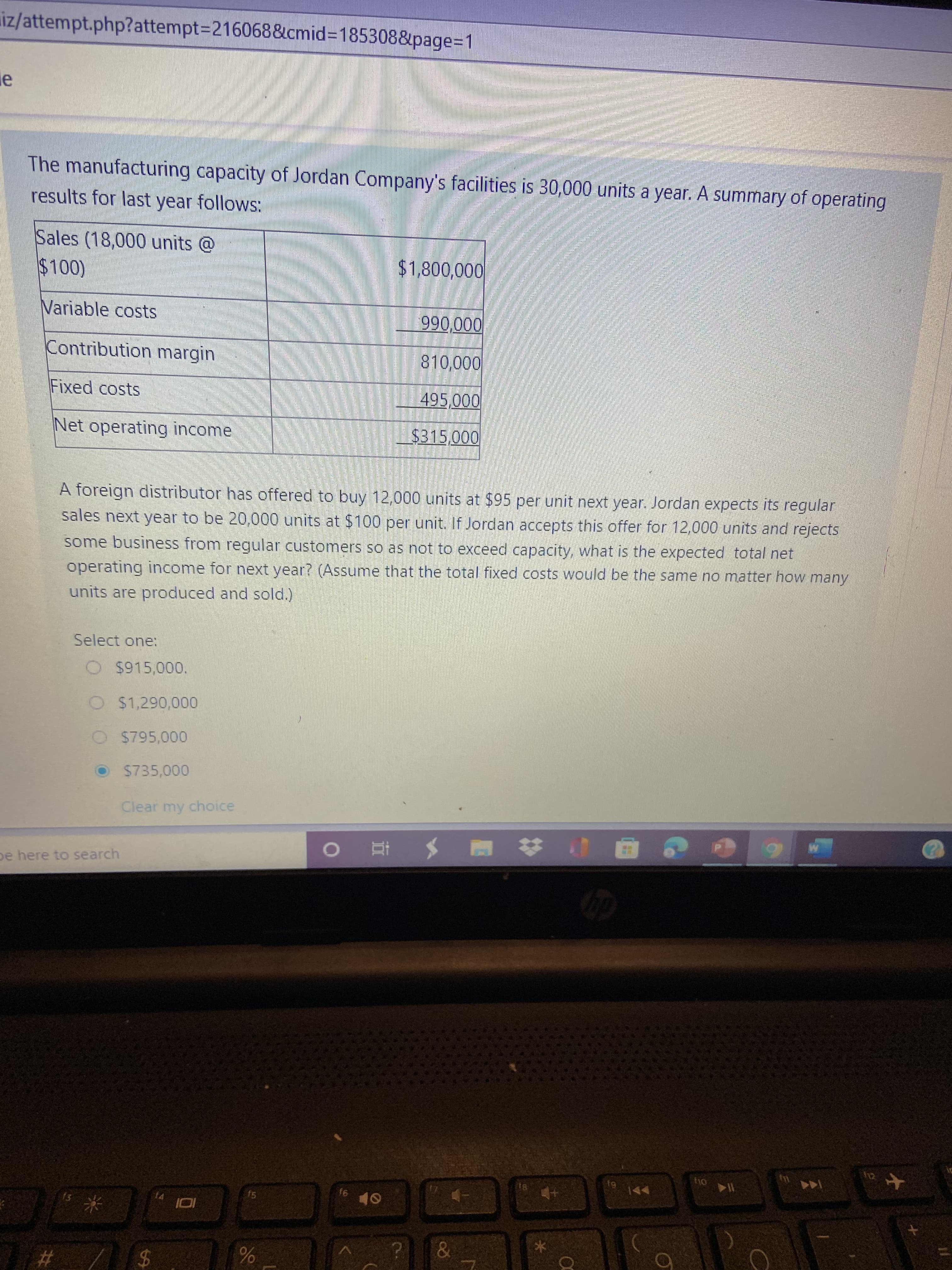

The manufacturing capacity of Jordan Company's facilities is 30,000 units a year. A summary of operating

results for last year follows:

Sales (18,000 units @

000'008

Variable costs

000'066

Contribution margin

000'018

Fixed costs

Net operating income

$315,000

A foreign distributor has offered to buy 12,000 units at $95 per unit next year. Jordan expects its regular

sales next year to be 20,000 units at $100 per unit. If Jordan accepts this offer for 12,000 units and rejects

some business from regular customers so as not to exceed capacity, what is the expected total net

operating income for next year? (Assume that the total fixed costs would be the same no matter how many

units are produced and sold.)

Select one:

$795,000

$735,000

Clear my choice

pe here to search

81

15

f4

f3

#

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning