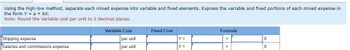

Using the high-low method, separate each mixed expense into variable and fixed elements. Express the variable and fixed portions of each mixed expense in the form Y= a + bx. Note: Round the Variable cost per unit to 2 decimal places. Shipping expense Salaries and commissions expense Variable Cost per unit per unit Fixed Cost Y = Y = Formula + X X

Using the high-low method, separate each mixed expense into variable and fixed elements. Express the variable and fixed portions of each mixed expense in the form Y= a + bx. Note: Round the Variable cost per unit to 2 decimal places. Shipping expense Salaries and commissions expense Variable Cost per unit per unit Fixed Cost Y = Y = Formula + X X

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

Our experts need more information to provide you with a solution. Financial data is not given Please resubmit your question, making sure it's detailed and complete. We've credited a question to your account.

Your Question:

Morrisey & Brown, Limited, of Sydney is a merchandising company that is the sole distributor of a product that is increasing in popularity among Australian consumers. The company’s income statements for the three most recent months follow:

- Using the high-low method, separate each mixed expense into variable and fixed elements. Express the variable and fixed portions of each mixed expense in the form Y = a + bX.

Transcribed Image Text:Using the high-low method, separate each mixed expense into variable and fixed elements. Express the variable and fixed portions of each mixed expense in

the form Y= a + bx.

Note: Round the Variable cost per unit to 2 decimal places.

Shipping expense

Salaries and commissions expense

Variable Cost

per unit

per unit

Fixed Cost

Y =

Y =

Formula

+

X

X

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning