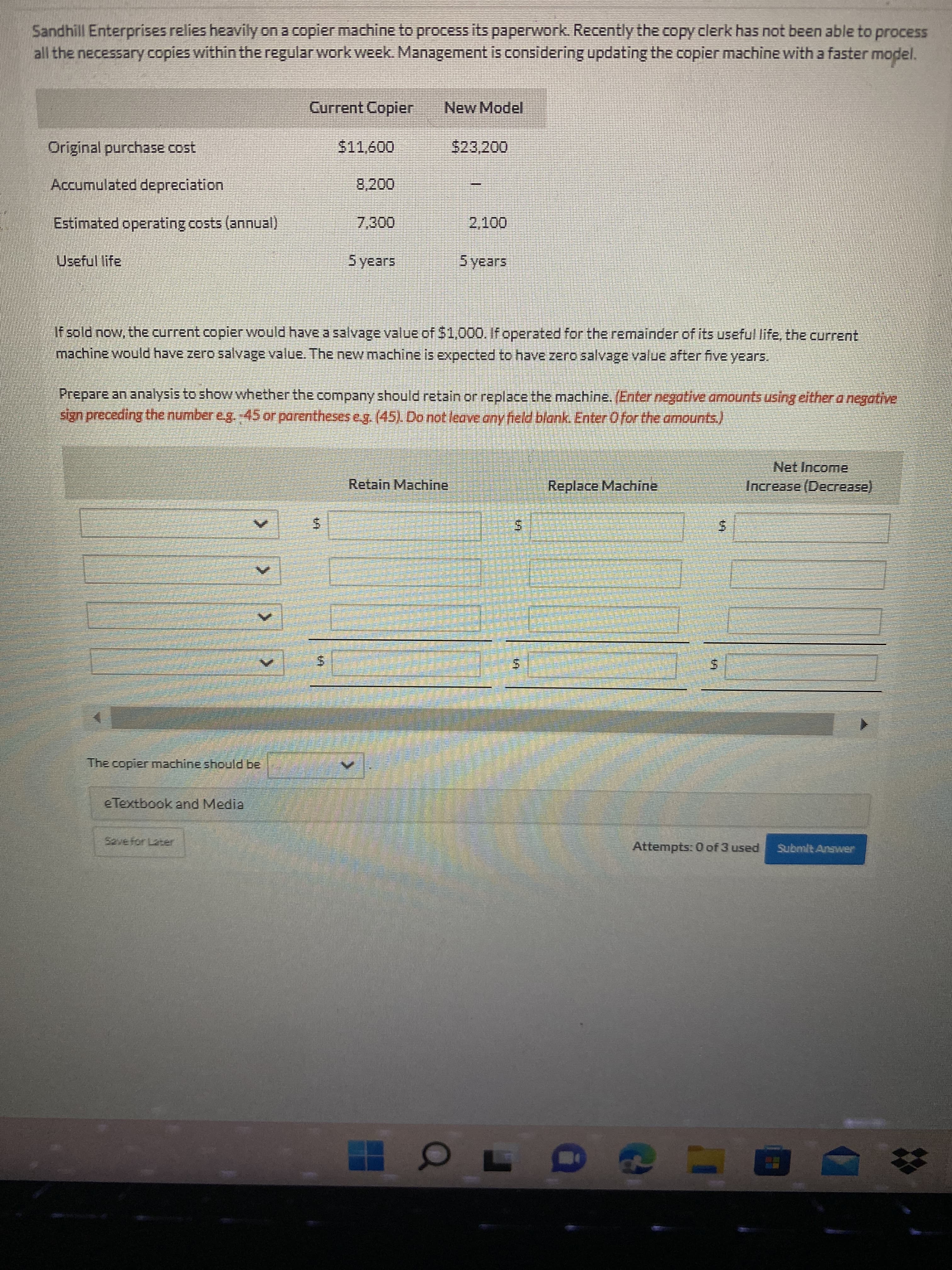

%24 %24 Sandhill Enterprises relies heavily on a copier machine to process its paperwork. Recently the copy clerk has not been able to process all the necessary copies within the regular work week. Management is considering updating the copier machine with a faster model. Current Copier New Model Original purchase cost 523,200 Accumulated depreciation Estimated operating costs (annual) 7,300 Useful life Syears If sold now, the current copierwould have a salvage value of $1,000, If operated for the remainder of its useful life, the current machine would have zero salvage value. The new machine is expected to have zero salvage value after five years. Prepare an analysis to show whether the company should retain or replace the machine. (Enter negative armounts using either a negotive sign preceding the number eg.-45 or parentheseseg. (45). Do not leave any field blank. Enter Ofor the armounts.) Net Income Retain Machine Replace Machine Increase (Decrease). 5. 5. 5. The copier machine should be eTextbook and Media Attempts: 0 of 3 used Submit Answer

%24 %24 Sandhill Enterprises relies heavily on a copier machine to process its paperwork. Recently the copy clerk has not been able to process all the necessary copies within the regular work week. Management is considering updating the copier machine with a faster model. Current Copier New Model Original purchase cost 523,200 Accumulated depreciation Estimated operating costs (annual) 7,300 Useful life Syears If sold now, the current copierwould have a salvage value of $1,000, If operated for the remainder of its useful life, the current machine would have zero salvage value. The new machine is expected to have zero salvage value after five years. Prepare an analysis to show whether the company should retain or replace the machine. (Enter negative armounts using either a negotive sign preceding the number eg.-45 or parentheseseg. (45). Do not leave any field blank. Enter Ofor the armounts.) Net Income Retain Machine Replace Machine Increase (Decrease). 5. 5. 5. The copier machine should be eTextbook and Media Attempts: 0 of 3 used Submit Answer

Financial & Managerial Accounting

13th Edition

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter19: Cost Behavior And Cost-Volume-Profit Analysis

Section: Chapter Questions

Problem 19.3CP: Break-even analysis Somerset Inc. has finished a new video game, Snowboard Challenge. Management is...

Related questions

Question

Unit VI question 15

Transcribed Image Text:%24

%24

Sandhill Enterprises relies heavily on a copier machine to process its paperwork. Recently the copy clerk has not been able to process

all the necessary copies within the regular work week. Management is considering updating the copier machine with a faster model.

Current Copier

New Model

Original purchase cost

523,200

Accumulated depreciation

Estimated operating costs (annual)

7,300

Useful life

Syears

If sold now, the current copierwould have a salvage value of $1,000, If operated for the remainder of its useful life, the current

machine would have zero salvage value. The new machine is expected to have zero salvage value after five years.

Prepare an analysis to show whether the company should retain or replace the machine. (Enter negative armounts using either a negotive

sign preceding the number eg.-45 or parentheseseg. (45). Do not leave any field blank. Enter Ofor the armounts.)

Net Income

Retain Machine

Replace Machine

Increase (Decrease).

5.

5.

5.

The copier machine should be

eTextbook and Media

Attempts: 0 of 3 used

Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning