PROBLEM 6-5 Comprehensive You have been asked by a client to audit the financial statements of Half-Hearted Company for the first time. In examining the books, you found out that certain adjustments had been overlooked at the end of 2020 and 2021. You also discovered that other items had been improperly recorded. These omissions and other failures for each year are summarized below: 2020 2021 Merchandise inventory, end P10,000 overstated P8,000 understated Advances to supplier were purchases but the merchandise was received in the following year: Advances from customers recorded as sales but the goods were delivered in the following year: Improvements on building had been charged to expense on January 1, 2020. Improvements have a life of 5 years. On January 1, 2020, an equipment costing P40,000 was sold for P20,000. At the date of sale, the equipment had an accumulated depreciation of P15,000. The cash received was recorded as other income in 2020. recorded as 30,000 40,000 20,000 70,000 100,000 Questions: Based on the above and the result of your audit, answer the following: 1. What is the total effect of the errors on the 2020 net income? c. Overstated by P115,000 d. Understated by P55,000 Understated by P45,000 b. Understated by P25,000 a. 2. What is the total effect of the errors on the 2021 net income? c. Overstated by P68,000 d. Overstated by P38,000 Overstated by P32,000 b. Overstated by P42,000 a. 3. What is the total effect of the errors on the company's working capital on December 31, 2021? Overstated by P22,000 b. Understated by P48,000 c. Overstated by P70,000 d. Overstated by P30,000 a.

PROBLEM 6-5 Comprehensive You have been asked by a client to audit the financial statements of Half-Hearted Company for the first time. In examining the books, you found out that certain adjustments had been overlooked at the end of 2020 and 2021. You also discovered that other items had been improperly recorded. These omissions and other failures for each year are summarized below: 2020 2021 Merchandise inventory, end P10,000 overstated P8,000 understated Advances to supplier were purchases but the merchandise was received in the following year: Advances from customers recorded as sales but the goods were delivered in the following year: Improvements on building had been charged to expense on January 1, 2020. Improvements have a life of 5 years. On January 1, 2020, an equipment costing P40,000 was sold for P20,000. At the date of sale, the equipment had an accumulated depreciation of P15,000. The cash received was recorded as other income in 2020. recorded as 30,000 40,000 20,000 70,000 100,000 Questions: Based on the above and the result of your audit, answer the following: 1. What is the total effect of the errors on the 2020 net income? c. Overstated by P115,000 d. Understated by P55,000 Understated by P45,000 b. Understated by P25,000 a. 2. What is the total effect of the errors on the 2021 net income? c. Overstated by P68,000 d. Overstated by P38,000 Overstated by P32,000 b. Overstated by P42,000 a. 3. What is the total effect of the errors on the company's working capital on December 31, 2021? Overstated by P22,000 b. Understated by P48,000 c. Overstated by P70,000 d. Overstated by P30,000 a.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter8: Inventories: Special Valuation Issues

Section: Chapter Questions

Problem 10E: Gross Profit Method: Estimation of Theft Loss You are requested by a client on September 28 to...

Related questions

Question

answers all and give solutions and explaination in each

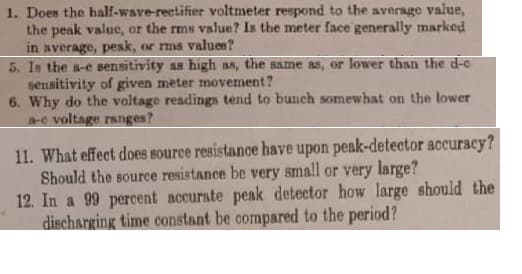

Transcribed Image Text:1. Does the half-wave-rectifier voltmeter respond to the average value,

the peak value, or the rms value? Is the meter face generally marked

in sverage, pesk, or rms values?

5. Is the s-e sensitivity ss high ss, the same as, or lower than the d-c

sensitivity of given meter movement?

6. Why do the voltage readings tend to bunch somewhat on the lower

e voltage ranges?

11. What effect does source resistance have upon peak-detector accuracy?

Should the source resistance be very small or very large?

12. In a 99 percent accurate peak detector how large should the

discharging time constant be compared to the period?

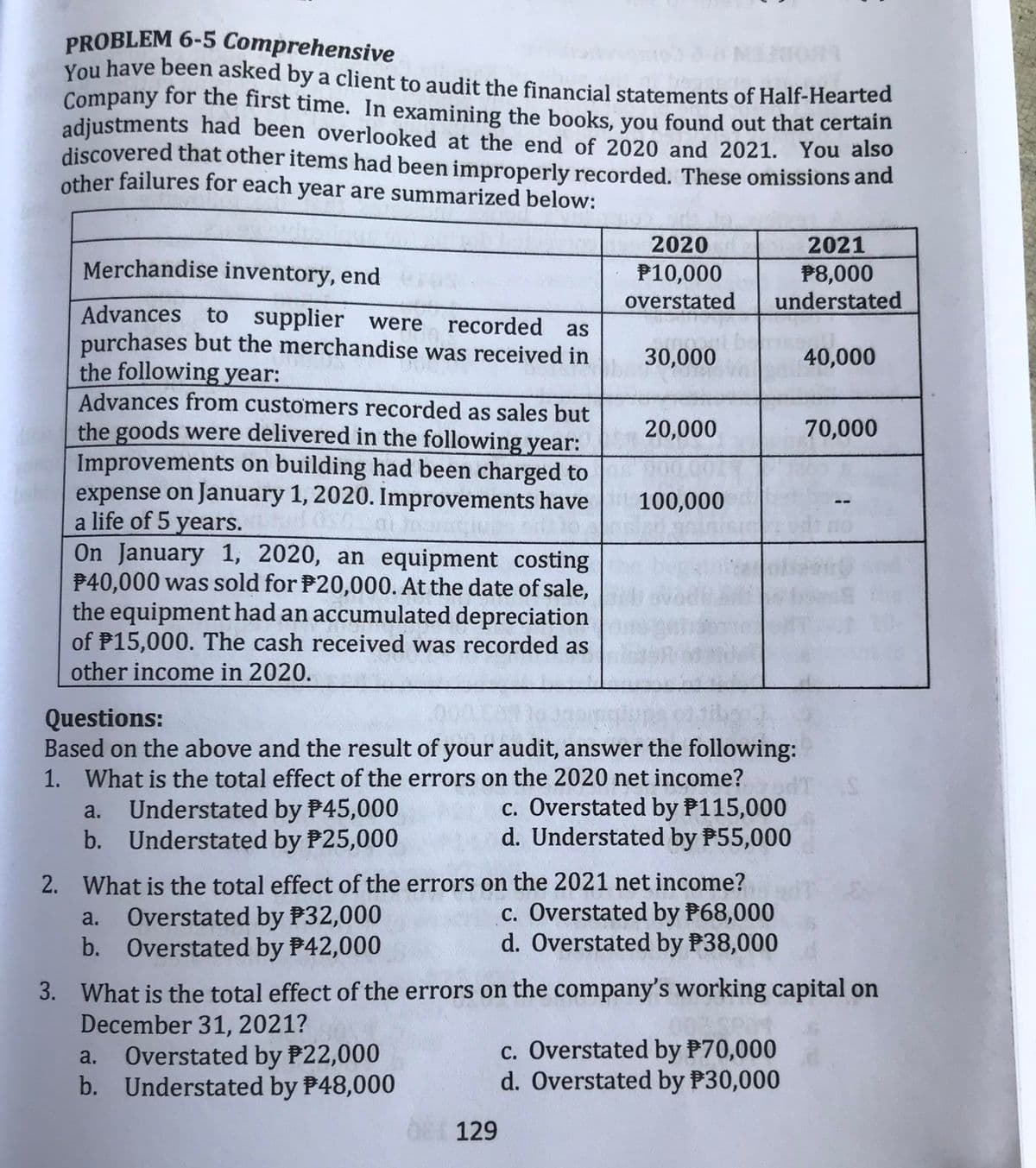

Transcribed Image Text:PROBLEM 6-5 Comprehensive

You have been asked by a client to audit the financial statements of Half-Hearted

Company for the first time. In examining the books, you found out that certain

adjustments had been overlooked at the end of 2020 and 2021. You also

discovered that other items had been improperly recorded. These omissions and

other failures for each year are summarized below:

2020

2021

Merchandise inventory, end

P10,000

overstated

P8,000

understated

Advances to supplier were recorded as

purchases but the merchandise was received in

the following year:

Advances from customers recorded as sales but

the goods were delivered in the following year:

Improvements on building had been charged to

expense on January 1, 2020. Improvements have 100,000

a life of 5 years.

On January 1, 2020, an equipment costing

P40,000 was sold for P20,000. At the date of sale,

the equipment had an accumulated depreciation

of P15,000. The cash received was recorded as

30,000

40,000

20,000

70,000

other income in 2020.

Questions:

Based on the above and the result of your audit, answer the following:

1. What is the total effect of the errors on the 2020 net income?

c. Overstated by P115,000

d. Understated by P55,000

Understated by P45,000

b. Understated by P25,000

a.

2. What is the total effect of the errors on the 2021 net income?

a. Overstated by P32,000

b. Overstated by P42,000

c. Overstated by P68,000

d. Overstated by P38,000

3. What is the total effect of the errors on the company's working capital on

December 31, 2021?

Overstated by P22,000

b. Understated by P48,000

c. Overstated by P70,000

d. Overstated by P30,000

a.

129

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning