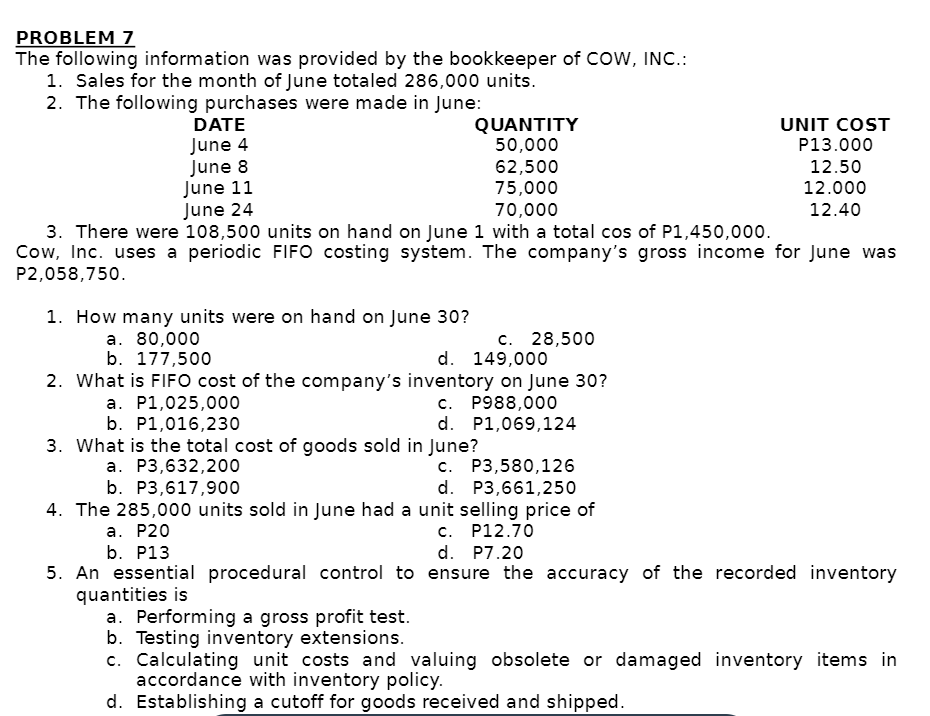

PROBLEM 7 The following information was provided by the bookkeeper of COW, INC.: 1. Sales for the month of June totaled 286,000 units. 2. The following purchases were made in June: DATE June 4 June 8 June 11 June 24 1. How many units were on hand on June 30? a. 80,000 b. 177,500 QUANTITY 50,000 3. There were 108,500 units on hand on June 1 with a total cos of P1,450,000. Cow, Inc. uses a periodic FIFO costing system. The company's gross income for June was P2,058,750. a. P1,025,000 b. P1,016,230 62,500 75,000 70,000 2. What is FIFO cost of the company's inventory on June 30? c. P988,000 d. P1,069,124 3. What is the total cost of goods sold in June? a. P3,632,200 b. P3,617,900 quantities is a. Performing a gross profit test. b. Testing inventory extensions. c. 28,500 d. 149,000 UNIT COST P13.000 12.50 12.000 12.40 c. P3,580,126 d. P3,661,250 4. The 285,000 units sold in June had a unit selling price of a. P20 c. P12.70 b. P13 d. P7.20 5. An essential procedural control to ensure the accuracy of the recorded inventory c. Calculating unit costs and valuing obsolete or damaged inventory items in accordance with inventory policy. d. Establishing a cutoff for goods received and shipped.

PROBLEM 7 The following information was provided by the bookkeeper of COW, INC.: 1. Sales for the month of June totaled 286,000 units. 2. The following purchases were made in June: DATE June 4 June 8 June 11 June 24 1. How many units were on hand on June 30? a. 80,000 b. 177,500 QUANTITY 50,000 3. There were 108,500 units on hand on June 1 with a total cos of P1,450,000. Cow, Inc. uses a periodic FIFO costing system. The company's gross income for June was P2,058,750. a. P1,025,000 b. P1,016,230 62,500 75,000 70,000 2. What is FIFO cost of the company's inventory on June 30? c. P988,000 d. P1,069,124 3. What is the total cost of goods sold in June? a. P3,632,200 b. P3,617,900 quantities is a. Performing a gross profit test. b. Testing inventory extensions. c. 28,500 d. 149,000 UNIT COST P13.000 12.50 12.000 12.40 c. P3,580,126 d. P3,661,250 4. The 285,000 units sold in June had a unit selling price of a. P20 c. P12.70 b. P13 d. P7.20 5. An essential procedural control to ensure the accuracy of the recorded inventory c. Calculating unit costs and valuing obsolete or damaged inventory items in accordance with inventory policy. d. Establishing a cutoff for goods received and shipped.

Accounting

27th Edition

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Chapter7: Inventories

Section: Chapter Questions

Problem 7.4CP: Communication Golden Eagle Company began operations on April 1 by selling a single product. Data on...

Related questions

Topic Video

Question

Please use moving average in answering the questions (disregard FIFO)

Transcribed Image Text:PROBLEM 7

The following information was provided by the bookkeeper of COW, INC.:

1. Sales for the month of June totaled 286,000 units.

2. The following purchases were made in June:

DATE

June 4

June 8

June 11

June 24

1. How many units were on hand on June 30?

a. 80,000

b. 177,500

QUANTITY

50,000

3. There were 108,500 units on hand on June 1 with a total cos of P1,450,000.

Cow, Inc. uses a periodic FIFO costing system. The company's gross income for June was

P2,058,750.

a. P1,025,000

b. P1,016,230

62,500

75,000

70,000

2. What is FIFO cost of the company's inventory on June 30?

c. P988,000

d. P1,069,124

3. What is the total cost of goods sold in June?

a. P3,632,200

b. P3,617,900

quantities is

a. Performing a gross profit test.

b. Testing inventory extensions.

c. 28,500

d. 149,000

UNIT COST

P13.000

12.50

12.000

12.40

c. P3,580,126

d. P3,661,250

4. The 285,000 units sold in June had a unit selling price of

a. P20

c. P12.70

b. P13

d. P7.20

5. An essential procedural control to ensure the accuracy of the recorded inventory

c. Calculating unit costs and valuing obsolete or damaged inventory items in

accordance with inventory policy.

d. Establishing a cutoff for goods received and shipped.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,