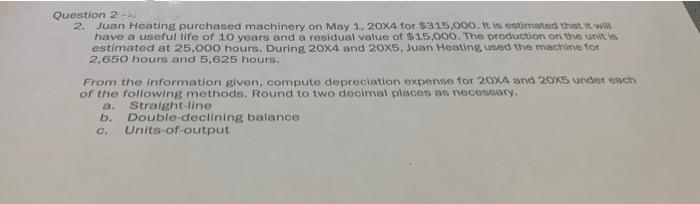

Question 2 2. Juan Heating purchased machinery on May 1, 20x4 for $315,000. It is estimated that it will have a useful life of 10 years and a residual value of $15,000. The production on the unit is estimated at 25,000 hours. During 20X4 and 20X5, Juan Heating, used the machine for 2,650 hours and 5,625 hours. From the information given, compute depreciation expense for 20X4 and 20x5 under each of the following methods. Round to two decimal places as necessary. a. Straight-line b. Double-declining balance Units-of-output C.

Question 2 2. Juan Heating purchased machinery on May 1, 20x4 for $315,000. It is estimated that it will have a useful life of 10 years and a residual value of $15,000. The production on the unit is estimated at 25,000 hours. During 20X4 and 20X5, Juan Heating, used the machine for 2,650 hours and 5,625 hours. From the information given, compute depreciation expense for 20X4 and 20x5 under each of the following methods. Round to two decimal places as necessary. a. Straight-line b. Double-declining balance Units-of-output C.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 71BPSB: Depreciation Schedules Dunn Corporation acquired a new depreciable asset for $135,000. The asset has...

Related questions

Question

Transcribed Image Text:Question 2 A

2. Juan Heating purchased machinery on May 1, 20X4 for $315,000. It is estimated that it will

have a useful life of 10 years and a residual value of $15,000. The production on the unit is

estimated at 25,000 hours. During 20X4 and 20x5, Juan Heating used the machine for

2,650 hours and 5,625 hours.

From the information given, compute depreciation expense for 20X4 and 20x5 under each

of the following methods. Round to two decimal places as necessary.

a.

Straight-line

b. Double-declining balance

Units-of-output

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning