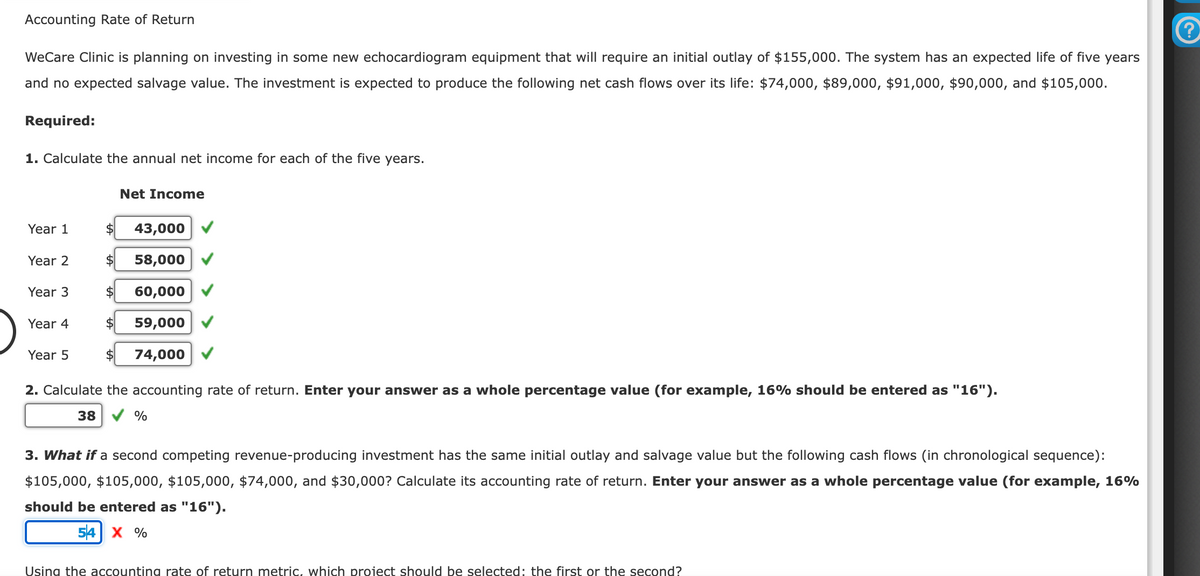

Accounting Rate of Return WeCare Clinic is planning on investing in some new echocardiogram equipment that will require an initial outlay of $155,000. The system has an expected life of five years and no expected salvage value. The investment is expected to produce the following net cash flows over its life: $74,000, $89,000, $91,000, $90,000, and $105,000. Required: 1. Calculate the annual net income for each of the five years. Net Income Year 1 $ 43,000 Year 2 $ 58,000 Year 3 $ 60,000 $ Year 4 Year 5 59,000 74,000 2. Calculate the accounting rate of return. Enter your answer as a whole percentage value (for example, 16% should be entered as "16"). 38 % 3. What if a second competing revenue-producing investment has the same initial outlay and salvage value but the following cash flows (in chronological sequence): $105,000, $105,000, $105,000, $74,000, and $30,000? Calculate its accounting rate of return. Enter your answer as a whole percentage value (for example, 16% should be entered as "16"). 54 X % Using the accounting rate of return metric, which project should be selected: the first or the second?

Accounting Rate of Return WeCare Clinic is planning on investing in some new echocardiogram equipment that will require an initial outlay of $155,000. The system has an expected life of five years and no expected salvage value. The investment is expected to produce the following net cash flows over its life: $74,000, $89,000, $91,000, $90,000, and $105,000. Required: 1. Calculate the annual net income for each of the five years. Net Income Year 1 $ 43,000 Year 2 $ 58,000 Year 3 $ 60,000 $ Year 4 Year 5 59,000 74,000 2. Calculate the accounting rate of return. Enter your answer as a whole percentage value (for example, 16% should be entered as "16"). 38 % 3. What if a second competing revenue-producing investment has the same initial outlay and salvage value but the following cash flows (in chronological sequence): $105,000, $105,000, $105,000, $74,000, and $30,000? Calculate its accounting rate of return. Enter your answer as a whole percentage value (for example, 16% should be entered as "16"). 54 X % Using the accounting rate of return metric, which project should be selected: the first or the second?

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 2CE

Related questions

Question

100%

Transcribed Image Text:Accounting Rate of Return

WeCare Clinic is planning on investing in some new echocardiogram equipment that will require an initial outlay of $155,000. The system has an expected life of five years

and no expected salvage value. The investment is expected to produce the following net cash flows over its life: $74,000, $89,000, $91,000, $90,000, and $105,000.

Required:

1. Calculate the annual net income for each of the five years.

Net Income

Year 1

$

43,000

Year 2

$

58,000

Year 3

$

60,000

$

Year 4

Year 5

59,000

74,000

2. Calculate the accounting rate of return. Enter your answer as a whole percentage value (for example, 16% should be entered as "16").

38

%

3. What if a second competing revenue-producing investment has the same initial outlay and salvage value but the following cash flows (in chronological sequence):

$105,000, $105,000, $105,000, $74,000, and $30,000? Calculate its accounting rate of return. Enter your answer as a whole percentage value (for example, 16%

should be entered as "16").

54 X %

Using the accounting rate of return metric, which project should be selected: the first or the second?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning