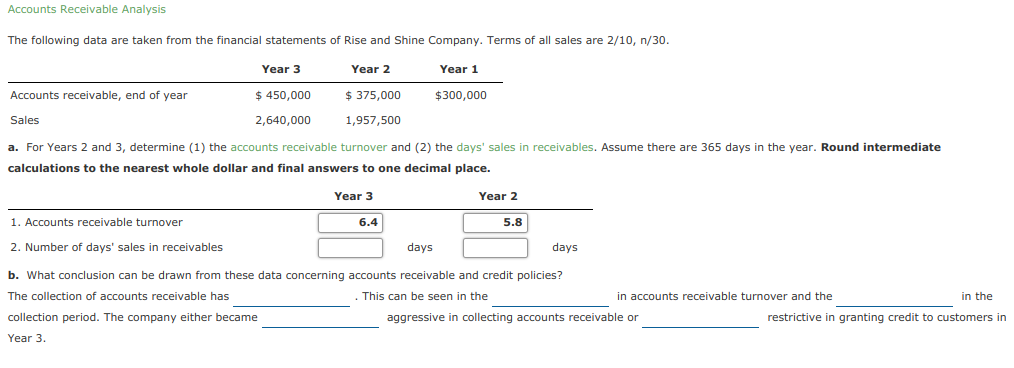

Accounts Receivable Analysis The following data are taken from the financial statements of Rise and Shine Company. Terms of all sales are 2/10, n/30. Year 3 Year 2 Year 1 Accounts receivable, end of year $ 450,000 $ 375,000 $300,000 Sales 2,640,000 1,957,500 a. For Years 2 and 3, determine (1) the accounts receivable turnover and (2) the days' sales in receivables. Assume there are 365 days in the year. Round intermediate calculations to the nearest whole dollar and final answers to one decimal place. Year 3 Year 2 1. Accounts receivable turnover 6.4 5.8 2. Number of days' sales in receivables days days b. What conclusion can be drawn from these data concerning accounts receivable and credit policies? The collection of accounts receivable has This can be seen in the in accounts receivable turnover and the in the collection period. The company either became aggressive in collecting accounts receivable or restrictive in granting credit to customers in Year 3.

Accounts Receivable Analysis The following data are taken from the financial statements of Rise and Shine Company. Terms of all sales are 2/10, n/30. Year 3 Year 2 Year 1 Accounts receivable, end of year $ 450,000 $ 375,000 $300,000 Sales 2,640,000 1,957,500 a. For Years 2 and 3, determine (1) the accounts receivable turnover and (2) the days' sales in receivables. Assume there are 365 days in the year. Round intermediate calculations to the nearest whole dollar and final answers to one decimal place. Year 3 Year 2 1. Accounts receivable turnover 6.4 5.8 2. Number of days' sales in receivables days days b. What conclusion can be drawn from these data concerning accounts receivable and credit policies? The collection of accounts receivable has This can be seen in the in accounts receivable turnover and the in the collection period. The company either became aggressive in collecting accounts receivable or restrictive in granting credit to customers in Year 3.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 9E

Related questions

Question

Transcribed Image Text:Accounts Receivable Analysis

The following data are taken from the financial statements of Rise and Shine Company. Terms of all sales are 2/10, n/30.

Year 3

Year 2

Year 1

Accounts receivable, end of year

$ 450,000

$ 375,000

$300,000

Sales

2,640,000

1,957,500

a. For Years 2 and 3, determine (1) the accounts receivable turnover and (2) the days' sales in receivables. Assume there are 365 days in the year. Round intermediate

calculations to the nearest whole dollar and final answers to one decimal place.

Year 3

Year 2

1. Accounts receivable turnover

6.4

5.8

2. Number of days' sales in receivables

days

days

b. What conclusion can be drawn from these data concerning accounts receivable and credit policies?

The collection of accounts receivable has

This can be seen in the

in accounts receivable turnover and the

in the

collection period. The company either became

aggressive in collecting accounts receivable or

restrictive in granting credit to customers in

Year 3.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning