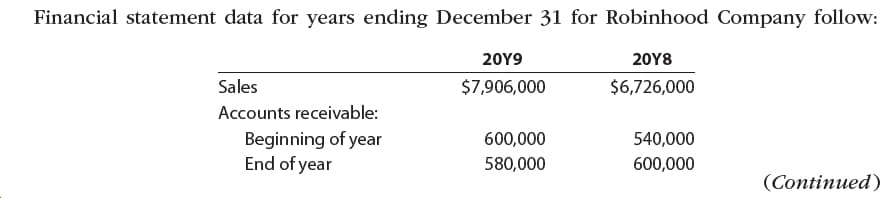

Financial statement data for years ending December 31 for Robinhood Company follow: 20Υ9 20Υ8 Sales $7,906,000 $6,726,000 Accounts receivable: Beginning of year End of year 600,000 540,000 580,000 600,000 (Continued) a. Determine the accounts receivable turnover for 20Y9 and 20Y8. b. Determine the days' sales in receivables for 20Y9 and 20Y8. Use 365 days and round to one decimal place. c. Does the change in accounts receivable turnover and the days' sales in receivables from 20Y8 to 20Y9 indicate a favorable or unfavorable change?

Financial statement data for years ending December 31 for Robinhood Company follow: 20Υ9 20Υ8 Sales $7,906,000 $6,726,000 Accounts receivable: Beginning of year End of year 600,000 540,000 580,000 600,000 (Continued) a. Determine the accounts receivable turnover for 20Y9 and 20Y8. b. Determine the days' sales in receivables for 20Y9 and 20Y8. Use 365 days and round to one decimal place. c. Does the change in accounts receivable turnover and the days' sales in receivables from 20Y8 to 20Y9 indicate a favorable or unfavorable change?

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.4.5P: Twenty metrics of liquidity, solvency, and profitability The comparative financial statements of...

Related questions

Question

Transcribed Image Text:Financial statement data for years ending December 31 for Robinhood Company follow:

20Υ9

20Υ8

Sales

$7,906,000

$6,726,000

Accounts receivable:

Beginning of year

End of year

600,000

540,000

580,000

600,000

(Continued)

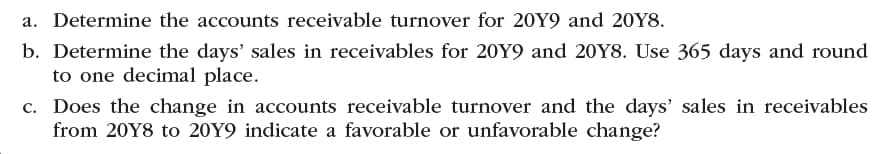

Transcribed Image Text:a. Determine the accounts receivable turnover for 20Y9 and 20Y8.

b. Determine the days' sales in receivables for 20Y9 and 20Y8. Use 365 days and round

to one decimal place.

c. Does the change in accounts receivable turnover and the days' sales in receivables

from 20Y8 to 20Y9 indicate a favorable or unfavorable change?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 5 images

Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning