ACCOUNTS RECEIVABLE Problem 1: Contra-Revenues and Other Issues Record the following transactions: 1. Sold goods with a selling price of $1,000 and cost of $750 with terms FOB Shipping Point, 2/10, n/30. 2. Goods in #2 arrived at buyers. 3. Buyer in #1/#2 paid within the discount period. 4. Sold goods with a selling price of $500 and cost of $275 with terms FOB Destination 2/10,n/30. Goods were shipped immediately. 5. Goods in #4 arrived at buyers. 6. Goods in #4/#5 were returned. They were undamaged and in salable condition. 7. Sold goods with a selling price of $5800 and cost of $3,600 with terms FOB Destination 2/10,n/30. Goods were shipped immediately. 8. Goods in #7 arrived at buyers but arrived 2 days late negatively impacting the buyers manufacturing process. 9. Customer in #8 received a $500 credit on his purchase. Goods were shipped immediately. The customer complained.... a lot.

ACCOUNTS RECEIVABLE Problem 1: Contra-Revenues and Other Issues Record the following transactions: 1. Sold goods with a selling price of $1,000 and cost of $750 with terms FOB Shipping Point, 2/10, n/30. 2. Goods in #2 arrived at buyers. 3. Buyer in #1/#2 paid within the discount period. 4. Sold goods with a selling price of $500 and cost of $275 with terms FOB Destination 2/10,n/30. Goods were shipped immediately. 5. Goods in #4 arrived at buyers. 6. Goods in #4/#5 were returned. They were undamaged and in salable condition. 7. Sold goods with a selling price of $5800 and cost of $3,600 with terms FOB Destination 2/10,n/30. Goods were shipped immediately. 8. Goods in #7 arrived at buyers but arrived 2 days late negatively impacting the buyers manufacturing process. 9. Customer in #8 received a $500 credit on his purchase. Goods were shipped immediately. The customer complained.... a lot.

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter5: Accounting For Retail Businesses

Section: Chapter Questions

Problem 34E

Related questions

Question

100%

Part 1: Prepare

Part 2: Accounting for

- Prepare T-Accounts for A/R; Allowance for Doubtful Accounts and Bad Debt Expense

- Put beginning balances that are given in these accounts.

- Record Journal Entries for Current Year Activity

- Post the JEs Activity to T-accounts above.

- Prepare

Adjusting Journal Entries for "a" and "b" based on the assumptions given in "a" and "b" - Indicate the following information that would appear on the financial statements under "a" and "b"

Accounts Receivable - Allowance for Doubtful Accounts

- Net realizable A/R --- (just subtract the two above)

- Bad Debt Expense

Thank you

Transcribed Image Text:ACCOUNTS RECEIVABLE

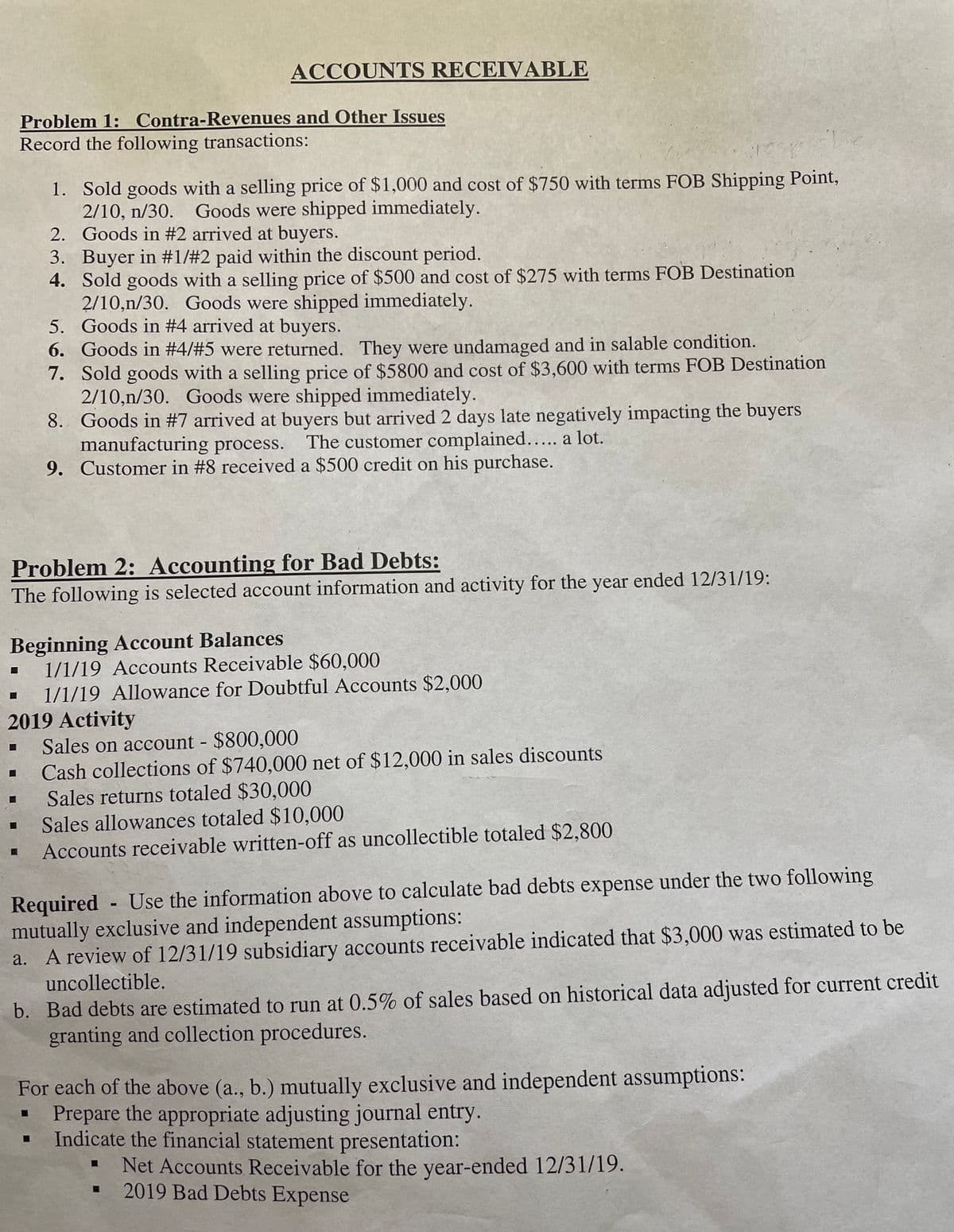

Problem 1: Contra-Revenues and Other Issues

Record the following transactions:

1. Sold goods with a selling price of $1,000 and cost of $750 with terms FOB Shipping Point,

2/10, n/30. Goods were shipped immediately.

2. Goods in #2 arrived at buyers.

3. Buyer in #1/#2 paid within the discount period.

4. Sold goods with a selling price of $500 and cost of $275 with terms FOB Destination

2/10,n/30. Goods were shipped immediately.

5. Goods in #4 arrived at buyers.

6. Goods in #4/#5 were returned. They were undamaged and in salable condition.

7. Sold goods with a selling price of $5800 and cost of $3,600 with terms FOB Destination

2/10,n/30. Goods were shipped immediately.

8. Goods in #7 arrived at buyers but arrived 2 days late negatively impacting the buyers

manufacturing process.

9. Customer in #8 received a $500 credit on his purchase.

The customer complained..... a lot.

Problem 2: Accounting for Bad Debts:

The following is selected account information and activity for the year ended 12/31/19:

Beginning Account Balances

1/1/19 Accounts Receivable $60,000

1/1/19 Allowance for Doubtful Accounts $2,000

2019 Activity

Sales on account - $800,000

Cash collections of $740,000 net of $12,000 in sales discounts

Sales returns totaled $30,000

Sales allowances totaled $10,000

Accounts receivable written-off as uncollectible totaled $2,800

Required Use the information above to calculate bad debts expense under the two following

mutually exclusive and independent assumptions:

a. A review of 12/31/19 subsidiary accounts receivable indicated that $3,000 was estimated to be

uncollectible.

b. Bad debts are estimated to run at 0.5% of sales based on historical data adjusted for current credit

granting and collection procedures.

For each of the above (a., b.) mutually exclusive and independent assumptions:

Prepare the appropriate adjusting journal entry.

Indicate the financial statement presentation:

Net Accounts Receivable for the year-ended 12/31/19.

2019 Bad Debts Expense

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College