Problem .3 Presented below are transactions related to Guillen, Inc. + May 10 Purchased goods billed at $20,000 subiect to cash discount terms of 2//10, n/60. + 11 Purchased goods billed at $15,000 subject to terms of 1/15, n/30. + 19 Paid invoice of May 10. +24 Purchased goods billed at $11,500 subject to cash discount terms of 2/10, n/30. Instructions (a) Prepare general journal entries for the transactions above under the assumption that purchases are to be recorded at net amounts after cash discounts and that discounts lost are to be treated as financial expense. (b) Assuming no purchase or payment transactions other than those given above, prepare the adjusting entry required on May 31 if financial statements are to be prepared as of that date.

Problem .3 Presented below are transactions related to Guillen, Inc. + May 10 Purchased goods billed at $20,000 subiect to cash discount terms of 2//10, n/60. + 11 Purchased goods billed at $15,000 subject to terms of 1/15, n/30. + 19 Paid invoice of May 10. +24 Purchased goods billed at $11,500 subject to cash discount terms of 2/10, n/30. Instructions (a) Prepare general journal entries for the transactions above under the assumption that purchases are to be recorded at net amounts after cash discounts and that discounts lost are to be treated as financial expense. (b) Assuming no purchase or payment transactions other than those given above, prepare the adjusting entry required on May 31 if financial statements are to be prepared as of that date.

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter21: Accounting For Accruals, Deferrals, And Reversing Entries

Section: Chapter Questions

Problem 2AP

Related questions

Question

Transcribed Image Text:Key Insurance Agency was organized on October 1, 2015. Assume that the a

are closed and financial statements prepared each month. The company occupies rented office

Max Wayer Meat Packing, Inc.Has recently accepted a donation of land with a fair

Packing promises to build a packing plant in Memphis. Recird the entry for Max Wayer's.

value of $150,000 from the MemphisIndustrial Development Corp. In return Max Wayer Meat

acquisition, October 1. The trial balance for Key Insurance Agency at December 31 is shown

space but owns office equipment estimated to have a useful life of 10 years from date of

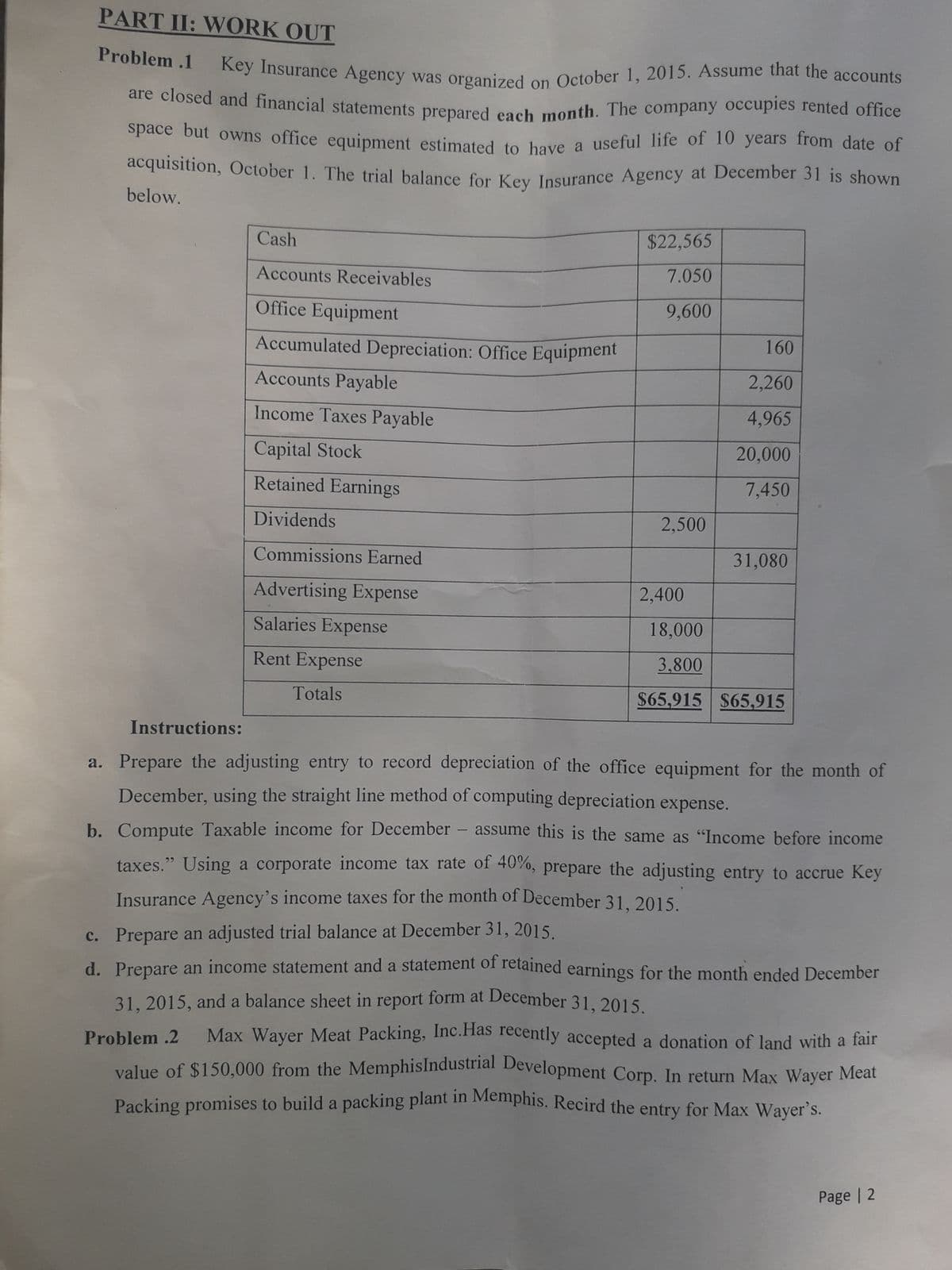

PART II: WORK OUT

Problem .1

Key Insurance Agency was organized

accounts

on October 1, 2015. Assume that the

are closed and financial statements prepared each month. The company occupies rented office

Space but owns office equipment estimated to have a useful life of I0 years from date of

acquisition, October 1. The trial balance for Key Insurance Agency at December 31 is shown

below.

Cash

$22,565

Accounts Receivables

7.050

Office Equipment

9,600

Accumulated Depreciation: Office Equipment

160

Accounts Payable

2,260

Income Taxes Payable

4,965

Capital Stock

20,000

Retained Earnings

7,450

Dividends

2,500

Commissions Earned

31,080

Advertising Expense

2,400

Salaries Expense

18,000

Rent Expense

3,800

Totals

$65,915 S65,915

Instructions:

a. Prepare the adjusting entry to record depreciation of the office equipment for the month of

December, using the straight line method of computing depreciation expense.

b. Compute Taxable income for December – assume this is the same as "Income before income

taxes." Using a corporate income tax rate of 40%, prepare the adjusting entry to accrue Key

Insurance Agency's income taxes for the month of December 31, 2015.

c. Prepare an adjusted trial balance at December 31, 2015.

d. Prepare an income statement and a statement of retained earnings for the month ended December

31, 2015, and a balance sheet in report form at December 31, 2015

Problem .2

Max Wayer Meat Packing, Inc.Has recently accepted a donation of land with a fair

value of $150,000 from the Memphislndustrial Development Corp. In return Max Wayer Meat

Packing promises to build a packing plant in Memphis. Recird the entry for Max Wayer's.

Page | 2

Transcribed Image Text:d. Compute gross profit using the perpetual system.

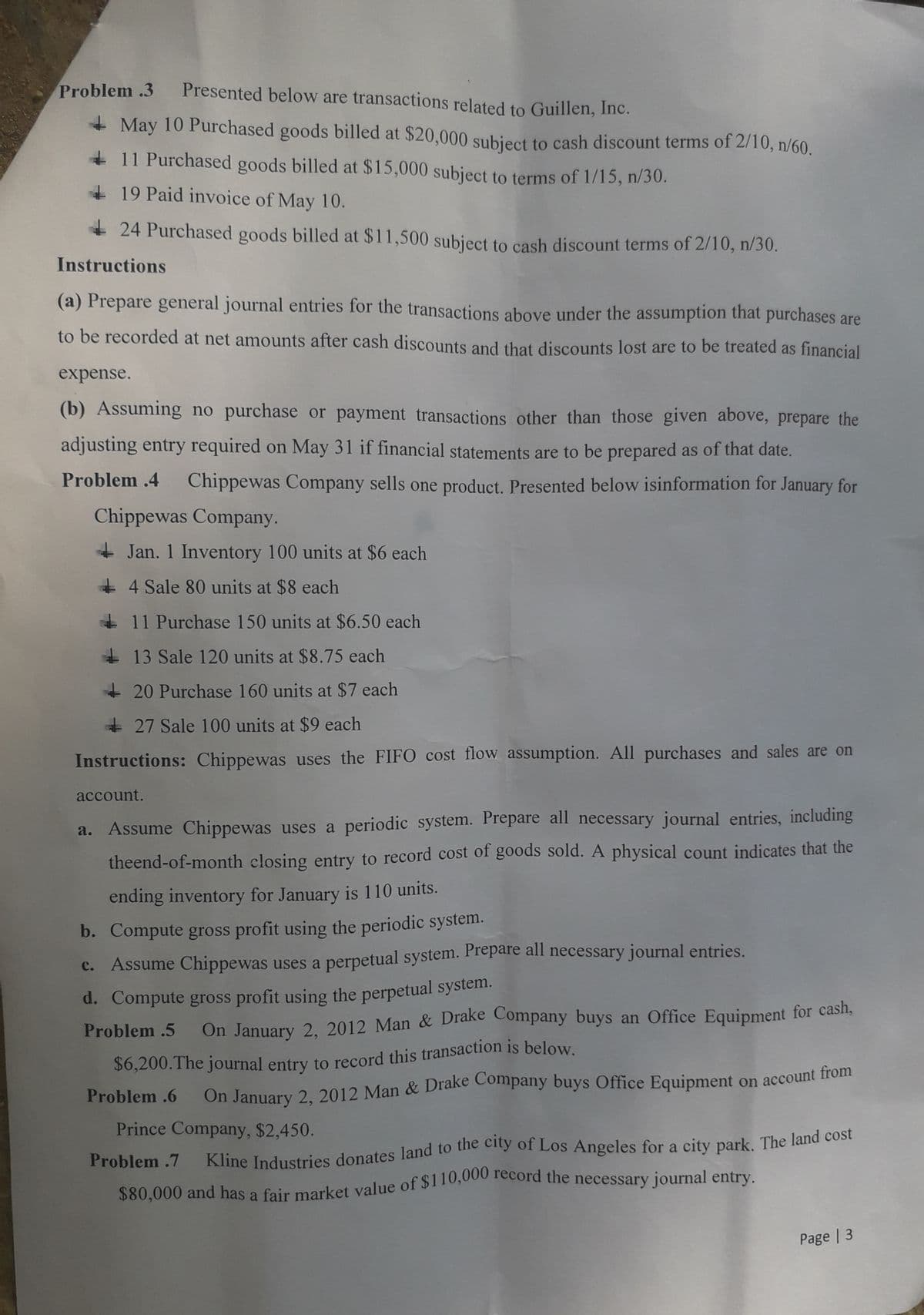

Problem .3 Presented below are transactions related to Guillen, Inc.

+ May 10 Purchased goods billed at $20,000 subiect to cash discount terms of 2/10, n/60.

+ 11 Purchased goods billed at $15,000 subject to terms of 1/15, n/30.

+ 19 Paid invoice of May 10.

+ 24 Purchased goods billed at $11,500 subject to cash discount terms of 2/10, n/30.

Instructions

(a) Prepare general journal entries for the transactions above under the assumption that purchases are

to be recorded at net amounts after cash discounts and that discounts lost are to be treated as financial

expense.

(b) Assuming no purchase or payment transactions other than those given above, prepare the

adjusting entry required on May 31 if financial statements are to be prepared as of that date.

Problem .4

Chippewas Company sells one product. Presented below isinformation for January for

Chippewas Company.

+ Jan. 1 Inventory 100 units at $6 each

+ 4 Sale 80 units at $8 each

+ 11 Purchase 150 units at $6.50 each

+ 13 Sale 120 units at $8.75 each

+ 20 Purchase 160 units at $7 each

+ 27 Sale 100 units at $9 each

Instructions: Chippewas uses the FIF0 cost flow assumption. All purchases and sales are on

account.

a. Assume Chippewas uses a periodic system. Prepare all necessary journal entries, including

theend-of-month closing entry to record cost of goods sold. A physical count indicates that the

ending inventory for January is 110 units.

b. Compute gross profit using the periodic system.

c. Assume Chippewas uses a perpetual system. Prepare all necessary journal entries.

Problem .5

Problem .6 On January 2, 2012 Man & Drake Company buys Office Equipment on account from

Prince Company, $2,450.

a

Problem .7

a

Page | 3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 8 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,