achel's health insurance policy has a monthly premium of $500. She has a $1,000 nnual deductible, after which she pays 80% and the insurance company pays 20%. er maximum annual co-insurance is $2,000. /hat is Rachel's maximum out of pocket cost per year, not counting any co-pays she ight incur? O $2,000 O $3,000 O $3,500 O $9,000

achel's health insurance policy has a monthly premium of $500. She has a $1,000 nnual deductible, after which she pays 80% and the insurance company pays 20%. er maximum annual co-insurance is $2,000. /hat is Rachel's maximum out of pocket cost per year, not counting any co-pays she ight incur? O $2,000 O $3,000 O $3,500 O $9,000

Chapter4: Income Exclusions

Section: Chapter Questions

Problem 41P

Related questions

Question

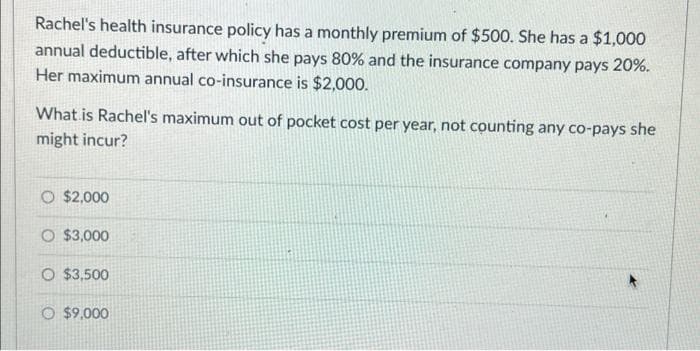

Transcribed Image Text:Rachel's health insurance policy has a monthly premium of $500. She has a $1,000

annual deductible, after which she pays 80% and the insurance company pays 20%.

Her maximum annual co-insurance is $2,000.

What is Rachel's maximum out of pocket cost per year, not counting any co-pays she

might incur?

O $2,000

O $3,000

O $3,500

O $9,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT