Acme Chemical, Inc. is a major manufacturer of chemical products for the agricultural ndustry, including pesticides, herbicides and other compounds. Due to a number of law suits elated to toxic wastes, Acme Chemical has recently experienced a market re-evaluation of its common stock. The firm also has a bond issue outstanding with 10 years to maturity and an nnual coupon rate of 5 percent, with interest paid semi annually. The required nominal market nnual interest rate on this bond has now risen to 10 percent due to the high risk level associated vith this firm. The bonds have a par or face value of $1,000. .. Label each of the variables that you would use to determine the value of this bond in the market today: N (time periods until maturity). PMT (periodic interest payment).= I per (periodic market interest rate) EV (future value to be received when the bond matures) = 2. Based on the variables that you have identified in Question #1, what is the market value today (the present value or PV) of one of Acme Chemical's bonds?

Acme Chemical, Inc. is a major manufacturer of chemical products for the agricultural ndustry, including pesticides, herbicides and other compounds. Due to a number of law suits elated to toxic wastes, Acme Chemical has recently experienced a market re-evaluation of its common stock. The firm also has a bond issue outstanding with 10 years to maturity and an nnual coupon rate of 5 percent, with interest paid semi annually. The required nominal market nnual interest rate on this bond has now risen to 10 percent due to the high risk level associated vith this firm. The bonds have a par or face value of $1,000. .. Label each of the variables that you would use to determine the value of this bond in the market today: N (time periods until maturity). PMT (periodic interest payment).= I per (periodic market interest rate) EV (future value to be received when the bond matures) = 2. Based on the variables that you have identified in Question #1, what is the market value today (the present value or PV) of one of Acme Chemical's bonds?

Chapter6: Fixed-income Securities: Characteristics And Valuation

Section: Chapter Questions

Problem 17P

Related questions

Question

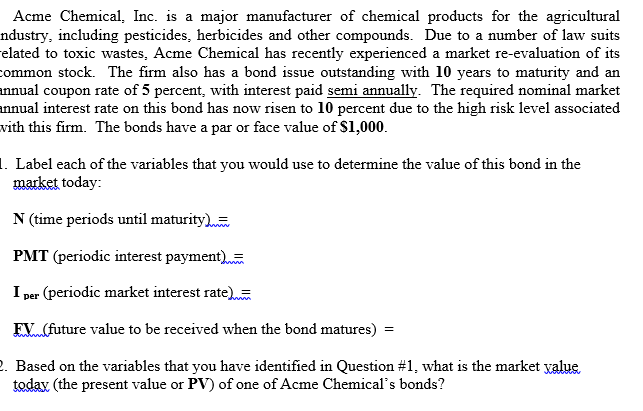

Transcribed Image Text:Acme Chemical, Inc. is a major manufacturer of chemical products for the agricultural

ndustry, including pesticides, herbicides and other compounds. Due to a number of law suits

elated to toxic wastes, Acme Chemical has recently experienced a market re-evaluation of its

common stock. The firm also has a bond issue outstanding with 10 years to maturity and an

annual coupon rate of 5 percent, with interest paid semi annually. The required nominal market

annual interest rate on this bond has now risen to 10 percent due to the high risk level associated

vith this firm. The bonds have a par or face value of $1,000.

1. Label each of the variables that you would use to determine the value of this bond in the

market today:

N (time periods until maturity)

PMT (periodic interest payment)

I per (periodic market interest rate)

EV (future value to be received when the bond matures) =

2. Based on the variables that you have identified in Question #1, what is the market value.

today (the present value or PV) of one of Acme Chemical's bonds?

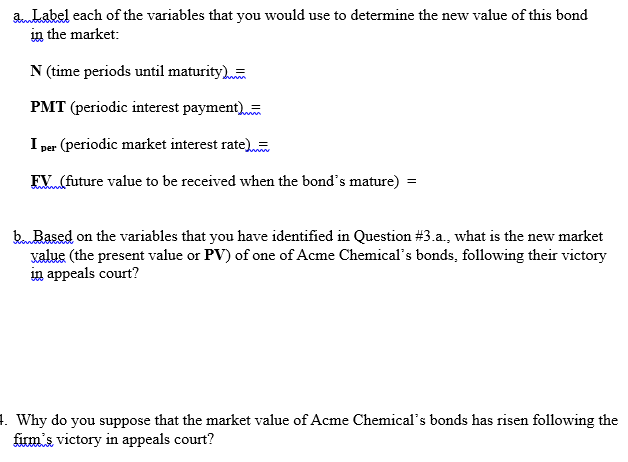

Transcribed Image Text:aLabel each of the variables that you would use to determine the new value of this bond

in the market:

N (time periods until maturity)

PMT (periodic interest payment)

I per (periodic market interest rate)

EV (future value to be received when the bond's mature) =

b Based on the variables that you have identified in Question #3.a., what is the new market

value (the present value or PV) of one of Acme Chemical's bonds, following their victory

in appeals court?

1. Why do you suppose that the market value of Acme Chemical's bonds has risen following the

firm's victory in appeals court?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning